These 50 Canadian corporations are carving out a more sustainable future

Corporate Knights

JUNE 25, 2025

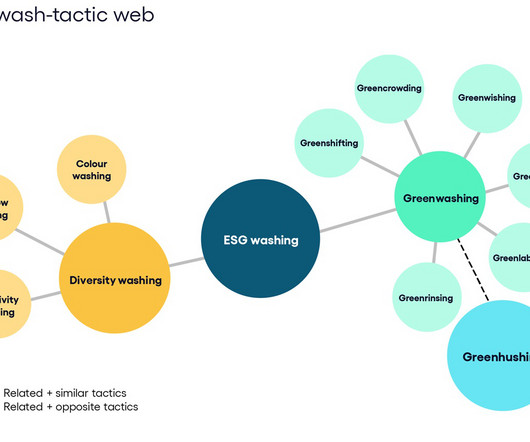

Yes, greenwashing and window-dressing still dominate the business landscape, but rankings like the Best 50 prove that progress is possible. Banks, asset management and insurance peer groups are not assessed on the sustainable investment KPI. The weight of this KPI has been reweighted to the sustainable revenue KPI.

Let's personalize your content