ESG Today: Week in Review

ESG Today

NOVEMBER 3, 2024

Copper Mine Operations to Renewable Diesel Southwest Airlines Eliminates 1.5

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

ESG Today

NOVEMBER 3, 2024

Copper Mine Operations to Renewable Diesel Southwest Airlines Eliminates 1.5

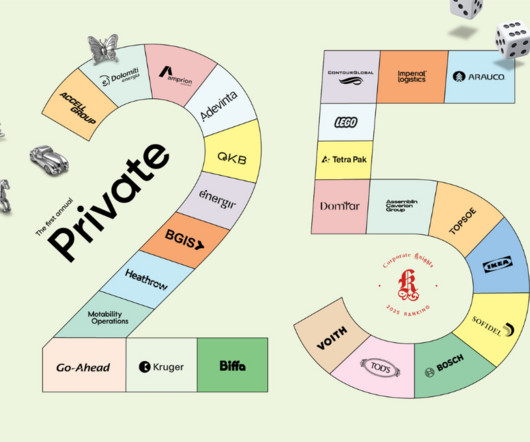

Corporate Knights

APRIL 21, 2025

The company recently closed a green bond offering that will help it transition to predominantly renewable sources of power. Imperial Logistics Ltd Responsible logistics Imperial Logistics provides logistics and supply-chain management services across industries, mostly in Africa and Europe.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Environmental Finance

JUNE 4, 2025

search Open main menu menu Close main menu close Main menu Channels Investment Policy People Sustainable Debt Equity Green Bonds Stranded Assets Carbon Renewables COP ESG Insurance IMPACT ESG Data Natural Capital Asia Pacific Blended Finance Transition Events Blended Finance ESG Data Natural Capital Sustainable Debt Transition Sign-in Register Home (..)

Corporate Knights

MARCH 3, 2025

The pullback threatens to erode years of progress, which has made Europe the leading market for sustainable funds , green bonds and other responsible investments, and jeopardizes the capital needed for the EUs ambitious climate goals. Supply chain audits will be required once every five years rather than annually.

Corporate Knights

APRIL 21, 2025

The amount of energy produced by wind energy is expected to rise to 9,500 MW, up from just 1,800 MW five years ago, and the company is now offering green bonds to help finance 4 billion in investments to help the country meet its net-zero targets by 2035. It is also one of the biggest green financiers globally.

Chris Hall

NOVEMBER 8, 2024

The Climate Bonds Initiative, for example, recently expanded its green bond taxonomy to cover adaptation and resilience. The Oxford Programme for Sustainable Infrastructure Systems, part of the ECI, has studied the UK’s dependence on global infrastructure systems and supply chains, and how the country is affected by disruption.

Sustainability Update

JULY 8, 2025

Physical climate risks pose significant material risks to companies’ assets, business operations, and supply chains. Among the negative impacts are declining air quality, which arises both from effects following weather events such as wildfires as well as increases in air pollutants being released.

Environmental Finance

JULY 17, 2025

US REIT green bond issuance struggles in 2025 as Equinix stands alone 17 July 2025 Green bond issuance by US real estate investment trusts (REITs) has continued to contract in 2025, as Equinix remains the sole issuer this year to date.

We Mean Business Coalition

NOVEMBER 27, 2024

For instance, investments in resilient infrastructure—such as flood defenses, sustainable agriculture, or water management systems—offer businesses a means to protect critical supply chains and thereby avoid both local and global disruption from climate shocks.

Environmental Finance

JULY 17, 2025

US REIT green bond issuance struggles in 2025 as Equinix stands alone 17 July 2025 Green bond issuance by US real estate investment trusts (REITs) has continued to contract in 2025, as Equinix remains the sole issuer this year to date. Dont have an account yet? Not registered? Sign up today for free.

GreenBiz

JULY 21, 2020

Apple embeds racial justice into new supply-chain carbon neutrality pledge. Apple already has ventured far beyond most other companies when it comes to pushing for climate action within its supply chain. . That's how much clean energy companies within Apple supply chain have committed to using. Supply Chain.

GreenBiz

FEBRUARY 21, 2024

Two tools funding decarbonization: Green bonds and supply chain financing programs.

GreenBiz

AUGUST 5, 2020

A proliferation of greening initiatives from industry players has emerged with public announcements of policies to tackle this issue, measures to address their supply chain footprints, promotion of circular economy practices and encouragement for sustainable brands growing increasingly popular. But it is not all doom and gloom.

