Canada is falling behind in global race to attract sustainable investments: Guilbeault

Corporate Knights

NOVEMBER 2, 2023

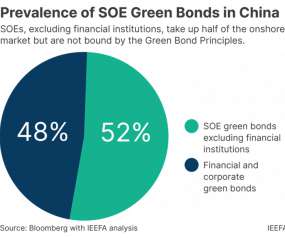

Canada is lagging in its efforts to drive private capital into sustainable investments to finance solutions on climate change and other environmental challenges. The post Canada is falling behind in global race to attract sustainable investments: Guilbeault appeared first on Corporate Knights.

Let's personalize your content