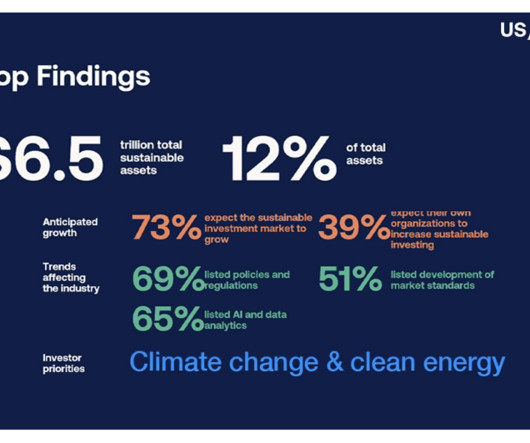

Key Highlights From the US Sustainable Investing Trends Report

3BL Media

FEBRUARY 3, 2025

The newest "US Sustainable Investing Trends Report" from the US SIF is Establishing a Baseline Universe for Sustainable Investment & Stewardship. Here are several Key Highlights: Market Size and Sustainable Investment (AUM) : US SIF analysis, based on submissions to the SEC, records the US market size as $52.5

Let's personalize your content