Ontario and Alberta are building natural gas plants despite lower costs of renewables

Corporate Knights

FEBRUARY 8, 2023

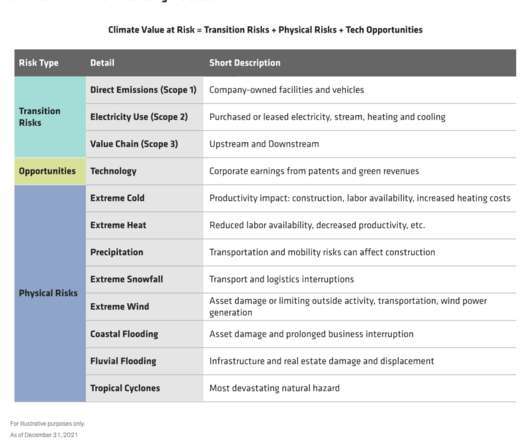

There is also the risk that fossil fuel infrastructure is retired before the end of its economic lifetime and becomes a stranded asset—a liability taxpayers would likely pay for.” Provincial legislation calls for a 30% renewable grid by 2030, and renewables have grown from 9% to 22% of grid capacity in five years.

Let's personalize your content