SFDR: Market Divided on Future of Article 8, 9 Funds

Chris Hall

DECEMBER 19, 2023

Market participants flag importance of double materiality to enhance Article 8/9 definition alignment, stress need to recognise transition strategies.

Chris Hall

DECEMBER 19, 2023

Market participants flag importance of double materiality to enhance Article 8/9 definition alignment, stress need to recognise transition strategies.

Chris Hall

FEBRUARY 9, 2022

Asset managers decide to re-label existing funds as green investment vehicles for two reasons, according to Paul Lacroix, Head of Structuring at Smart Beta specialist investment firm Ossiam, an affiliate of Natixis. The first is client demand for investment solutions that are ESG-based,” he tells ESG Investor.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Chris Hall

SEPTEMBER 8, 2023

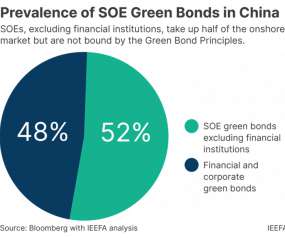

Inclusion of coal in green taxonomy would border on state-sanctioned greenwashing, says Christina Ng, Research & Stakeholder Engagement Leader, Debt Markets, and Putra Adhiguana, Energy Technologies Research Lead, Asia, at IEEFA. This article was co-authored by Putra Adhiguna , Energy Technologies Research Lead, Asia, at IEEFA.

Corporate Knights

DECEMBER 20, 2022

Even if we quickly agree on disclosure frameworks and measurements around biodiversity, disclosures that are voluntary and not supported by regulation are vulnerable to greenwashing which is widespread in the ESG space. We need to encourage more targeted investments in nature-positive solutions that reverse biodiversity loss.

Chris Hall

DECEMBER 9, 2022

A key amendment requires 100% of the proceeds to fund green projects, instead of 50-70% previously. This is a big step for foreign investors who are eager to invest in China’s domestic green bond market but have concerns about greenwashing—inadvertently buying ‘green’ bonds that, in fact, support non-green projects.

Chris Hall

JUNE 8, 2023

Dutch firm’s fifth impact-focused investment strategy launches amid continued demand for Article 9 funds. ING Asset Management’s new SDG Impact Strategy will provide clients with exposure to companies that contribute specifically to the 17 UN Sustainable Development Goals (SDGs), responding to strong demand for ‘dark green’ investments.

Chris Hall

APRIL 21, 2023

This sparked a plethora of comment this week warning of investor confusion and the prospect of a rethink among those SFDR Article 9 funds that downgraded over the past six months for fear of being accused by regulators of greenwashing. To quote a past contributor to ESG Investor , for fund managers, it’s still not easy being green.

Let's personalize your content