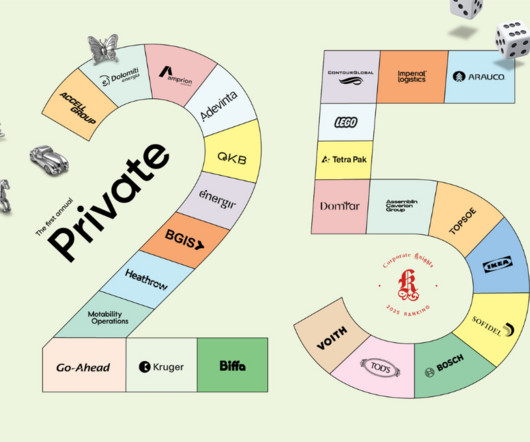

The 25 most sustainable private companies in the world

Corporate Knights

APRIL 21, 2025

While publicly traded companies often dominate the headlines, private companies are a much larger part of the global economy. The ranking includes key performance indicators (KPIs) in areas such as energy, water, and waste, and governance factors like gender diversity. Biffa PLC Conscientious waste management U.K.-based

Let's personalize your content