The new normal in sustainable investing post-COVID-19

GreenBiz

MAY 4, 2020

The time has passed for small commitments, hyperbole and delays in embracing sustainable investing.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Sustainable Investment Related Topics

Sustainable Investment Related Topics

GreenBiz

MAY 4, 2020

The time has passed for small commitments, hyperbole and delays in embracing sustainable investing.

3BL Media

FEBRUARY 3, 2025

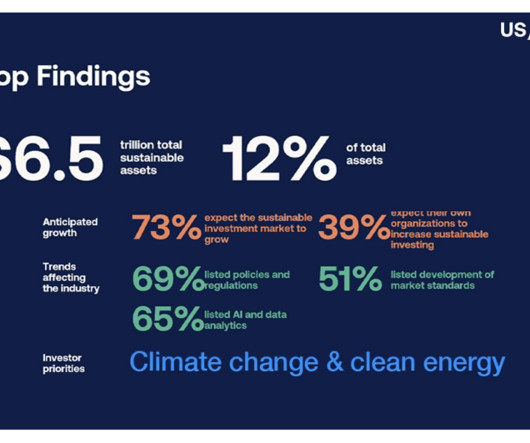

The newest "US Sustainable Investing Trends Report" from the US SIF is Establishing a Baseline Universe for Sustainable Investment & Stewardship. Here are several Key Highlights: Market Size and Sustainable Investment (AUM) : US SIF analysis, based on submissions to the SEC, records the US market size as $52.5

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

3BL Media

JANUARY 14, 2025

In its 15th edition, US SIF Foundations Report on US Sustainable Investing Trends identified climate action as the number one sustainable investing priority over the long- and short-term. trillion in total US sustainable investment assets under management at the beginning of 2024.

GreenBiz

JANUARY 20, 2021

Sustainable investing is changing global supply chains: 4 key takeaways. Sustainable investing strategies have ascended quickly in the last 10 years. Morgan Global Equity Research estimated that the sustainable investing market is expected to reach $45 trillion in assets under management (AUM) by the end of the year.

Corporate Knights

DECEMBER 14, 2022

Sustainable investing assets in the United States have plunged by more than half to US$8.4 trillion at the end of 2019, according to a new report from the US Forum for Sustainable and Responsible Investment (US SIF). Sustainable investing assets skyrocket post 2014. trillion at the end of 2021 from US$17.1

Corporate Knights

JANUARY 10, 2024

Despite appearances, sustainable investments have quietly had a great year. Given the poor performance of green energy stocks and the chorus of opposition against anything viewed as “woke,” it’s easy to get lost in the narrative that the shine has worn off sustainable investing. But that’s not what I’m seeing.

GreenBiz

AUGUST 2, 2021

Private equity is starting to see meaningful opportunity in climate finance.

Corporate Knights

FEBRUARY 8, 2022

When I led Canada’s Social Investment Organization (SIO) in the early 2000s, one of our most important debates concerned the question of whether the organization should develop an industry-wide label for socially responsible investment, as sustainable investing was called back then.

ESG Today

DECEMBER 17, 2024

Gresham House, a London-based sustainability-focused alternative asset manager, announced the appointment of Hyewon Kong as Sustainable Investment Director, responsible for advancing the firms ESG efforts across the firms strategies. billion (USD $11.18

Corporate Knights

JULY 21, 2022

Because of the growing popularity of assets with a strong focus on environmental, social and governance (ESG) goals – companies with corporate policies that encourage them to act responsibly – we wanted to look at what role emotions can play in determining people’s preference for sustainable investments.

GreenBiz

MARCH 1, 2023

Asha Mehta, founder of investment firm Global Delta Capital, discusses the intersection of sustainable investing, ESG and emerging markets.

