Why the Paris Agreement poses major stranded asset risk to Indonesian palm oil

GreenBiz

SEPTEMBER 7, 2021

Research lays bare scale of stranded asset risk facing Indonesia's palm oil sector if Paris Agreement climate goals are met.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Stranded Assets Related Topics

Stranded Assets Related Topics

GreenBiz

SEPTEMBER 7, 2021

Research lays bare scale of stranded asset risk facing Indonesia's palm oil sector if Paris Agreement climate goals are met.

Renew Economy

FEBRUARY 22, 2022

The post “Makes no sense:” Push for new gas pipelines could create $A675bn of stranded assets appeared first on RenewEconomy. A US$500 billion global rush to build new gas pipelines - including Australia's "gas fired recovery" - undermines efforts to achieve zero net goals.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

GreenBiz

SEPTEMBER 10, 2019

As with so many climate-related topics, the hypothetical is rapidly turning into the hypercritical.

Impact Alpha

JULY 7, 2020

The post New poster child for stranded assets: Dakota Access Pipeline appeared first on ImpactAlpha. The contested pipeline, opposed by the Standing Rock Sioux Tribe and a broad coalition of activists, was increasingly an economic millstone.

Environmental Finance

OCTOBER 24, 2022

Governments should compensate oil and gas investors for stranded assets to avoid costly tribunals, the International Institute for Sustainable Development (IISD) has said.

Environmental News Bits

JUNE 6, 2022

Even if the new well is a success, future government policies designed to slow climate change could make the project unprofitable or force it to shut down years … Continue reading Who really owns the oil industry’s future stranded assets? If you own investment funds or expect a pension, it might be you.

Corporate Knights

JUNE 9, 2022

“The ownership distribution reveals an international net transfer of more than 15% of global stranded asset risk to OECD-based investors,” the researchers warn. trillion in stranded assets world-wide, the researchers found that physical stranded assets in OECD countries accounted for a total US$552 billion, or 39.2%.

Impact Alpha

JULY 1, 2020

20: Investors share experiences in getting their assets off the sidelines (video). The post The Brief: Assets off the sidelines (video), Erie’s opportunity zones, Netflix banks Black, carbon tax on meat, Big Energy’s stranded assets appeared first on ImpactAlpha. Featured: Agents of Impact Call No.

Renew Economy

NOVEMBER 14, 2023

Households in Victoria could soon be required to pay up front for a new connection to the gas network to defray cost of stranded assets for other users. The post New blow to fossil gas as regulator shifts death spiral risk to new connections appeared first on RenewEconomy.

Impact Alpha

AUGUST 12, 2020

Living Cities’ Demetric Duckett, Cambridge Associates’ Sarah Hoyt, Sinclair Capital’s Jon Lukomnik and The Investment Integration Project’s Bill Burckart join ImpactAlpha’s David Bank, Monique Aiken and other Agents of Impact, Thursday, The post The Brief: Hourly employee ownership, seeding vertical farms, eco-packaging, e-motorcycles in Brazil, tropical (..)

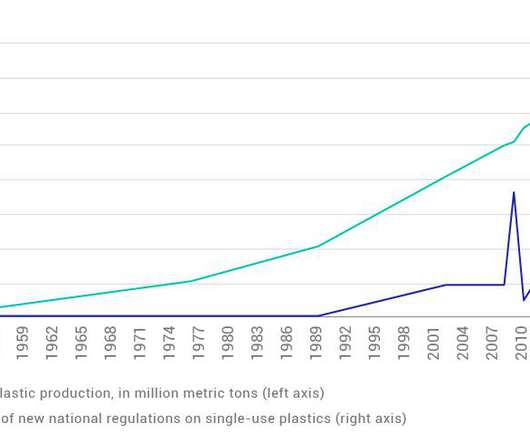

MSCI

AUGUST 22, 2019

Could plastic become the next stranded asset? Oil and gas companies are accelerating investment in plastics, in response to the shift away from fossil fuels. But is this pivot sustainable?

Impact Alpha

JUNE 16, 2020

The post The Brief: Building community wealth, alt-home-financing, curbing construction carbon, employee financial health, BP’s stranded assets appeared first on ImpactAlpha. ImpactAlpha’s next Agents of Impact call will explore how to ramp up.

