ESG is the private equity industry’s next frontier

Corporate Knights

MARCH 8, 2023

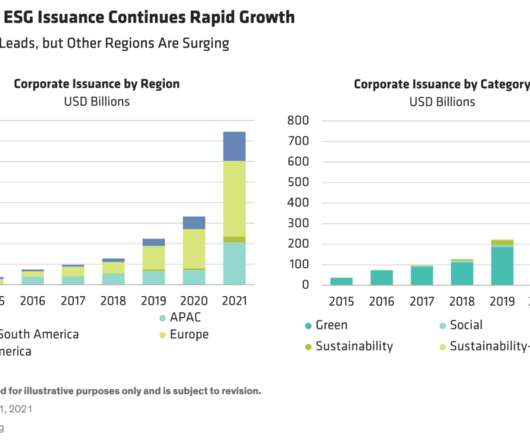

But, while the door was wide open for the industry to start focusing on environmental, social and governance (ESG) criteria, private equity players have historically been slow to move on this opportunity. Research by BlackRock shows that PE outperformed the S&P 500 and MSCI World indexes by 2.8 But where to find those signs?

Let's personalize your content