Canada is sleeping on the energy transition

Corporate Knights

DECEMBER 9, 2022

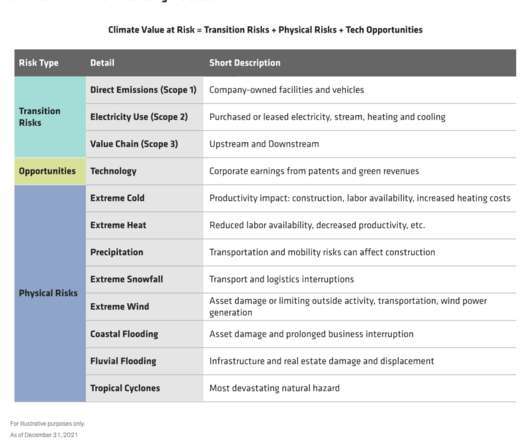

Although we’ve promised to introduce a cap on energy sector emissions, this cap will not address Scope 3 emissions (those up and down a company’s supply chain), which account for around 88% of total emissions from the oil and gas industry.

Let's personalize your content