Sustainable Investments, a Growing Trend

3BL Media

SEPTEMBER 11, 2024

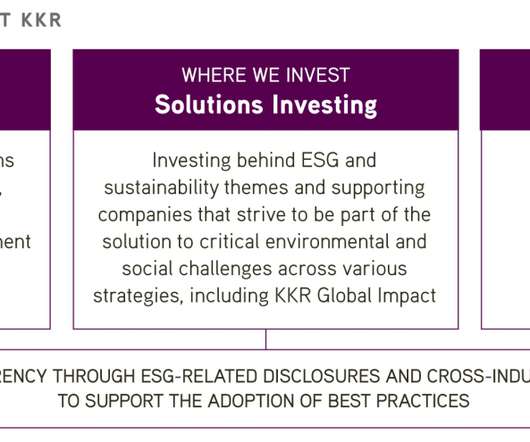

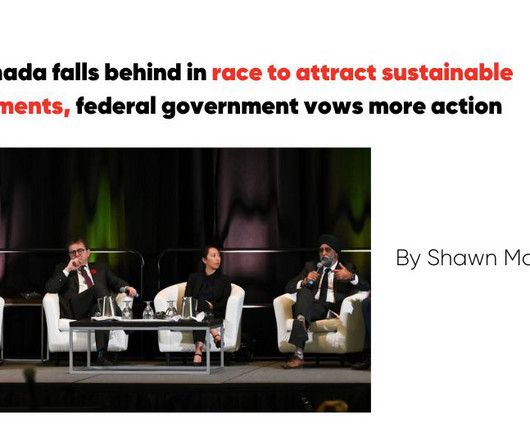

Sofidel According to the Global Sustainable Investment Alliance (GSIA), in 2023 sustainable investments in major financial markets will reach a 44% share of all assets under management in the U.S., Canada, Japan, Australia, and Europe, totaling $44 billion invested in green assets.

Let's personalize your content