Winners of Environmental Finance's Sustainable Investment Awards 2025 revealed

Environmental Finance

JUNE 26, 2025

This years awards honour investors and other players in the market who have been leaders in the field of sustainable finance.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Environmental Finance

JUNE 26, 2025

This years awards honour investors and other players in the market who have been leaders in the field of sustainable finance.

3BL Media

SEPTEMBER 28, 2022

4th webinar presented, focusing on what carbon offsets can – and can’t – do as part of our Climate Action webinar series. More recently, we conducted a four-part Climate Action webinar series with related resources to build capacity and spur action. 1st Climate Action Report published, in line with TCFD recommendations.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Environmental Finance

JUNE 18, 2025

Carrefour raises €650m from first SLB under new framework 18 June 2025 French supermarket chain Carrefour has raised €650 million ($750 million) from the first sustainability-linked bond (SLB) it has issued under its updated and expanded framework.

Chris Hall

DECEMBER 16, 2024

The European Supervisory Authority (ESA) proposed creating two fund categories, one for sustainable funds and another for transition funds, while the European Sustainable Investment Forum (Eurosif) suggested introducing three categories. InfluenceMap also reported that Article 8 funds had cumulatively invested 43.8

Environmental Finance

JUNE 26, 2025

Nana Skari Maidugu has been named Personality of the year in Environmental Finance s Sustainable Investment Awards, for her role in embedding sustainability at the heart of one of Africas most influential sovereign wealth funds.

Environmental Finance

JUNE 27, 2025

Lack of reliable data hindering investment in the Global South, says AXA 27 June 2025 A lack of reliable data is preventing asset managers from committing to sustainable investing in the developing markets, AXA has said.

Strategic Sustainability Consulting

JULY 6, 2022

As the worlds of finance and sustainability converge, it’s vital that investors and companies share a clear understanding about the key issues being faced — both now and in the future. The Where Do ESG and Sustainable Finance Go from Here? This is a necessity to set accurate and meaningful targets and timetables.

Environmental Finance

JUNE 25, 2025

Nature rising on the agenda amid anti-climate and ESG rhetoric, says Aviva Latest Stories Investors see exclusion as doing little to reduce real world emissions, says Nordea 25 June 2025 Institutional investors are increasingly viewing exclusion-based sustainability investing as "somewhat artificial", says Nordea Asset Management.

Sustainable Development Network

MARCH 24, 2023

On Thursday, March 23, SDSN and Geopark Quadrilátero Ferrífero (an SDSN Member) organized the webinar Climate Change Impacts on Mining Operations and Mining Territories. Artaxo called on participants to act with urgency to avoid the worst climate impacts and move towards a sustainable development trajectory.

Environmental Finance

JUNE 27, 2025

Lack of reliable data hindering investment in the Global South, says AXA 27 June 2025 A lack of reliable data is preventing asset managers from committing to sustainable investing in the developing markets, AXA has said.

Environmental Finance

JUNE 19, 2025

Public sector accounting standards setter splits workstreams 18 June 2025 Sustainable finance rules fully consistent with €800bn defence push, EU says 18 June 2025 The EUs sustainable finance rulebook "is fully consistent with" a push to invest €800 billion ($920 billion) in defence, the European Commission said as it suggested it was ready to change (..)

Environmental Finance

JUNE 27, 2025

Lack of reliable data hindering investment in the Global South, says AXA 27 June 2025 A lack of reliable data is preventing asset managers from committing to sustainable investing in the developing markets, AXA has said.

Environmental Finance

JUNE 27, 2025

Lack of reliable data hindering investment in the Global South, says AXA 27 June 2025 A lack of reliable data is preventing asset managers from committing to sustainable investing in the developing markets, AXA has said.

Environmental Finance

JUNE 27, 2025

Lack of reliable data hindering investment in the Global South, says AXA 27 June 2025 A lack of reliable data is preventing asset managers from committing to sustainable investing in the developing markets, AXA has said.

Environmental Finance

JUNE 27, 2025

Lack of reliable data hindering investment in the Global South, says AXA 27 June 2025 A lack of reliable data is preventing asset managers from committing to sustainable investing in the developing markets, AXA has said.

Environmental Finance

JUNE 24, 2025

24 June 2025 Capital is pouring into the defence sector - but can it be considered a sustainable investment, asks Rob Langston Stuck in cycle of metrics on nature, says mining giant 23 June 2025 The market is obsessed with creating the right metrics on nature, with many financial institutions failing to think long-term, a mining giant has argued.

Environmental Finance

JUNE 27, 2025

Lack of reliable data hindering investment in the Global South, says AXA 27 June 2025 A lack of reliable data is preventing asset managers from committing to sustainable investing in the developing markets, AXA has said.

