How green is your green bond?

GreenBiz

FEBRUARY 8, 2023

With green bond growth projected strong for 2023, investors would do well to read the fine print.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Green Bonds Related Topics

Green Bonds Related Topics

GreenBiz

FEBRUARY 8, 2023

With green bond growth projected strong for 2023, investors would do well to read the fine print.

GreenBiz

OCTOBER 19, 2022

Can financial instruments such as green bonds and other sustainability-related financial instruments deliver enough financing for a multi-trillion-dollar energy transition?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Chris Hall

OCTOBER 18, 2024

Out of its class A secured debt of £15 billion, about £3 billion is labelled green, potentially making the company a green bond default case. Green bonds are structurally no different to conventional bonds under the same class (with the same ranking, covenants and security package among all creditors in the case of distress).

GreenBiz

JULY 21, 2023

2023 is poised to be a record year for the booming green bonds market, according to a new Linklaters analysis.

Corporate Knights

JULY 26, 2022

Provincially owned Ontario Power Generation has adopted a green bond framework that includes nuclear power – a first for the electricity utility. . The move followed a controversial decision in the European Union to classify natural gas and nuclear investments as green. . But does that make them objectively green?

GreenBiz

AUGUST 4, 2021

Europe is leading the acceleration in green bond issues, while China and the U.S. are the most active markets.

Global Renewable News

SEPTEMBER 11, 2024

Statkraft has today (Sept 11) issued SEK 500 million 14-year senior unsecured green bonds with a coupon of 3.21% under its EMTN (Euro Medium Term Note) programme.The settlement date is set to Se.

ESG Today

SEPTEMBER 16, 2024

International asset manager Robeco announced the launch of the High Income Green Bonds strategy, investing in high yielding green bonds by corporate issuers globally. Kohler added: “Robeco’s High Income Green Bonds strategy is our first strategy focusing purely on green bonds from corporate issuers.

GreenBiz

APRIL 26, 2021

What it took for this company to issue a $625 million green bond. What does it take for a company to issue a green bond? The chief sustainability officer and the chief financial officer at Johnson Controls offer a behind-the-scenes look at how it successfully issued its $625 million bond last year.

3BL Media

MAY 16, 2024

(“O-I Glass”, “O-I” or the “Company”) announced that the Company has completed full allocation of the proceeds from its second round of Green Bond offerings to advance the company’s climate-change strategy. launched private Green Bond offerings of $690 million and €600 million, respectively. and OI European Group B.V.

Renew Economy

JUNE 14, 2023

The post WA raises $1.9bn from state’s first ever green bond to fund 50GW transition appeared first on RenewEconomy. Western Australia raises $1.9 billion to help fund the state's decarbonisation plans, including big batteries, wind farms and standalone power systems.

Environmental Finance

OCTOBER 16, 2024

Crisis at a major green bond issuer hurts lacklustre UK green bond market already struggling to attract corporate issuers, says IEEFA. Ahren Lester reports

Global Renewable News

JUNE 2, 2024

On May 27, 2024, Energy Development Corporation (EDC) listed PHP10 billion Fixed Rate ASEAN Green Bonds, the second tranche of its PHP15 billion ASEAN Green Bonds shelf registration, in the Philippine.

3BL Media

NOVEMBER 16, 2022

DESCRIPTION: November 16, 2022 /3BL Media/ - Lenovo Group (HKSE: 992) (ADR: LNVGY) is pleased to report that its green bond has been included in the Bloomberg MSCI Green Bond Index, one of the most important global benchmarks for institutional Environmental, Social, Governance (ESG) funds. Find out more here: [link].