Impact Alpha

FEBRUARY 8, 2024

Dave Jones was California’s state insurance commissioner eight years ago when the then-novel idea of fossil fuel “stranded assets” caught his attention. The post California’s climate-risk pioneer Dave Jones on our march ‘toward an uninsurable future’ (Q&A) appeared first on ImpactAlpha.

Energy Central

JUNE 13, 2023

Originally posted here. Broken Window Economics: an event that seems to be beneficial for those immediately involved can have negative economic consequences for many others. The US and most countries have energy economies based on fossil fuels, plus contributions from nuclear, hydro, geothermal and biomass.

Eco-Business

AUGUST 29, 2021

Two thirds of unplanted concessions in Indonesia could be stranded assets by 2040, due to efforts to reduce the sector's impact on forests. But companies that grow sustainably could win big, a new study predicts.

Environmental Finance

MAY 14, 2024

"Considerable economic disruption" from policies to support the transition to net zero is likely, feeding inflation in the near term and raising the risk of stranded assets and asset bubbles, according to research by Pictet Asset Management and the Institute of International Finance (IIF).

Corporate Knights

JUNE 19, 2024

Gas demand is set to peak in 2030 in all scenarios, the IEA has said, raising the thorny question of when new investments in oil and gas will become stranded assets. That’s why Julia Levin, associate director of Environmental Defence, is wary of the federal government’s “sector-agnostic” loan guarantee.

Environmental News Bits

SEPTEMBER 29, 2021

Download the document.

Environmental Finance

APRIL 4, 2023

Despite a movement into 'cleaner' assets, Chinese banks have yet to shift away from coal, which risks leaving many with stranded assets, Sustainable Fitch has said.

Environmental Finance

APRIL 12, 2023

Japan's six largest banks and energy companies have been hit by shareholder calls to disclose decarbonisation plans, over concerns that fossil fuel expansion will result in stranded assets.

Environmental News Bits

AUGUST 9, 2022

Research commissioned by the Changing Markets Foundation surveying 201 respondents from the investment community shows that 82% agreed that climate change presents a material risk to meat and dairy industry-related investments and 84% believe that a lack of mitigation of climate change could lead to stranded assets in this industry.

Environmental News Bits

JULY 23, 2021

Physical risks, stranded assets and greater firm default risk expose… Read more → Both climate change and the transition to a carbon neutral economy pose substantial challenges for the economy and the financial system, with the potential to affect growth and inflation in the short term, but also over much longer horizons.

Energy Central

MAY 24, 2022

Blue hydrogen woes Producing H2 from methane 'does not make sense' during a gas price crisis, and projects may end up as stranded assets within the decade, says IEEFA study. Join: Offshore Wind and Hydrogen [link]

3BL Media

SEPTEMBER 23, 2022

Case Study: Stranded Assets and the Economics of a Chinese Power Plant. These differences can be more sharply examined by analyzing the economics of a Chinese power plant and stranded-assets risk. Stranded assets are a common theme in investment analysis of the global energy transition.

Chris Hall

FEBRUARY 28, 2022

Stranded assets, defaults in thermal power, steel and cement sectors may increase if companies do not shift to low-carbon alternatives. The People’s Bank of China (PBOC) has revealed the results of its first phase of climate risk stress tests of major banks in the country.

Impact Alpha

DECEMBER 6, 2019

6 – The risk that fossil fuel investments will become ‘stranded assets’ went from fringe thesis to mainstream preoccupation in what must be near-record time. ImpactAlpha, Dec. It’s not a theory: this week, the Spanish oil producer Repsol took a $5.3

Corporate Knights

FEBRUARY 14, 2023

To climate-focused investors, the continued investment in fossil fuels and the scaling back of climate targets is shortsighted given what they see as the need for BP to decouple itself from oil and gas production or face future risks of litigation , regulation and stranded assets.

Renewable Energy World

JULY 26, 2021

The focus of our argument beyond reduction of GHG emissions was that the installation of natural-gas-fed electric power generators would be a “stranded asset.” Stranded assets are unable to earn their original economic return due to changes in the landscape in which the assets operate.