GreenBiz

JULY 12, 2022

Wellington Management believes that through stewardship, ESG integration and informed, active ownership they can improve investment outcomes for their clients. Come hear what the $1.4

GreenBiz

MAY 22, 2024

The ROSI framework provides a 5-step approach to unlock investment in sustainability initiatives.

GreenBiz

APRIL 18, 2022

The BSR advisor, NYU professor and executive director at Ethical Systems discusses what concerning orthodoxies she’s seeing begin to ossify, and what leadership in ESG investing should really be doing right now.

ESG Today

JANUARY 14, 2025

Global investment manager Schroders announced that it has been awarded a 5.2 billion) sustainable investment mandate by UK wealth manager St. Jamess Place (SJP), as the new manager of the SJP Sustainable & Responsible Equity fund. billion (USD$6.3

GreenBiz

JUNE 30, 2022

How to become a leader in the high-finance paradigm shift? Follow pioneer Wendy Cromwell.

Corporate Knights

JANUARY 21, 2025

Corporate Knights Global 100 ranking of the worlds most sustainable firms, now in its 21st year, shows that the top firms continue to increase their investment in the green transition. Were finding that growth in sustainable revenues is outpacing all other revenues, says Toby Heaps, co-founder and CEO of Corporate Knights.

ESG Today

NOVEMBER 6, 2024

In its review, however, the Commission expressed concern that the Article 8 and 9 classifications were being used as de-facto sustainability quality labels, raising potential greenwashing risks.

3BL Media

SEPTEMBER 11, 2024

Sofidel According to the Global Sustainable Investment Alliance (GSIA), in 2023 sustainable investments in major financial markets will reach a 44% share of all assets under management in the U.S., Canada, Japan, Australia, and Europe, totaling $44 billion invested in green assets.

Environmental Finance

JUNE 26, 2025

This years awards honour investors and other players in the market who have been leaders in the field of sustainable finance.

Corporate Knights

JUNE 25, 2025

Banks, asset management and insurance peer groups are not assessed on the sustainable investment KPI. The weight of this KPI has been reweighted to the sustainable revenue KPI. of their capital spend into sustainable investments compared to just 8.7% Best 50 companies are pouring 56.4%

3BL Media

AUGUST 1, 2024

We are seeing institutional investors around the world become more interested in sustainable investment products —and we’re responding. As a global asset manager, we have focused on converting and launching new funds that comply with greater expectations of sustainability.

Corporate Knights

NOVEMBER 2, 2023

Canada is lagging in its efforts to drive private capital into sustainable investments to finance solutions on climate change and other environmental challenges. The post Canada is falling behind in global race to attract sustainable investments: Guilbeault appeared first on Corporate Knights.

3BL Media

AUGUST 28, 2024

Owens Corning, owner of Paroc AB, celebrated breaking ground on its new sustainability investment at the Paroc Hällekis plant in Sweden. We are excited to begin the groundbreaking for our new sustainability investment and the reactions from the local community and employees have been very positive.

GreenBiz

MAY 9, 2024

Whether you want to learn how to make more sustainable investment choices or improve your company’s ESG performance, these 28 courses can help.

GreenBiz

SEPTEMBER 20, 2021

Tariq Fancy, BlackRock’s former chief investment officer for sustainable investing, thinks its governments, not businesses, that must take the lead on climate change.

Corporate Knights

FEBRUARY 4, 2025

In this weeks CK Drill Down, we focus on a subset of our sustainable investment database consisting of 800 large companies that we have been tracking since 2018, including 175 from the U.S.A, In 2023 the European companies invested over 3.5 Click here for more on how we define sustainability.

GreenBiz

FEBRUARY 9, 2022

Samantha McCafferty, director, sustainable investing at Harvard Management Company, discusses the influential asset owner’s Sustainable Investing Policy and its broader approach to ESG.

GreenBiz

JANUARY 17, 2024

MIT Sloan School of Management working paper challenges the idea that sustainable investing detracts from work on climate policy.

