How to Re-establish the UK’s Lead on Climate Change

Chris Hall

NOVEMBER 1, 2024

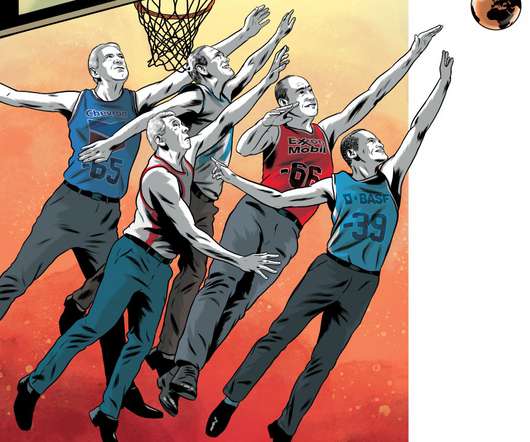

Former chair of the Committee on Climate Change Lord Deben believes the country can get back on track to net zero and regain its status as a global leader. When Glasgow hosted COP26 in 2021, bringing together 120 world leaders and more than 40,000 participants, the UK was seen as a world leader in the battle against climate change.

Let's personalize your content