How Green Bonds Will Fund a Green Future

3BL Media

MARCH 23, 2022

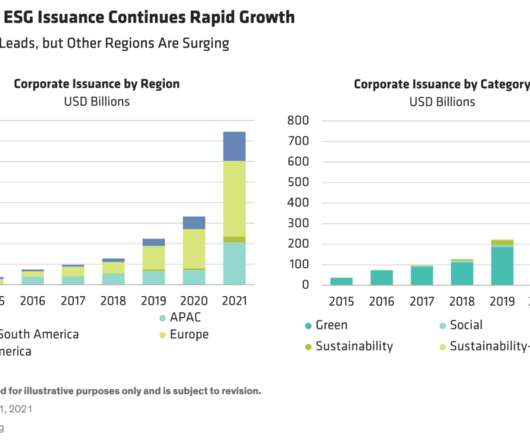

DESCRIPTION: More securities labeled as environmental, social and governance (ESG) bonds are being issued by a wider variety of companies than ever before. This is a welcome development, because such financing will play a critical role in the global transition to a greener world. But not all ESG-labeled bonds are equal.

Let's personalize your content