Hundreds of funds to be stripped of ESG rating

Financial Times: Moral Money

MARCH 23, 2023

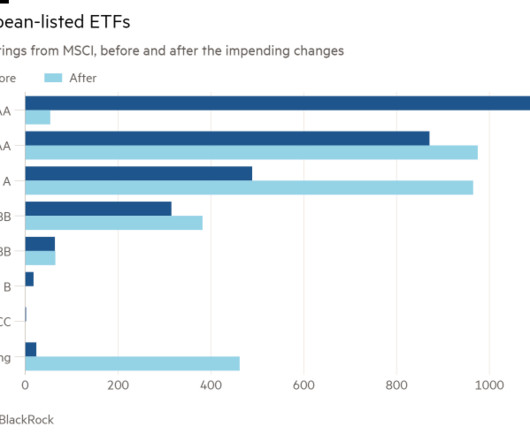

Unpublished BlackRock research also reveals thousands more will be downgraded in wide-ranging MSCI shake-up

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

esg-fund-ratings

esg-fund-ratings

Financial Times: Moral Money

MARCH 23, 2023

Unpublished BlackRock research also reveals thousands more will be downgraded in wide-ranging MSCI shake-up

3BL Media

SEPTEMBER 6, 2023

We recently added Integrum ESG ’s data set to CSRHub. Nearly 900 sources of ESG opinion now contribute to our consensus ratings. Integrum ESG has from inception committed to total transparency with their ESG ratings. Integrum ESG combines machine learning technology with a review by human analysts.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

3BL Media

APRIL 11, 2022

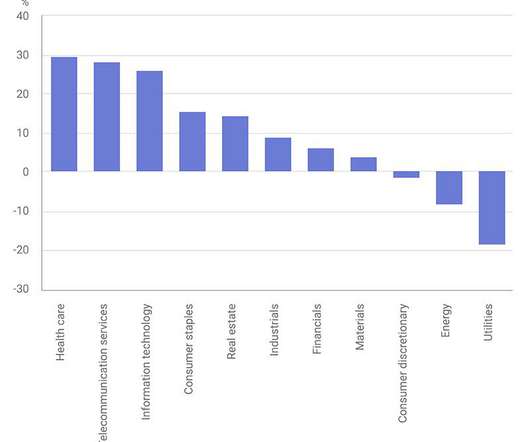

DESCRIPTION: by Lori Keith, the Director of Research at Parnassus Investments and Portfolio Manager of the Parnassus Mid Cap Fund . ESG strategies are rapidly gaining popularity as interest in supporting companies that manage their carbon footprints, invest in their employees, and promote diversity surges.

3BL Media

JANUARY 8, 2024

In the EMEA markets, for example, the team launched two global bond ESG funds, the Global Bond ESG Climate Index Fund and the NT Global 1-5 Years Bond ESG Climate Index Fund. market, through our FlexShares ETFs, we launched an emerging markets fund that also utilizes the Northern Trust ESG Vector ScoreTM.

Corporate Knights

DECEMBER 14, 2022

financial industry has reassessed trillions of dollars in sustainable investments, stripping them of their previously reported environmental, social and governance (ESG) status, says the 2022 biennial Report on US Sustainable Investing Trends , released this week and based on a survey of asset managers and institutional investors.

GreenBiz

AUGUST 24, 2020

Indeed, the pandemic response is being financed in part through bonds designed to fund development of vaccines or treatments, support healthcare systems fighting the outbreak or provide relief efforts, such as for cities and counties facing budgetary challenges due to lost revenues and emergency spending.

Chris Hall

NOVEMBER 1, 2023

Difficulties in definition continue to thwart efforts to demonstrate the financial benefits of sustainable investments. Sustainable fund flows attracted US$37 billion of net new money in Q4 2022, with global sustainable fund assets reaching a total of US$2.5 trillion by 2026, up from US$18.4

3BL Media

NOVEMBER 16, 2022

DESCRIPTION: Meyer Memorial Trust is First Dynamo Client to Adopt New ESG Integration to Establish ESG Ratings. The Dynamo-CSRHub integration helps investors take subjectivity out of the ratings universe by providing a CSRHub consensus overall score and four ESG category scores.” SOURCE: CSRHub.

