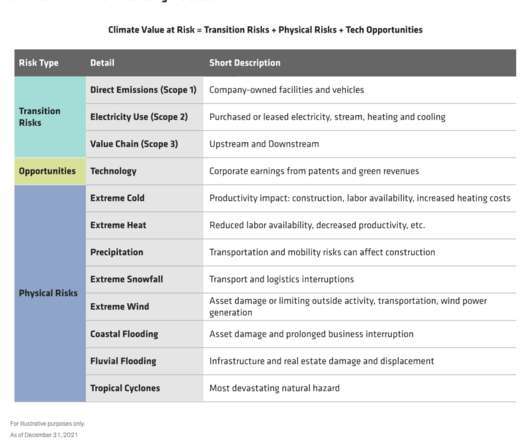

Social Cost of Mandates - Lots of "Broken Windows" and stranded assets

Energy Central

JUNE 13, 2023

Broken Window Economics: an event that seems to be beneficial for those immediately involved can have negative economic consequences for many others. Originally posted here. The US and most countries have energy economies based on fossil fuels, plus contributions from nuclear, hydro, geothermal and biomass.

Let's personalize your content