The rise (and rise) of sustainability-linked finance

GreenBiz

AUGUST 24, 2020

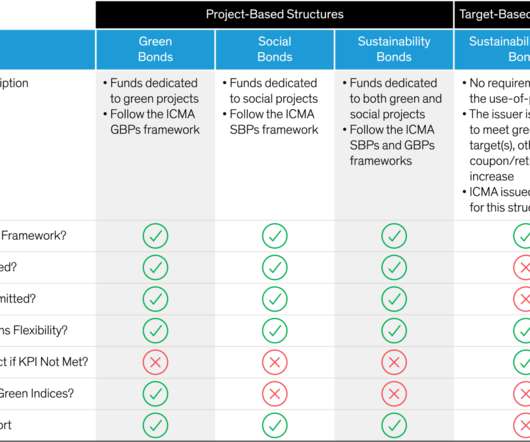

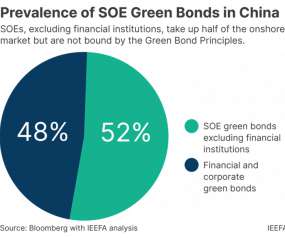

One silver lining of this horrific moment is the rise of loans, bonds and other financial instruments linked to sustainability outcomes. Pandemic bonds join a growing list of sustainability-linked financial instruments that have been gaining the attention of investors worldwide. By whatever name, money is pouring in.

Let's personalize your content