ESG Today: Week in Review

ESG Today

NOVEMBER 3, 2024

Copper Mine Operations to Renewable Diesel Southwest Airlines Eliminates 1.5

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

ESG Today

NOVEMBER 3, 2024

Copper Mine Operations to Renewable Diesel Southwest Airlines Eliminates 1.5

GreenBiz

APRIL 15, 2021

In fact, Mather expects the SLL market to grow many times bigger than the green bond market, which because of its higher costs has failed to become the financial mechanism it could have become. Featured in featured block (1 article with image touted on the front page or elsewhere). Sponsored Article. Finance & Investing.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Environmental Finance

JUNE 13, 2025

CAF raises €100m from BNP Paribas-backed blue bond debut 13 June 2025 Development bank CAF has raised €100 million ($116 million) from its inaugural blue bond focused on the Latin America and Caribbean (LAC) region, the first issued under its updated sustainable bond framework. Not registered? Sign up today for free.

Environmental Finance

JUNE 4, 2025

and more 4 June 2025 Sustainable debt round-up: IDA, African Development Bank, Piraeus Bank. and more 4 June 2025 Sustainable debt round-up: IDA, African Development Bank, Piraeus Bank. and more By Ashton Rowntree Sign-in Username (E-mail address) Password Stay signed in? Sign-in Forgot your password? Not registered?

Environmental Finance

JUNE 27, 2025

Register now Channels: Green Bonds Most Read Catalysing sustainable growth: how CGIF unlocks bond markets in the ASEAN+3 region Forestry companies to standardise natural capital valuation Defending the indefensible? Dont have an account yet? Not registered? Sign up today for free.

Environmental Finance

JUNE 9, 2025

Register now Channels: IMPACT Natural Capital Companies: CAF Most Read Catalysing sustainable growth: how CGIF unlocks bond markets in the ASEAN+3 region Exclusive: Important methane abatement guidance expected to be published imminently Final Transition Loan guidance expected by November ESG 2.0:

Environmental Finance

JUNE 12, 2025

Quantitative tightening hampers ECB carbon tilting efforts 12 June 2025 The European Central Bank (ECB) said its shift from quantitative easing to tightening has brought an end to its efforts to apply a climate tilt to its corporate bond portfolio. Sign-in Forgot your password? Dont have an account yet? Not registered? Not registered?

Environmental Finance

JUNE 10, 2025

Struggle to sell labelled debt in US leads to pivot to Asia and Middle East, says HSBC 10 June 2025 The "struggle" to sell labelled debt products in the US in the current political environment is leading banks to seek business in markets with greater potential for growth, including in Asia and the Middle East, according to an executive at HSBC.

Environmental Finance

JULY 1, 2025

Pioneering Poland returns to green bond market after six-year hiatus 01 July 2025 Poland has raised €1.25 billion) from its first green bond since 2019, nine years after the central European country became the first sovereign sustainable bond issuer. billion ($1.5

Environmental Finance

JUNE 9, 2025

Register now Channels: Carbon Companies: South Pole People: Karolien Casaer-Diez Ritika Tewari Most Read Catalysing sustainable growth: how CGIF unlocks bond markets in the ASEAN+3 region Exclusive: Important methane abatement guidance expected to be published imminently Final Transition Loan guidance expected by November ESG 2.0:

Environmental Finance

JULY 4, 2025

and more 4 July 2025 People Moves, 4 July: ResponsAbility, Morningstar, Riyad Bank, Aegon. and more 4 July 2025 People Moves, 4 July: ResponsAbility, Morningstar, Riyad Bank, Aegon. and more By Jennifer Forrest Sign-in Username (E-mail address) Password Stay signed in? Sign-in Forgot your password? Dont have an account yet?

Environmental Finance

JUNE 13, 2025

CAF raises €100m from BNP Paribas-backed blue bond debut 13 June 2025 Development bank CAF has raised €100 million ($116 million) from its inaugural blue bond focused on the Latin America and Caribbean (LAC) region, the first issued under its updated sustainable bond framework.

GreenBiz

DECEMBER 8, 2020

Hence, the addition of sustainability-linked finance — bonds and loans with terms tied to environmental (and, in some cases, social) outcomes. That’s the realm of banks and other financial institutions. "OK, We’ll focus, as my learning journey did, primarily on ESG investing and green bonds and loans. Sponsored Article.

Environmental Finance

JULY 1, 2025

Pioneering Poland returns to green bond market after six-year hiatus 01 July 2025 Poland has raised €1.25 billion) from its first green bond since 2019, nine years after the central European country became the first sovereign sustainable bond issuer. billion ($1.5

Chris Hall

MARCH 13, 2025

Asset managers Head of Fixed Income hopes market expansion will eliminate need for the purely green bond-focused vehicle within the next decade. Niche to mainstream evolution Storebrand stated that the fund was the first commercial green bond fund, building on the first ever green bond issued by the World Bank in 2008.