ESG Today

OCTOBER 4, 2023

BNP Paribas Asset Management announced the expansion of its ESG fixed income ETF range, with the launch of the new BNP Paribas Easy € Corp Bond SRI Fossil Free Ultrashort Duration UCITS ETF and BNP Paribas Easy USD Corp Bond SRI Fossil Free UCITS ETF. The funds have been listed on Euronext Paris, Borsa Italiana and Deutsche Börse Xetra.

GreenBiz

MARCH 4, 2021

The exclusion of JBS is quite dramatic for us because it is from all of our funds, not just the ones labelled ESG," Eric Pedersen, Nordea’s head of responsible investments, told The Guardian. . Still, progress in this area could move faster than we’ve typically seen in ESG-land, for a few reasons: .

3BL Media

DECEMBER 19, 2023

With heightened societal expectations and an evolving regulatory landscape, companies and their investors are increasingly motivated to address social sustainability, the “S” in ESG. Social sustainability is the core of the “S” component of ESG.

GreenBiz

NOVEMBER 30, 2020

The world of environmental, social and governance (ESG) reporting and investing has ramped up significantly over the past couple years, even more so during 2020, when social risks and reporting became front and center for many companies and investors. So, too, the growth of ESG-related bonds and loans. Introducing … GreenFin 21.

Corporate Knights

NOVEMBER 28, 2022

Reclassifying responsible funds. The Canadian Securities Administrators (the umbrella group for Canadian securities commissions) cited greenwashing concerns earlier this year when it released new guidance for investment funds employing ESG strategies. Managers pull back on ESG integration .

3BL Media

NOVEMBER 22, 2022

For seven consecutive years Principal strategies earned a 4-star GRESB rating. real estate core strategy and two European real estate core property strategies received 4-star ratings in 2022 from the Global Real Estate Sustainability Benchmark (GRESB). core strategy has earned a 4-star rating from GRESB.

3BL Media

FEBRUARY 20, 2024

Reduced cost of capital Sustainable investments often attract a broader base of investors, including socially responsible investment funds and individuals looking for ethical investment opportunities. Green bonds Corporations can issue green bonds to raise funds for new and existing projects with environmental benefits.

Corporate Knights

JULY 21, 2022

Because of the growing popularity of assets with a strong focus on environmental, social and governance (ESG) goals – companies with corporate policies that encourage them to act responsibly – we wanted to look at what role emotions can play in determining people’s preference for sustainable investments. Our study comes with a caveat.

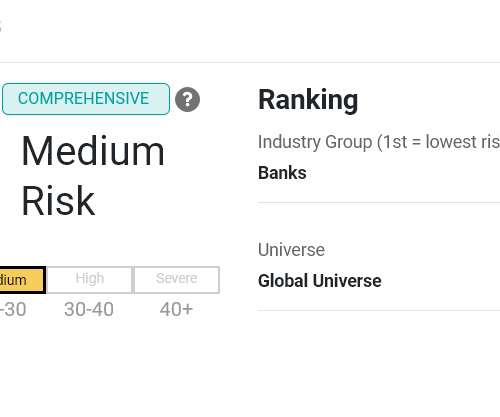

MSCI

JULY 10, 2019

Nearly $31 trillion in assets under management were invested in funds that consider ESG issues in their investing process as of January 2018, a 34% increase from two years previously. Transparency is key to understanding what this expansion means.

ESG Today

NOVEMBER 27, 2022

See below for the highlights of the past week, and get all your ESG news at ESG Today: Sustainability Goals, Initiatives and Achievements. See below for the highlights of the past week, and get all your ESG news at ESG Today: Sustainability Goals, Initiatives and Achievements. ESG Reporting & Disclosure.

