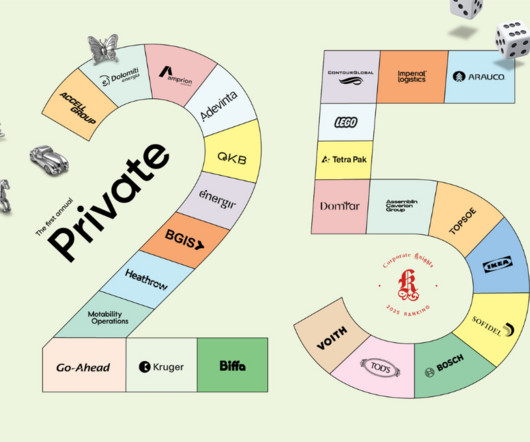

The 25 most sustainable private companies in the world

Corporate Knights

APRIL 21, 2025

While publicly traded companies often dominate the headlines, private companies are a much larger part of the global economy. They dont have the same regulatory requirements to disclose information that public companies do, especially when it comes to revenues and profits. Historically, private companies are more, well, private.

Let's personalize your content