Sustainable Investing at KKR

3BL Media

SEPTEMBER 8, 2022

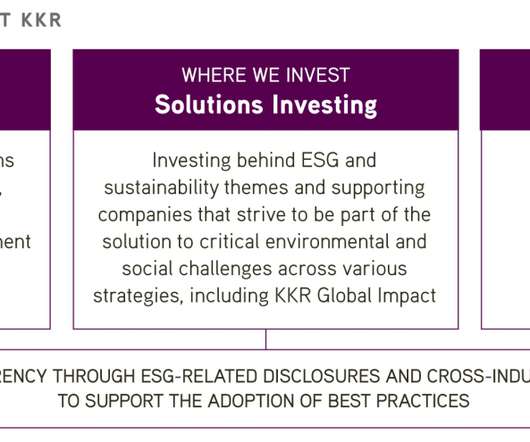

Sustainable investing is a key lever of KKR’s approach to value creation and a way of doing business that we believe helps us make better investments. As sustainable investing practices accelerate, a vast lexi- con of terminology continues to develop around them. SUSTAINABLE INVESTING AT KKR.

Let's personalize your content