SOEs Undermine Credibility of China’s Green Bonds

Chris Hall

DECEMBER 9, 2022

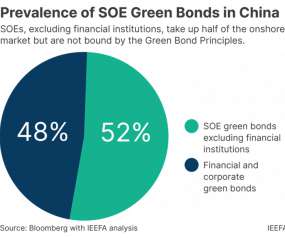

The IEEFA’s Christina Ng says China’s state-owned enterprises continue to allocate up to half of their green bond proceeds to non-green projects. . China’s ambition to green its financial market has been making significant progress. SOEs accounted for about half the onshore green issuances from 2019 to 2022.

Let's personalize your content