3BL Media

NOVEMBER 17, 2022

DESCRIPTION: by Mark Regier of Praxis Funds and Everence Financial. Tweet me: Community Investing is Economic Sustainability -- by Mark Regier of Praxis Funds and Everence Financial -- [link] || #ESG impinv #CreationCare #sustainability #SustainableInvestors @PraxisFunds. SOURCE: GreenMoney Journal.

3BL Media

NOVEMBER 16, 2022

DESCRIPTION: November 16, 2022 /3BL Media/ - Lenovo Group (HKSE: 992) (ADR: LNVGY) is pleased to report that its green bond has been included in the Bloomberg MSCI Green Bond Index, one of the most important global benchmarks for institutional Environmental, Social, Governance (ESG) funds. Find out more here: [link].

Chris Hall

APRIL 6, 2023

Research finds declining confidence, as the UK opens a consultation on regulating ESG rating agencies. But investor confidence in ESG rating products was moderate. Speaking to ESG Investor , Aiste Brackley, Partner at ERM, said while ESG ratings had evolved in recent years, many pain points persisted.

Corporate Knights

MARCH 20, 2024

W ith the nuclear calamities of Three Mile Island and Chernobyl fresh in the public mind, the 1980s saw a number of socially responsible investment funds pledge to keep nuclear energy out of their portfolios. The bonds are ranked “medium green” by investment rating service S&P Global.

ESG Today

DECEMBER 7, 2023

The Monetary Authority of Singapore (MAS), the central bank and financial regulator of Singapore, announced today the publication of its finalized Code of Conduct for ESG Rating and Data Product Providers (COC), introducing a set of principles aimed at boosting transparency, comparability and reliability of ESG ratings and data.

ESG Today

FEBRUARY 11, 2024

This week in ESG news: EU lawmakers agree to regulate ESG ratings providers; Brookfield raises $10 billion for climate transition fund, on track for largest ever; EU proposes new 2040 climate goal; Deloitte, Informatica, Workiva partner on ESG data and reporting; HSBC, Google launch climate tech finance partnership; GRI launches sustainability reporting (..)

ESG Today

FEBRUARY 21, 2023

In the new consultation paper released Monday, SEBI notes the “growing recognition of the significant economic and financial impact of climate change and environmental, social and governance (ESG) risks,” which has led to the launch of ESG funds and calls by investors and regulators for ESG-related disclosures.

3BL Media

SEPTEMBER 28, 2022

Investors can validate fund ESG names and climate claims with factual data and easy reporting tools. Investors’ growing appetite for sustainable investments now places funds marketed as ESG at more than $2.7trn in AUM. SOURCE: Impact Cubed. For more information, visit www.impact-cubed.com.

ESG Today

OCTOBER 10, 2023

Global investment manager Franklin Templeton’s specialist investment manager ClearBridge Investments announced today the launch of the FTGF ClearBridge Global Sustainability Improvers Fund, a new global value equity fund investing in undervalued companies with improving ESG profiles.

Jon Hale

DECEMBER 16, 2022

Sustainability Matters Adding sustainable funds will take some time, but could improve retirement readiness for many participants. Department of Labor has just made it easier for American workers to invest in sustainable funds in their 401(k) plans. That being the case, a plan can choose the ESG fund.

ESG Today

JUNE 13, 2023

The European Commission released a series of measures on Tuesday aimed at bolstering its sustainable finance framework, including a new proposal to regulate ESG ratings providers, and the introduction of a new set of criteria for sustainable economic activities under the EU Taxonomy.

Chris Hall

AUGUST 25, 2022

ESG funds currently investing in firms and projects responsible for “serious human rights violation and environmental destruction”. Plans by the US Securities and Exchange Commission (SEC) to crack down on greenwashing by fund managers must be revised to cover not just environmental but human rights issues.