3BL Media

MARCH 23, 2022

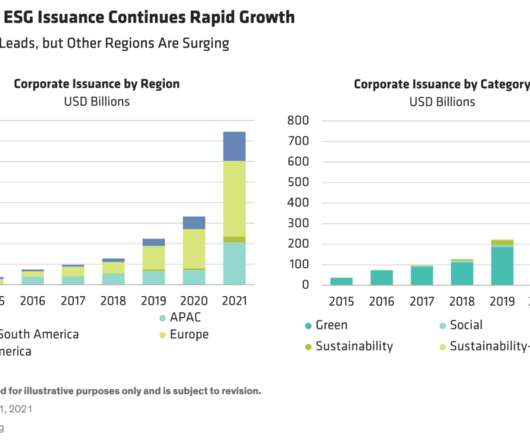

An Explosion of ESG Bond Issuance. ESG-labeled bond issuance surged to new heights in 2021. Green bonds, which fund particular projects, continued to dominate. But issuance of social, sustainability and sustainability-linked bonds—which reference specific key performance indicators, or KPIs—grew fastest (Display).

Global Renewable News

SEPTEMBER 18, 2023

The City of Toronto has issued a $100 million green bond to help finance transformative climate action projects with an all-in cost of 4.972 per cent. The transaction is a reopening of the green bond.

Chris Hall

JULY 26, 2023

Linklaters forecasts record year for green bonds, while SLB issuance suffers Q2 slowdown. Investor demand for green, social, sustainability, sustainability-linked and transition bonds (GSS+) has surged in H1 2023, with regulatory developments bringing greater transparency and confidence to the market.

ESG Today

MARCH 5, 2024

The Government of Canada announced that it has completed the issuance of a C$4 billion green bond, the country’s second, and the first by a sovereign issuer to include nuclear energy expenditures as an eligible use for proceeds.

ESG Today

JULY 22, 2024

UAE-based clean energy-focused developer Masdar announced that it has raised $1 billion through the issuance of green bonds, with proceeds aimed at investing in new renewable energy projects. According to Masdar, demand for the bonds was strong, with the offering 4.6x oversubscribed.

Environmental Finance

SEPTEMBER 20, 2024

The volume of green bond reporting requirements for participants is at "crazy" levels, according to panellists at the Environmental Finance's Sustainable Debt Americas 2024 conference held in New York this morning.

Global Renewable News

JANUARY 15, 2024

Massachusetts Municipal Wholesale Electric Company (MMWEC), the Commonwealth's designated joint action agency for municipal utilities, has closed on approximately $15 million in green bonds to co.

Impact Alpha

MAY 2, 2024

The post India lists a yen-denominated green bond for renewable projects appeared first on ImpactAlpha. About 70% of India’s electricity comes from dirty fuels, especially coal. The government is aiming to generate 50% of its power from renewable.

ESG Today

FEBRUARY 20, 2024

Verizon Communications announced today that it has fully allocated the $1 billion in proceeds from its most recent green bond, issued in May 2023 , will the full amount directed towards investments in renewable energy, supporting the company’s clean energy targets. we are proud to help accelerate the greening of the U.S.

ESG Today

FEBRUARY 8, 2024

The Government of the Hong Kong announced that it has issues approximately HK$6 billion (USD$765 million) of digital green bonds, with the issuance including bonds denominated in HK dollars, Renminbi, US dollars and euros, making it the first multi-currency digital bond offering in the world.

Environmental Finance

OCTOBER 9, 2024

Scepticism over cryptocurrencies is a major barrier to utilising blockchain within the green bond market, the Council for Scientific and Industrial Research (CSIR) has said.

ESG Today

FEBRUARY 15, 2024

Goldman Sachs Asset Management announced today the launch of the Goldman Sachs Global Green Bond UCITS ETF, a new Article 9 fund tracking a bespoke index developed with Solactive, tracking the performance of investment-grade bonds denominated in G10 currencies.

ESG Today

NOVEMBER 10, 2022

The Government of India announced the release of its Sovereign Green Bonds framework, in preparation for the country’s inaugural issuance of green bonds to finance renewable energy, clean transport, sustainable water, and other environmental sustainability projects.

ESG Today

MARCH 19, 2024

Energy provider Constellation Energy announced today that it has raised $900 million through a green bond offering, the first of its kind in the U.S. The inclusion of nuclear power in the eligible use of proceeds for green bonds is a still rare, but increasing phenomenon. Constellation is the U.S.’

ESG Today

APRIL 21, 2023

The government of Australia will issue its first ever green bond next year, joining the growing ranks of sovereign debt issuers participating in the sustainable finance market to help fund their environmental sustainability initiatives, according to an announcement on Friday by Treasurer Jim Chalmers.