Environmental Finance

JUNE 27, 2025

Microsoft in landmark soil carbon credit deal 27 June 2025 Singaporean banks carry out nature-risk study 27 June 2025 Some of Singapores largest banks and the Monetary Authority of Singapore have launched an initiative to better understand the financial implications of nature-related risk.

Environmental Finance

JULY 2, 2025

IDB, World Bank launch Amazonia Bond programme with $1bn deal plan 02 July 2025 The Inter-American Development Bank (IDB) has announced plans to raise $1 billion from a debut Amazonia Bond after it launched a new sustainable bond issuance platform focused on the Amazon with the World Bank. Not registered?

GreenBiz

MAY 10, 2021

“The Emerging Leaders program provides a forum where environmentally focused youth can explore and learn about climate solutions and sustainability efforts across public and private sectors,” said Alex Liftman, global environmental executive at Bank of America, which sponsored the program at GreenFin. Sponsored Article. Mecca Luster.

Environmental Finance

JUNE 5, 2025

search Open main menu menu Close main menu close Main menu Channels Investment Policy People Sustainable Debt Equity Green Bonds Stranded Assets Carbon Renewables COP ESG Insurance IMPACT ESG Data Natural Capital Asia Pacific Blended Finance Transition Events Blended Finance ESG Data Natural Capital Sustainable Debt Transition Sign-in Register Home (..)

GreenBiz

NOVEMBER 30, 2020

Corporate bond offerings focusing on sustainability and social issues are growing each quarter, and there’s a burgeoning market for loans linked to a company’s ESG performance or other sustainability metrics. As we reported recently , global green bond issuance shot past the $1 trillion mark in September. Sponsored Article.

3BL Media

APRIL 30, 2025

According to an article below from CME Group, to date more than 18.2 Developers and investors are tapping into green financing tools to raise capital to help meet this demand and boost returns. According to an article in Urban Land Magazine, an estimated $1.5 corn product has been exported carrying a Record of Sustainability.

Edouard Stenger

MAY 24, 2017

Part of this revolution is the meteoritic growth of green bonds, which were started in 2007 by the World Bank and the European Investment Bank. If growth was slow from the first green bond issuance to 2012, things have accelerated since. Green bonds are indeed often oversubscribed due to their success.

Environmental Finance

JUNE 4, 2025

search Open main menu menu Close main menu close Main menu Channels Investment Policy People Sustainable Debt Equity Green Bonds Stranded Assets Carbon Renewables COP ESG Insurance IMPACT ESG Data Natural Capital Asia Pacific Blended Finance Transition Events Blended Finance ESG Data Natural Capital Sustainable Debt Transition Sign-in Register Home (..)

Environmental Finance

JUNE 11, 2025

billion ($1.7 billion) deal also setting a record for European municipal issuers. billion ($1.7 billion) deal also setting a record for European municipal issuers.

Environmental Finance

JUNE 26, 2025

Institutional investors looking for 50-60% IRR in nature projects, claims major bank 26 June 2025 Institutional investors are still expecting nature projects in emerging markets to deliver unachievable rates of return, a major European bank has told Environmental Finance.

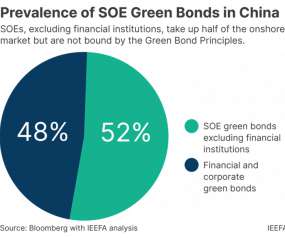

Chris Hall

DECEMBER 9, 2022

The IEEFA’s Christina Ng says China’s state-owned enterprises continue to allocate up to half of their green bond proceeds to non-green projects. . China’s ambition to green its financial market has been making significant progress. SOEs accounted for about half the onshore green issuances from 2019 to 2022.

Environmental Finance

JUNE 13, 2025

CAF raises €100m from BNP Paribas-backed blue bond debut 13 June 2025 Development bank CAF has raised €100 million ($116 million) from its inaugural blue bond focused on the Latin America and Caribbean (LAC) region, the first issued under its updated sustainable bond framework.

Environmental Finance

JULY 1, 2025

Pioneering Poland returns to green bond market after six-year hiatus 01 July 2025 Poland has raised €1.25 billion) from its first green bond since 2019, nine years after the central European country became the first sovereign sustainable bond issuer. billion ($1.5

Environmental Finance

JULY 4, 2025

search Open main menu menu Close main menu close Main menu Channels Investment Policy People Sustainable Debt Equity Green Bonds Stranded Assets Carbon Renewables COP ESG Insurance IMPACT ESG Data Natural Capital Asia Pacific Blended Finance Transition Adaptation Events Blended Finance ESG Data Natural Capital Sustainable Debt Transition Sign-in Register (..)