3BL Media

MARCH 23, 2022

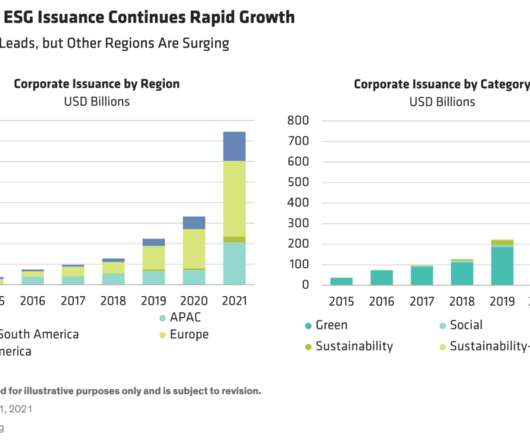

An Explosion of ESG Bond Issuance. ESG-labeled bond issuance surged to new heights in 2021. Green bonds, which fund particular projects, continued to dominate. But issuance of social, sustainability and sustainability-linked bonds—which reference specific key performance indicators, or KPIs—grew fastest (Display).

ESG Today

JULY 21, 2022

Food and beverage giant PepsiCo announced today the completion of a new green bond offering, raising $1.25 billion, with proceeds aimed at funding projects supporting the company’s agriculture and value chain-focused sustainability initiatives. The post PepsiCo Issues $1.25

GreenBiz

MAY 10, 2021

The current green bonds used to offset GHG emissions can be expanded to identify a roadmap that supports individuals within a corporation’s community or supply chain. Although interests may not align, the purchasing power of these groups can be harnessed to pinpoint cleaner financial decisions.

ESG Today

SEPTEMBER 12, 2022

Railroad company Union Pacific announced today the completion of a $600 million green bond issuance, with proceeds aimed at funding its decarbonize and emissions reduction investments. Union Pacific recently released its Green Financing Framework, outlining eligible categories from investment from its issuances of green bonds.

Renewable Energy World

MARCH 26, 2021

American multinational technology company Apple has announced that its 2020 green bonds will support the installation of 1.2 The company funded 17 green bond projects, from the $4.7 billion in green bond funding the company issued since 2016. From its green bond portfolio, Apple has so far allocated $2.8

ESG Today

AUGUST 11, 2024

See below for the highlights of the past week, and get all your ESG news at ESG Today: Sustainability Goals, Initiatives and Achievements Microsoft Partners with Pivot Energy to Develop Community Solar Projects to Help Tackle Scope 3 Emissions JERA Nex Enters U.S.

GreenBiz

FEBRUARY 1, 2021

Because we're Scope 3, it's got to be across your whole supply chain. And then we're going to take that money, and we're going to deploy it with a third party into our supply chain. It's not something that's out there, it's put into our supply chain, to fully eliminate the impact of the emissions from that flight.

ESG Today

MARCH 24, 2024

This week in ESG news: Texas pulls $8.5

3BL Media

APRIL 30, 2025

corn sustainability across international supply chains, the U.S. trillion in green, social, and sustainability-linked bonds and other mechanisms are being raised annually around the world. To provide traceability of U.S. Grains Council (USCG) introduced the Corn Sustainability Assurance Protocol (CSAP) in 2023.

Environment + Energy Leader

MAY 22, 2023

The money will help enhance sustainable technology at its new $3 billion facility expected to open next year.

ESG Today

FEBRUARY 18, 2024

billion green bond to build new net zero chemical plant, and more. Billion Green Bonds to Fund New Net Zero Chemical Plant Private Equity & Venture Capital Industrial Decarbonization Startup Celadyne Raises $4.5 Billion to Build Gigafactories Across Europe Dow Issues Inaugural $1.25

Chris Hall

MARCH 13, 2025

Asset managers Head of Fixed Income hopes market expansion will eliminate need for the purely green bond-focused vehicle within the next decade. Niche to mainstream evolution Storebrand stated that the fund was the first commercial green bond fund, building on the first ever green bond issued by the World Bank in 2008.

ESG Today

OCTOBER 14, 2022

Corporate interest in sustainability-linked loans has grown rapidly, as the financing provides flexibility to use proceeds for general corporate purposes, while with instruments such as green bonds, raised funds can only be allocated to specific categories of green projects.

GreenBiz

DECEMBER 4, 2020

Several big aquaculture companies have tried to eliminate soy grown on deforested land from their supply chains, but it’s notoriously hard to track sourcing in remote regions. Switching to these systems can be costly, but, as Planet Tracker argues in its report, green bonds can be used to finance the transition.

3BL Media

FEBRUARY 20, 2024

Another way companies reduce operational costs is through investing in a sustainable supply chain. This can lead to more stable and resilient supplier relationships, reducing the risks and costs associated with supply chain disruptions. These improvements can significantly reduce operational costs over time.