Eco-Business

MAY 11, 2021

The country's only domestic source of liquified natural gas is expected to run dry this decade sparking a boom in import terminal projects. But regulatory uncertainty and financial risks could turn them into bad investments.

GreenBiz

MAY 20, 2021

If the world heeds that advice, we’ll leave a lot of stranded assets lying around. Of course, a chorus of activist investors have been pressing investors, banks and companies to examine their risks on stranded oil and gas assets for more than a decade, knowing this day would arrive.

3BL Media

AUGUST 30, 2022

CDP and Planet Tracker’s High and Dry: How Water Issues Are Stranding Assets , May 2022 report recognizes that “Water risk is already stranding assets across major sectors of the global economy.”.

Corporate Knights

DECEMBER 9, 2022

A study published in the journal Nature found that Canada alone will face $100 billion in stranded assets by 2036, representing 35% of the book value of oil and gas properties for all oil and gas issuers listed on the Toronto Stock Exchange.

ESG Today

MAY 7, 2024

Additionally, both CEOs (75%) and investors (70%) broadly agree that technology and AI hold the answers to many of the key sustainability challenges facing their companies.

Chris Hall

MAY 12, 2022

Ex-BoE chief calls for “radical new approach” to mobilising investment in emerging and developed markets; also warns of stranded assets. This would lead to more stranded assets in the medium term, waned the former Bank of England governor, requiring “a more granular breakdown of the use of proceeds of new fossil fuel financing. “In

Chris Hall

MAY 6, 2022

Sixty-nine percent of listed equities reporting via CDP’s platform stated they are exposed to water risks that could “generate a substantive change in their business”, said CDP’s report on how water issues are stranding assets. Water risk factors and stranded assets.

Chris Hall

MAY 7, 2024

Mining giant BHP’s bid to acquire Anglo-American would create the world’s biggest shipper of metallurgical coal and a global mega-polluter, exposing shareholders to stranded asset risk as the world moves away from fossil fuels, a think tank has warned.

ESG Today

JANUARY 8, 2024

Skidmore added that following the initiation of “the global transition away from fossil fuels” set in motion at the COP28 climate conference, the future obsolescence of fossil fuels will cause new oil and gas licenses to create stranded assets, instead of supporting communities “to transition their skills and expertise to renewable and clean energy.”

ESG Today

JULY 25, 2023

Canada’s Environment and Climate Change Minister Steven Guilbeault said: “By eliminating inefficient fossil fuel subsidies, we are encouraging smart and efficient government investment decisions that can increase Canada’s competitiveness in a decarbonizing global economy, while avoiding creation of stranded assets.

ESG Today

JANUARY 25, 2023

Build more investor confidence in green infrastructure projects The greatest fear that many investors have around investing in green infrastructure projects is that they become “stranded assets.” To prevent this, governments must make a long-term commitment to a green energy source such as hydrogen or nuclear.

Corporate Knights

SEPTEMBER 16, 2022

The more invested they remain in carbon-intensive assets, the greater the risk they face of holding stranded assets that lose value due to the transition. Their disclosures will signal to the rest of the world, including their own shareholders, whether they are reducing their financed emissions.

Corporate Knights

FEBRUARY 8, 2023

There is also the risk that fossil fuel infrastructure is retired before the end of its economic lifetime and becomes a stranded asset—a liability taxpayers would likely pay for.” “Building new natural gas-fired power plants means locking in emissions—and costs—for many years to come.

Corporate Knights

MARCH 22, 2023

If Canada’s pension fund managers don’t take sustainability seriously, he adds, “they could get caught with stranded assets, which will cost their pensioners a lot.” They have a big role to play in facilitating the transition to a low-carbon economy.”

Eco-Business

OCTOBER 14, 2022

Energy analysts say it is unclear who will buy the soon-to-be stranded assets from the utility firm. Korea Electric Power Corporation suffered from an unprecended deficit in the first half of the year due to high coal and gas prices.

Envirotec Magazine

SEPTEMBER 15, 2022

Those failing to do so will find the risk of stranded assets to be high and rising. For companies that leveraged aggressively in this period, refinancing and follow-on financing strategies in the coming years must pivot toward the equity markets.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content