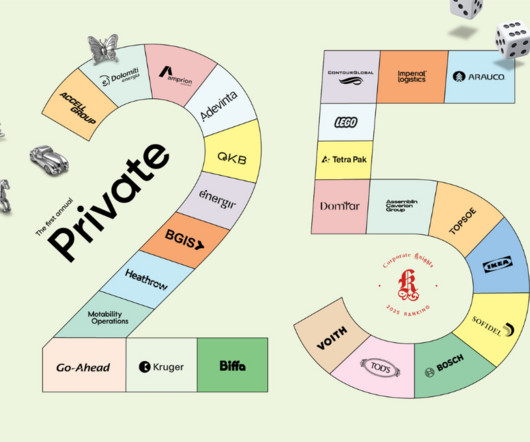

The 25 most sustainable public-sector companies in the world

Corporate Knights

APRIL 21, 2025

From the ranking leader Hydro-Qubecs $155-billion green-energy expansion plan, to 12th-place Bpifrance banks financing solar and wind power loans, the inaugural list shows how investments in renewable energy pay off. Bpifrance Bpifrance is a French public-sector bank that bills itself as a one stop shop for entrepreneurs.

Let's personalize your content