Ontario Power Generation includes nuclear energy in green bonds

Corporate Knights

JULY 26, 2022

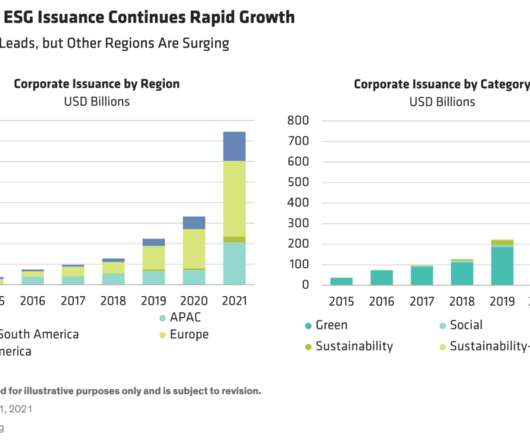

Provincially owned Ontario Power Generation has adopted a green bond framework that includes nuclear power – a first for the electricity utility. . The move followed a controversial decision in the European Union to classify natural gas and nuclear investments as green. . But does that make them objectively green?

Let's personalize your content