ESG Today

FEBRUARY 25, 2024

This week in ESG news: EU adopts new law against greenwashing; Walmart reaches 1 billion ton supply chain emissions reduction milestone; S&P forecasts $1 trillion sustainable bond market in 2024; Airbus, TotalEnergies launch sustainable aviation fuel partnership; Verizon invests $1 billion in renewable energy; EU lawmakers agree to certification (..)

ESG Today

JULY 3, 2022

Guest Post: ESG Risks in the Supply Chain and Identifying Weaknesses. responsAbility, ESG-AM Launch Bond Fund Targeting Industrial Decarbonization Leaders. Amundi Launches Corporate Green Bond Fund. HSBC, PVH Launch Sustainable Supply Chain Finance Program. ESG Investing.

ESG Today

SEPTEMBER 18, 2022

Truck Builder Scania Sets 2030 Goal to Decarbonize Supply Chain. Capgemini Sets Goal to Reduce Emissions Across Value Chain by 90%. Assent Launches Supply Chain Sustainability Reporting Solution for Complex Manufacturers. Anglo American Ties Interest on $745 Million Bond to Climate, Water & Job Creation Goals.

ESG Today

APRIL 23, 2023

This week in ESG news: IBM study shatters “myth” that ESG harms profitability; PwC boosts nature and biodiversity capabilities; Starbucks certifies 3,500 environmentally sustainable stores; Hong Kong to require all issuers to report on climate; EU lawmakers adopt rules tackling deforestation in supply chains; Schneider Electric launches (..)

ESG Today

OCTOBER 11, 2022

The announcement follows Verizon’s issuance earlier this year of its fourth $1 billion green bond. Verizon has allocated billions from green bond offerings over the past few years to scale up its use of renewable energy. In January, the company revealed that it had secured approximately 2.6 energy grid.

ESG Today

MAY 16, 2023

The demand for low-carbon steel is set to rise as manufacturers worldwide strive to decarbonize their supply chains. Steelmaking, a major CO2 emitter, poses challenges in reducing greenhouse gas emissions, accounting for 7% – 9% of direct emissions from fossil fuel use globally.

ESG Today

APRIL 21, 2024

to Fund Clean Energy Buildout EdgeConneX Secures $1.9 Billion in Financing Tied to Sustainability Goals Private Equity & Venture Capital Fintech Startup Unwritten Raises $3.5

3BL Media

NOVEMBER 18, 2024

For example: A Hong Kong Monetary Authority study revealed that one-third of corporate green bond issuers globally had worse environmental performance after their initial green bond issuance. By embedding sustainability into the supply chain, companies can reduce their exposure to greenwashing risks.

ESG Today

JANUARY 10, 2024

The new green loan follows the company’s announcement in 2021 of plans for its financing structure to have an increasingly higher percentage of green and sustainable products, estimated to account for nearly two-thirds of its debt by 2025. In December, Iberdrola announced a €5.3

3BL Media

MARCH 9, 2022

SynTao Green Finance is a leading consultancy providing professional services in green finance and responsible investment in China. It provides consulting and researching services in responsible investment, ESG data, green bond verification, and other green finance areas.

Chris Hall

OCTOBER 25, 2024

Ujala Qadir, Director of Strategic Programmes at the Climate Bonds Initiative, explains why the organisation has expanded its green bond taxonomy to cover climate resilience. But it’s called ‘supply-chain management’ or ‘business continuity’ – not adaptation or resilience,” she said.

ESG Today

AUGUST 13, 2023

invests over $1 billion in carbon removal projects; BlackRock, New Zealand partner to launch climate infrastructure fund; California launches clean hydrogen strategy; Fitch study finds green bond allocations overlooking climate adaptation; Goldman invests in U.S.

B the Change

APRIL 16, 2023

How to uphold human rights in the supply chain. Supply chain operations can be distant and full of social and environmental problems. As companies take more responsibility for their supply chains, they want to know how to address modern slavery and advance living wages. Social Justice 8.

ESG Today

FEBRUARY 12, 2023

See below for the highlights of the past week, and get all your ESG news at ESG Today: Sustainability Goals, Initiatives and Achievements Shell Board of Directors Sued over “Flawed” Climate Strategy Wendy’s Commits to Slash Emissions Across Operations, Franchisees and Supply Chain HVAC Giant Carrier Commits to Net Zero Emissions Across Value Chain (..)

ESG Today

OCTOBER 31, 2022

Wong also highlighted the importance of developing green finance in order to channel the trillions of dollars in capital necessary to facilitate the low carbon transition. Other initiatives highlighted by the Deputy PM included raising the carbon tax and new public sector commitments.

3BL Media

MAY 16, 2022

Continues to help create long-term value for business through ongoing investments in ESG and supply chain resiliency. The issues we are tackling are systemic, requiring supply chain and business transformation. Black management representation by 60 percent year-over-year. z International, Inc. z International.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content