Environmental Finance

JUNE 18, 2025

Carrefour raises €650m from first SLB under new framework 18 June 2025 French supermarket chain Carrefour has raised €650 million ($750 million) from the first sustainability-linked bond (SLB) it has issued under its updated and expanded framework.

Environmental Finance

JUNE 25, 2025

ECBF, Pymwymic co-lead €7m investment in agritech 25 June 2025 Investors see exclusion as doing little to reduce real world emissions, says Nordea 25 June 2025 Institutional investors are increasingly viewing exclusion-based sustainability investing as "somewhat artificial", says Nordea Asset Management.

Environmental Finance

JUNE 24, 2025

24 June 2025 Capital is pouring into the defence sector - but can it be considered a sustainable investment, asks Rob Langston Stuck in cycle of metrics on nature, says mining giant 23 June 2025 The market is obsessed with creating the right metrics on nature, with many financial institutions failing to think long-term, a mining giant has argued.

Environmental Finance

JUNE 18, 2025

Carrefour raises €650m from first SLB under new framework 18 June 2025 French supermarket chain Carrefour has raised €650 million ($750 million) from the first sustainability-linked bond (SLB) it has issued under its updated and expanded framework.

Environmental Finance

JUNE 18, 2025

Carrefour raises €650m from first SLB under new framework 18 June 2025 French supermarket chain Carrefour has raised €650 million ($750 million) from the first sustainability-linked bond (SLB) it has issued under its updated and expanded framework.

Chris Hall

FEBRUARY 28, 2025

Spain and Denmark voiced support for the CSRD’s use of double materiality in public statements ahead of the omnibus publication, with the principle also supported by Germanys Sustainable Finance Advisory Council. The reliability and the availability of the sustainability data will be drastically reduced.

Environmental Finance

JUNE 18, 2025

Carrefour raises €650m from first SLB under new framework 18 June 2025 French supermarket chain Carrefour has raised €650 million ($750 million) from the first sustainability-linked bond (SLB) it has issued under its updated and expanded framework.

Environmental Finance

JUNE 24, 2025

24 June 2025 Capital is pouring into the defence sector - but can it be considered a sustainable investment, asks Rob Langston Stuck in cycle of metrics on nature, says mining giant 23 June 2025 The market is obsessed with creating the right metrics on nature, with many financial institutions failing to think long-term, a mining giant has argued.

Environmental Finance

JUNE 18, 2025

Carrefour raises €650m from first SLB under new framework 18 June 2025 French supermarket chain Carrefour has raised €650 million ($750 million) from the first sustainability-linked bond (SLB) it has issued under its updated and expanded framework.

Environmental Finance

JUNE 25, 2025

ECBF, Pymwymic co-lead €7m investment in agritech 25 June 2025 Investors see exclusion as doing little to reduce real world emissions, says Nordea 25 June 2025 Institutional investors are increasingly viewing exclusion-based sustainability investing as "somewhat artificial", says Nordea Asset Management.

3BL Media

SEPTEMBER 28, 2022

She cited the massive growth of ESG initiatives as a great achievement but was wary of the lack of democratized data that can clearly define certain ESG investments as sustainable. SOURCE: Nasdaq, Inc. Right now] ESG is basically a box of chocolates; you don’t know what you are going to get,” said Pretorius.

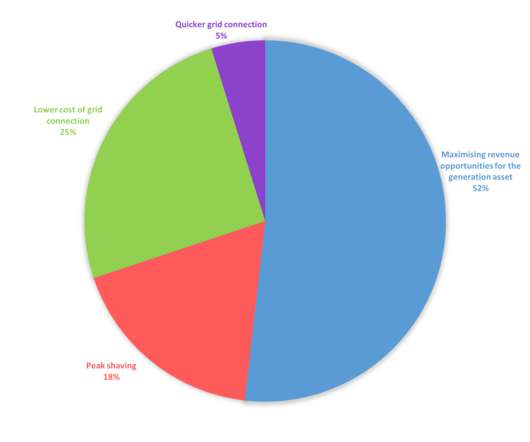

Envirotec Magazine

DECEMBER 8, 2022

“As the focus on green and sustainable investment continues, co-location is expected to have a significant role to play, and we hope this report provides a useful analysis of the opportunities and challenges that lie ahead.”.

Chris Hall

NOVEMBER 29, 2023

An announcement from EU member states on the implementation of EUDR is expected at COP28, he added. Also speaking on the webinar, Julie Gorte, Senior Vice President for Sustainable Investing at Impax Asset Management, described EUDR as one of the more “comprehensive and far-reaching tools” focused on environmental preservation.

