AB: ESG in Action - The Human Touch in Interpreting Climate Scenario Analysis

3BL Media

MARCH 25, 2022

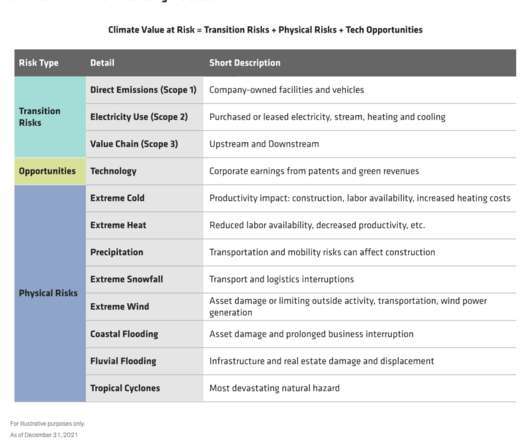

The evolving climate drives physical risks—damaged or stranded assets and business-interruption costs from severe weather events. For example, one provider calculates a company’s physical risk based solely on its headquarters location, despite its global supply chain stretching across far-flung manufacturing locations.

Let's personalize your content