All Systems go for Net Zero

Chris Hall

JANUARY 3, 2024

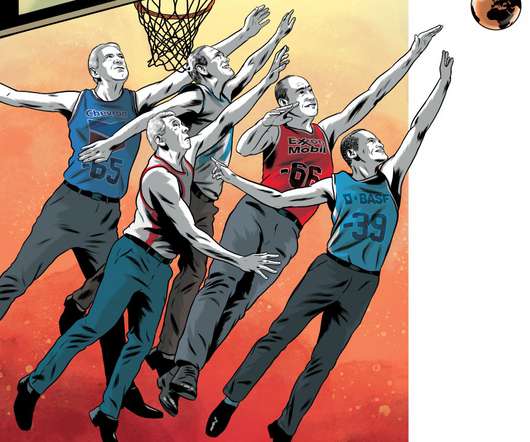

COP28 reminded investors of the difficulties involved in reaching inter-governmental consensus on intensifying climate action. All this suggests 2024 will prove a difficult and perhaps pivotal year for asset owners looking to make headway on their net zero commitments.

Let's personalize your content