ESG Today

AUGUST 9, 2024

Global energy and electricity provider Iberdrola announced that its has raised $525 million in a new green bond issuance through its U.S. Overall, Iberdrola has approximately €23 billion in green bonds outstanding. network business.

ESG Today

FEBRUARY 27, 2024

The Government of Canada announced that it will issue its second green bond this week, aimed at unlocking financing to accelerate green infrastructure and nature conservation projects, and supporting the achievement of the country’s climate goals.

ESG Today

OCTOBER 24, 2023

The Council of the European Union announced today the adoption of a regulation creating a new European Green Bond Standard, marking the last major step for the establishment of a new European Green Bonds (EuGB) label, aimed at fighting greenwashing and helping advance the sustainable finance market in the EU.

ESG Today

FEBRUARY 27, 2024

Verizon Communications announced that it has completed a new $1 billion green bond offering, with proceeds from the issuance to be allocated entirely towards renewable energy investments. The offering marks the sixth green bond issuance for Verizon, raising $6 billion since the launch of the company’s inaugural green bond in 2019.

ESG Today

OCTOBER 6, 2023

Lawmakers in the European Parliament voted 418-79 on Thursday to approve the adoption of a new European Green Bond (EuGB) label, aimed at fighting greenwashing and providing investors with confidence that their investments are being appropriately directed towards financing sustainable business activities and technologies.

ESG Today

OCTOBER 13, 2022

The Swiss government announced the completion of its inaugural green bond issuance, raising CHF766 million ($USD766 million) to fund expenditures supporting its environmental goals in areas including clean transportation and biodiversity. billion of green expenditures, which will be partly funded by the new green bond.

Impakter

MARCH 11, 2023

Impakter EU Green Bond Deal: Sustainable Gold Standard or Unrealistic? In what’s being labelled a “landmark’’ moment for sustainable finance, EU negotiators last week finally announced the agreement of a provisional deal establishing a gold standard for European green bonds (EuGB). appeared first on Impakter.

Environmental Finance

OCTOBER 7, 2024

ESMA's new Fund Naming Guidelines could create inconsistencies with the EU Green Bond Standard that may hamper the growth of the corporate green bond market, says a leading asset manager trade body.

Environmental Finance

OCTOBER 15, 2024

Mongolian lender Khan Bank has completed a $30 million fundraise from the first green bond listed in the domestic Mongolian market, more than a year after securing approval for the programme.

ESG Today

MARCH 31, 2023

Energy technology company Siemens Energy announced the successful placement of its inaugural green bond, raising €1.5 With the successful issuance of our first bond, which meets our Green Bond Framework, I am very pleased to see that the capital markets are confident in our strategy to become the leader in the energy transition.”

ESG Today

JULY 19, 2022

Canadian utility Ontario Power Generation announced the issuance of a $300 million “nuclear green bond,” one of the first green bond offerings aimed at financing nuclear power generation. ” The post OPG Issues $300M “Nuclear Green Bond” appeared first on ESG Today.

Environmental Finance

OCTOBER 9, 2024

Canada has announced plans to tap its second sovereign green bond this week as it looks to raise a further CAD4 billion ($2.9 billion) from its programme by the end of March.

ESG Today

AUGUST 5, 2022

billion) in its inaugural green bond offering, kicking off a multi-year program aimed at raising up to S$35 billion to fund the country’s sustainable transition strategy. The offering of the August 2022 bonds was met with strong demand, with the S$2.4 Billion in Inaugural Green Bond Offering appeared first on ESG Today.

ESG Today

FEBRUARY 12, 2024

Chemicals and materials science giant Dow announced today the completion of its inaugural green bond offering, raising over $1.2 billion to support the company’s decarbonization and circular economy strategies, including the construction of a new net zero emissions chemical plant in Canada.

Environmental Finance

AUGUST 22, 2024

billion) green bond persisted after the deal was more than twice oversubscribed by investors, with the German development bank already reaching its 2024 green bond funding target. KfW reported the 'greenium' on its €3 billion ($3.3

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content