Impact Cubed's New EU Taxonomy Solution Provides Global Insights Into Green Investments

3BL Media

FEBRUARY 22, 2022

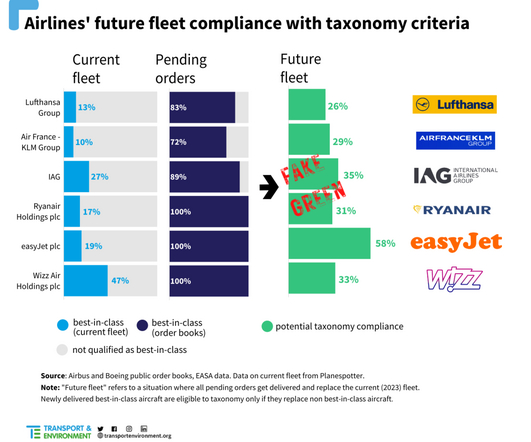

These new rules, intended to counteract greenwashing, spell out the criteria for a green investment and require market participants to disclose how they are aligned with them. The outcome is a seamless approach to customized sustainable investing. Media Contact: Arleta Majoch, COO Impact Cubed Arleta@impact-cubed.com.

Let's personalize your content