IWBI and GRESB Announce Partnership To Accelerate Social Sustainability

3BL Media

DECEMBER 19, 2023

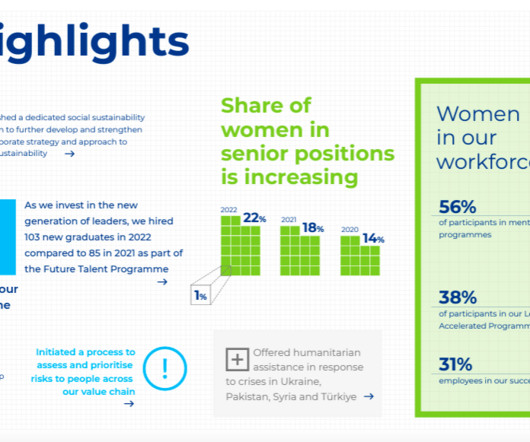

With heightened societal expectations and an evolving regulatory landscape, companies and their investors are increasingly motivated to address social sustainability, the “S” in ESG. Provide other supporting materials to help investors use information from the GRESB and IWBI social sustainability reports and tools.

Let's personalize your content