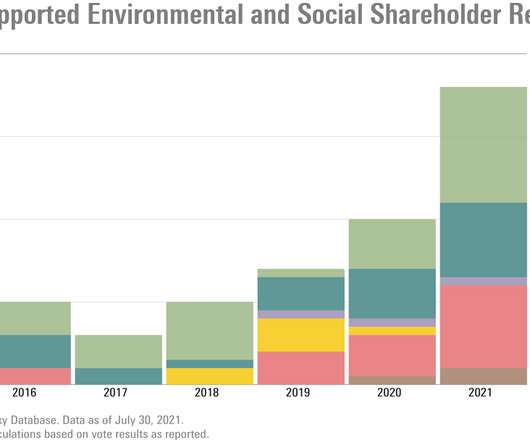

Jon Hale

NOVEMBER 12, 2021

SEC Decision Will Strengthen Investor Proxy Action on Companies' Climate Targets Bringing Sustainable Investing Options to 140 Million Americans To learn more about the proposed rule on ESG investments in retirement plans, including guidance on submitting public comment by the Dec. Wednesday, Nov.

Chris Hall

APRIL 3, 2024

In a webinar held on 2 April to discuss the details of the three guidance papers, ten members of the NZAOA, including AkademikerPension , Kenfo and University Pension Plan Ontario , highlighted the need for better transparency, consistency and accessibility in asset managers’ stewardship practices when it comes to ESG issues.

Chris Hall

NOVEMBER 17, 2023

IPR, which was commissioned by the Principles for Responsible Investment (PRI) in 2018, stressed that policy is “central to any scale up” in the development of clean energy technologies.

Chris Hall

SEPTEMBER 7, 2023

During the webinar, Thomas Van Rompeay, Responsible Investment Officer at AXA Investment Managers Alts, provided an overview of the guidance for real estate debt funds and residential mortgages.

Chris Hall

DECEMBER 8, 2023

COP28 President Sultan Al Jaber found it necessary to emphasise his commitment to science , after an ill-tempered webinar circulated in which he said there was no scientific evidence to suggest 1.5°C Siding with science – The week in Dubai started with a row about a row. C would be reached by the phase-out of fossil fuels.

Chris Hall

DECEMBER 13, 2022

Climate change is the leading issue being addressed by US asset owners that incorporate ESG factors into their investment decisions, according to the US SIF Foundation’s latest biennial Report on US Sustainable Investing Trends. trillion of assets by almost 500 pension funds, insurers, foundations, endowments and family offices.

Chris Hall

JULY 5, 2024

Story time – The halfway point of the calendar year brings forth a stream of impact and sustainability reports from asset managers and owners, particularly in the UK, as signatories also comply with their obligations under the Stewardship Code.

Chris Hall

JANUARY 26, 2022

At a webinar co-hosted by the FAIRR Initiative and the Institutional Investors Group on Climate Change (IIGCC) last week, speakers said ‘eco-schemes’ being submitted as part of countries’ national plans under the revised Common Agricultural Policy (CAP) could be automatically included in the taxonomy.

Sphera

MAY 1, 2023

2022 brought a flurry of new rules, regulations and frameworks aimed at sustainable investing and the consideration of ESG factors, and we expect more in 2023. The shift from voluntary to mandatory ESG and climate-related disclosures is transforming corporate sustainability practice along the way.

Chris Hall

MARCH 22, 2023

She was speaking on a webinar organised late last year by NGO Preventable Surprises on climate action and investor stewardship on migrant rights. Pomfret notes the same journey happened with climate change before it became an investor priority.

Chris Hall

AUGUST 31, 2023

Despite growing sustainable investment opportunities across Africa, “business-as-usual” finance system reinforces funding gap. Climate finance channelled into Africa cannot be upscaled in line with a 1.5°C

Sustainability Update

OCTOBER 15, 2024

G&A Institute will conduct an informative webinar on IFRS reporting requirements: IFRS’ ISSB Reporting Standards Pathfinders Webinar. As you tune in to IFRS reporting requirements, consider the G&A Institute team your guide to structure and navigate your company’s IFRS sustainability reporting. To help U.S.

Chris Hall

SEPTEMBER 11, 2023

“Drawing from experiences in other regions, the UK has an opportunity to consider various use cases, prioritise them, and tailor the taxonomy to suit these purposes, particularly as it launches its taxonomy consultation in the autumn,” GTAG Member Kate Levick said during a webinar on 8 September.

Chris Hall

FEBRUARY 9, 2022

Inconsistent, limited corporate disclosures continue to frustrate investors’ efforts to secure decision-useful data on social impact, according to panellists during a webinar hosted by the UK Sustainable Investment and Finance Forum (UKSIF) this week.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content