GreenBiz

MAY 10, 2022

Tariq Fancy, former BlackRock chief investment officer for sustainable investing, and Financial Times editor-at-large Gilian Tett share their takes on the tension between the tenets of neoliberalism and the potential for ESG investing.

Financial Times: Moral Money

MAY 20, 2025

Number of mandates under review over asset managers record is growing, consultants say

Financial Times: Moral Money

MAY 21, 2025

Banks caught between sustainable investing backlash and EU clean energy push

GreenBiz

AUGUST 25, 2022

Sustainability investment group Ceres aims to engage the world's largest companies and investors to protect global water systems.

ESG Today

NOVEMBER 10, 2024

This week in ESG news: Canada to require oil & gas industry to slash emissions; California’s climate reporting law survives legal challenge; Mizuho invests in climate solutions provider Pollination; new clean energy deals signed by H&M, Meta, Saint-Gobain; incoming EU finance Commissioner calls for sustainable investment labels, reduced SFDR (..)

Environmental Finance

JUNE 30, 2025

Data centres represent a significant sustainability investment opportunity for institutional investors, according to HSBC, despite the sector's energy and water use "raising eyebrows".

GreenBiz

OCTOBER 3, 2022

Japan's big increase in sustainable investment assets from 2016 to 2020 means it accounts for 8 percent of the $35.3 trillion from the five major markets of Europe, the United States, Canada, Australasia and Japan.

ESG Today

NOVEMBER 4, 2024

UK-based investment management, wealth planning and private investment office services provider LGT Wealth Management announced the appointment of Phoebe Stone as its first Chief Sustainability Officer (UK).

ESG Today

DECEMBER 8, 2024

See below for the highlights of the past week, and get all your ESG news at ESG Today: Sustainability Goals, Initiatives and Achievements Meta Turns to Nuclear Energy to Decarbonize AI Buildout TotalEnergies Acquires Renewable Energy Developer VSB for $1.7

Corporate Knights

JUNE 8, 2025

In the Corporate Knights methodology, revenue from sustainable sources and sustainable investment together account for half of the total score that then determines rankings. These European companies are lighting a path that is not only more sustainable and sensible, but also more rewarding. B 22 Essity AB Packaging 66.7%

Financial Times: Moral Money

APRIL 25, 2025

European investors pull money from sector for first time in sign that US scepticism of woke capitalism is spreading

Corporate Knights

MARCH 13, 2024

Sustainable Investment Forum, in a statement. vice-president and co-founder of sustainable asset firm Generation Investment Management. “But

ESG Today

JUNE 20, 2025

Canadian institutional investor, Caisse de dépôt et placement du Québec (La Caisse, formerly CDPQ), announced a new sustainable investing target, aiming to reach $400 billion in “climate action” investments by the end of this decade.

3BL Media

JUNE 9, 2025

The world is changing and so are the markets.

3BL Media

APRIL 22, 2025

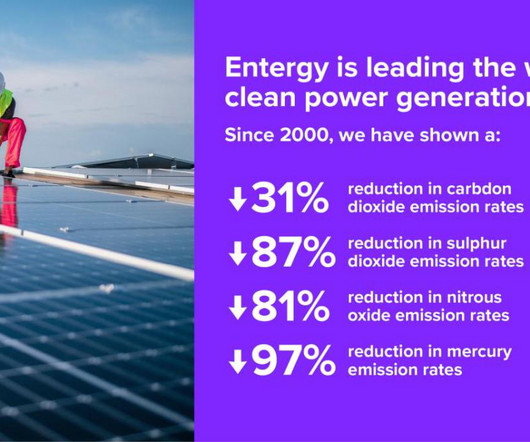

We are uniquely positioned to accelerate the transitionto a low-carbon economy by investing in low- to zero-carbon power sources and magnifying our impact by collaborating with customers and suppliers to reduce their emissions. Our regional economy and the demand for clean energy are growing.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content