Decarbonising Investment Portfolios on the Journey to Net Zero

3BL Media

SEPTEMBER 29, 2023

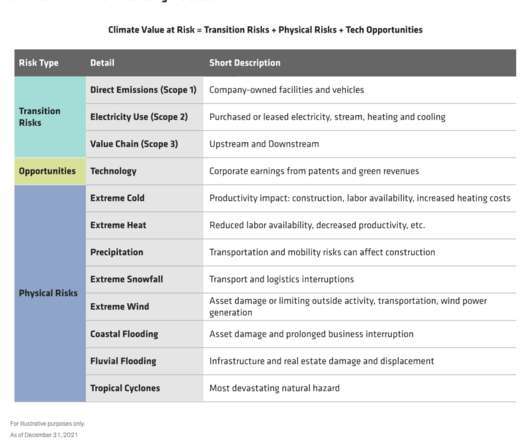

For financial institutions such as banks, insurance companies and investment managers, scope 3 emissions from supply chains and lending/investment portfolios are often more complex than for other industries. Clearly much more needs to be done to pivot towards more sustainable investment and lending practices.

Let's personalize your content