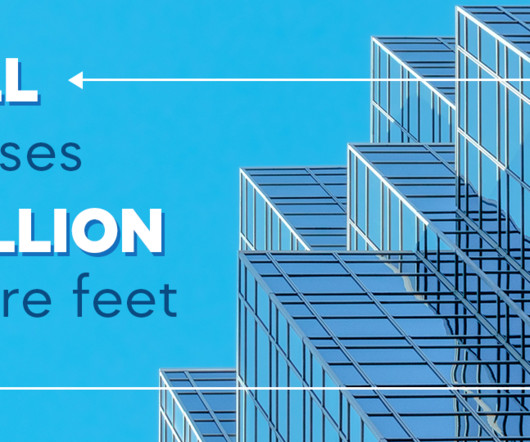

Global WELL Adoption Experiences Unprecedented Growth, With 6 Billion Square Feet of Space Now Engaged With the World’s Leading Standard for Healthy Buildings, Organizations and Communities

3BL Media

JULY 10, 2025

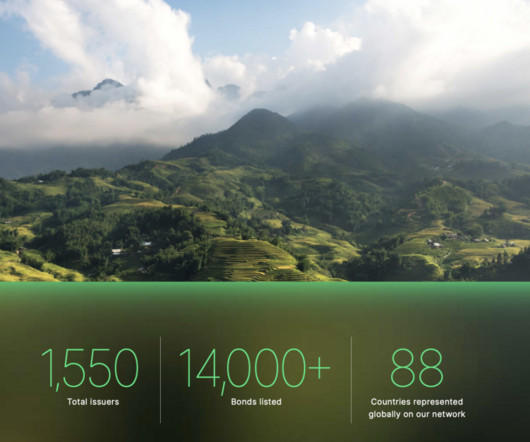

Since the end of 2024, WELL has also been incorporated in 12 different types of financial instruments—including green bonds, social bonds and sustainability-linked bonds and loans—and featured in sustainable finance frameworks, regulatory guides, reports and case studies in 24 countries, spanning five continents.

Let's personalize your content