The 'green label effect' for green bonds is real

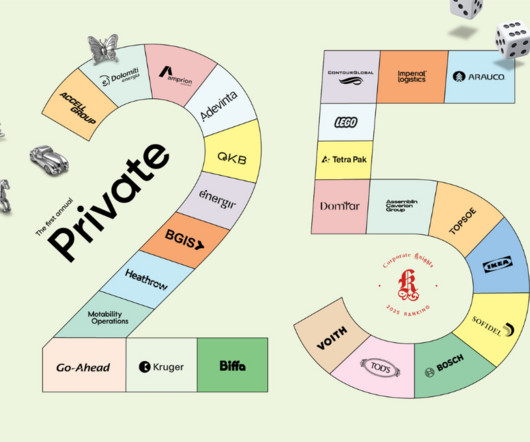

Corporate Knights

MARCH 7, 2025

This finding raises critical questions about how sustainable finance is marketed and whether green labels alone are enough to drive real environmental change. Green bonds and retail investors Green bonds are a financial tool designed to fund environmentally friendly projects.

Let's personalize your content