Canadian LNG deal with Germany seems unlikely, as emphasis grows on hydrogen

Corporate Knights

AUGUST 15, 2022

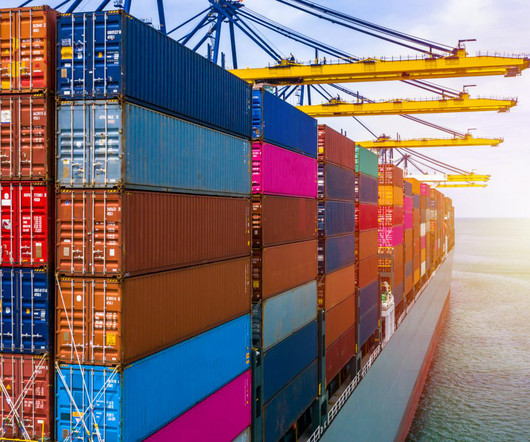

For months, Canadian fossils have been touting the possibility of shipping LNG to Germany to help the country cope with an energy supply crisis brought on by Russia’s war in Ukraine. Building a new LNG export facility in Canada sounds like an enormous stranded asset in the making.”. Canada’s Duty. On a trip to St.

Let's personalize your content