ESG Today

AUGUST 13, 2023

This week in ESG news: KPMG survey finds most M&A dealmakers have cancelled deals on ESG due diligence findings; Blackstone raises $7 billion for energy transition fund; S&P removes ESG scores from credit ratings; U.S.

3BL Media

JANUARY 24, 2024

In this edition of the Insights Series, we look at the key themes in ESG reporting and the main responsibilities of those specialist functions across investment management, banking and insurance and private markets. So, what do we mean when we refer to “ESG reporting” in the context of financial services?

ESG Today

JUNE 18, 2023

The post ESG Today: Week in Review appeared first on ESG Today. Million Solar Tech Startup CubicPV Raises Over $100 Million Brookfield Acquires Duke Energy’s Commercial Renewables Business for $2.8 Million Solar Tech Startup CubicPV Raises Over $100 Million Brookfield Acquires Duke Energy’s Commercial Renewables Business for $2.8

3BL Media

DECEMBER 21, 2023

The DJSI is a widely recognized standard for measuring corporate environmental, social, and governance (ESG) progress across regions and industries. The FTSE4Good indices are used by a wide variety of market participants to create and assess responsible investment funds and other products. 2 The inclusion of Keysight Technologies, Inc.

3BL Media

MARCH 29, 2022

Tech-enabled solution allows investors to select, compare and report on ESG funds with factual data. Providing enhanced transparency with factual ESG data means investors can create better funds and avoid greenwashing concerns. Sustainable fund assets continue to grow rapidly, topping $2.7 SOURCE: Impact Cubed.

3BL Media

NOVEMBER 28, 2023

This event will delve into the means and examples of how to access funding by GCF and the critical role of ESG principles in shaping investment decisions and financial mechanisms to combat climate change and foster a more sustainable global economy.

Environmental Finance

JANUARY 17, 2024

Norway's sovereign wealth fund has called for greater transparency in ESG ratings, and backed the International Organization of Securities Commissions (IOSCO) principles for regulating the market.

ESG Today

DECEMBER 2, 2022

ESG ratings, data, and research provider Morningstar Sustainalytics announced today an expansion to its ESG Risk Ratings service to new asset classes including fixed income and private equity, as well as the addition of listed Chinese.

ESG Today

JULY 24, 2023

ESG funds in India will be required to have at least 80% of their assets invested in securities aligned with their specific strategies, and asset managers will be required to provide monthly ESG scores for holdings, according to new rules released for ESG investment funds by the Securities and Exchange Board of India (SEBI).

3BL Media

NOVEMBER 7, 2022

DESCRIPTION: As we enter 2021, environmental, social and governance (ESG) continues to be a top priority for boards and management teams. Karen Snow , Senior Vice President and Head of East Coast Listings and Capital Services at Nasdaq, interviews veteran board member Betsy Atkins to get her insights on how to operationalize ESG.

3BL Media

JUNE 30, 2022

DESCRIPTION: What is it about an investable product – a mutual fund, an exchange traded fund (ETF) –that would qualify it as an “ESG,” “green” or “sustainable” investment offering to retail or institutional investors? S&P Global looked at about 12,000 equity funds and ETFs with $20 trillion in total market value.

Environmental Finance

SEPTEMBER 22, 2022

Amid ongoing criticism of environmental, social and governance (ESG) ratings, European credit ratings provider Scope has argued that a "paradigm shift" is needed for the industry to focus on ESG impact rather than risk - especially as they increasingly get used for 'impact' funds.

ESG Today

OCTOBER 31, 2022

ESG investing is no longer a niche pursuit but rather rapidly becoming a go-to strategy for investment managers looking to meet the increasing demands and ESG awareness of their end capital owners. Enabling comparability of debt instruments from an ESG perspective. About Sustainable Fitch ESG Ratings.

Chris Hall

FEBRUARY 24, 2023

BRSR framework enhancements will require ESG disclosures assurance, with mandatory requirements for ESG rating providers. The consultation paper proposes to improve assurance of ESG disclosures through the integration on KPIs for each of the E, S, and G in the framework.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content