CalPERS, Leader in Sustainable Investment, Stays the Course on ESG

3BL Media

APRIL 15, 2024

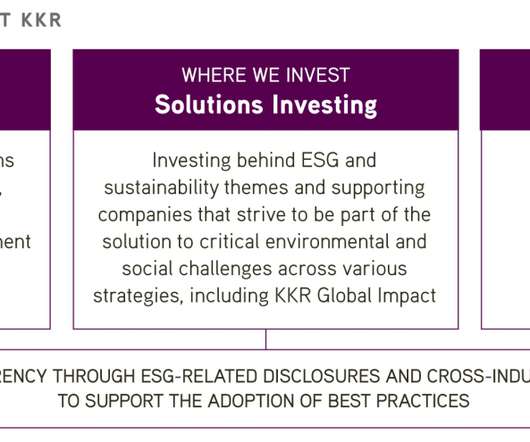

The investments made by the plan are central to CalPERS staying power, with 56% of income over the last 20 years coming from investment earnings; 11% coming from plan member dues; and 33% from state public sector employers paying into the system. As the systems’ managers note, “We take sustainability seriously.

Let's personalize your content