Environmental Finance

JUNE 9, 2025

Register now Channels: Investment Transition Companies: Partners Group Most Read Catalysing sustainable growth: how CGIF unlocks bond markets in the ASEAN+3 region Exclusive: Important methane abatement guidance expected to be published imminently Final Transition Loan guidance expected by November ESG 2.0:

Environmental Finance

JULY 1, 2025

Pioneering Poland returns to green bond market after six-year hiatus 01 July 2025 Poland has raised €1.25 billion) from its first green bond since 2019, nine years after the central European country became the first sovereign sustainable bond issuer. billion ($1.5

Environmental Finance

JUNE 27, 2025

Register now Channels: ESG Policy Companies: European Banking Authority European Insurance and Occupational Pensions Authority European Securities and Markets Authority Most Read Catalysing sustainable growth: how CGIF unlocks bond markets in the ASEAN+3 region Forestry companies to standardise natural capital valuation Defending the indefensible?

Environmental Finance

JUNE 12, 2025

Quantitative tightening hampers ECB carbon tilting efforts 12 June 2025 The European Central Bank (ECB) said its shift from quantitative easing to tightening has brought an end to its efforts to apply a climate tilt to its corporate bond portfolio.

Environmental Finance

JUNE 5, 2025

search Open main menu menu Close main menu close Main menu Channels Investment Policy People Sustainable Debt Equity Green Bonds Stranded Assets Carbon Renewables COP ESG Insurance IMPACT ESG Data Natural Capital Asia Pacific Blended Finance Transition Events Blended Finance ESG Data Natural Capital Sustainable Debt Transition Sign-in Register Home (..)

Environmental Finance

JUNE 4, 2025

search Open main menu menu Close main menu close Main menu Channels Investment Policy People Sustainable Debt Equity Green Bonds Stranded Assets Carbon Renewables COP ESG Insurance IMPACT ESG Data Natural Capital Asia Pacific Blended Finance Transition Events Blended Finance ESG Data Natural Capital Sustainable Debt Transition Sign-in Register Home (..)

Environmental Finance

JUNE 10, 2025

Struggle to sell labelled debt in US leads to pivot to Asia and Middle East, says HSBC 10 June 2025 The "struggle" to sell labelled debt products in the US in the current political environment is leading banks to seek business in markets with greater potential for growth, including in Asia and the Middle East, according to an executive at HSBC.

Environmental Finance

JUNE 12, 2025

Quantitative tightening hampers ECB carbon tilting efforts 12 June 2025 The European Central Bank (ECB) said its shift from quantitative easing to tightening has brought an end to its efforts to apply a climate tilt to its corporate bond portfolio.

Environmental Finance

JUNE 9, 2025

Register now Channels: IMPACT Natural Capital Companies: BNP Paribas Eurazeo Mirova People: Karen Sack Most Read Catalysing sustainable growth: how CGIF unlocks bond markets in the ASEAN+3 region Exclusive: Important methane abatement guidance expected to be published imminently Final Transition Loan guidance expected by November ESG 2.0:

Environmental Finance

JUNE 9, 2025

Register now Channels: IMPACT Investment Natural Capital Companies: Swen Capital Partners People: Olivier Raybaud Most Read Catalysing sustainable growth: how CGIF unlocks bond markets in the ASEAN+3 region Exclusive: Important methane abatement guidance expected to be published imminently Final Transition Loan guidance expected by November ESG 2.0:

Environmental Finance

JUNE 10, 2025

Struggle to sell labelled debt in US leads to pivot to Asia and Middle East, says HSBC 10 June 2025 The "struggle" to sell labelled debt products in the US in the current political environment is leading banks to seek business in markets with greater potential for growth, including in Asia and the Middle East, according to an executive at HSBC.

Environmental Finance

JUNE 10, 2025

Struggle to sell labelled debt in US leads to pivot to Asia and Middle East, says HSBC 10 June 2025 The "struggle" to sell labelled debt products in the US in the current political environment is leading banks to seek business in markets with greater potential for growth, including in Asia and the Middle East, according to an executive at HSBC.

Environmental Finance

JUNE 13, 2025

CAF raises €100m from BNP Paribas-backed blue bond debut 13 June 2025 Development bank CAF has raised €100 million ($116 million) from its inaugural blue bond focused on the Latin America and Caribbean (LAC) region, the first issued under its updated sustainable bond framework.

Environmental Finance

JULY 4, 2025

Not registered? Sign up today for free.

Environmental Finance

JUNE 4, 2025

search Open main menu menu Close main menu close Main menu Channels Investment Policy People Sustainable Debt Equity Green Bonds Stranded Assets Carbon Renewables COP ESG Insurance IMPACT ESG Data Natural Capital Asia Pacific Blended Finance Transition Events Blended Finance ESG Data Natural Capital Sustainable Debt Transition Sign-in Register Home (..)

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content