How Green Bonds Will Fund a Green Future

3BL Media

MARCH 23, 2022

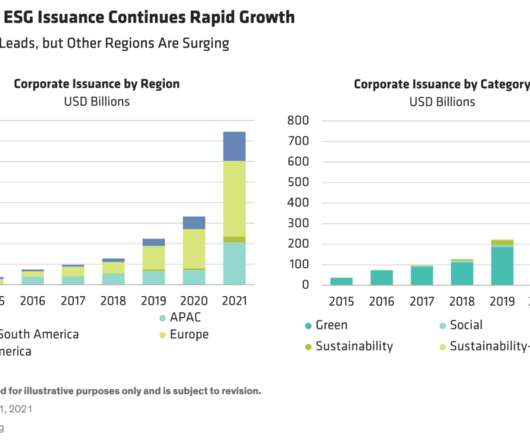

An Explosion of ESG Bond Issuance. ESG-labeled bond issuance surged to new heights in 2021. Green bonds, which fund particular projects, continued to dominate. But issuance of social, sustainability and sustainability-linked bonds—which reference specific key performance indicators, or KPIs—grew fastest (Display).

Let's personalize your content