How banks can accelerate net-zero emissions commitments

GreenBiz

OCTOBER 27, 2021

On the eve of COP26, large banks have yet so shift fundamentally towards the Paris Agreement.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

GreenBiz

OCTOBER 27, 2021

On the eve of COP26, large banks have yet so shift fundamentally towards the Paris Agreement.

GreenBiz

OCTOBER 13, 2020

HSBC is latest bank to pledge net-zero financed emissions by mid-century. HSBC has become the latest bank to commit to achieving net-zero financed emissions, announcing Monday that it intends to align its portfolio of investments and debt financing with global climate targets by mid-century. Cecilia Keating. Tue, 10/13/2020 - 00:46.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Corporate Knights

JANUARY 21, 2022

Civil society organizations are gearing up to hold financial industry players accountable on the lofty commitments they made at COP26 in November. The alliance, led by former Bank of England governor Mark Carney, comprises separate agreements for various financial sectors. Royal Bank of Canada and Toronto-Dominion Bank.

Chris Hall

FEBRUARY 22, 2022

What actions must investors, companies and policy makers prioritise in 2022 and beyond, in order to make COP26 pledges and commitments meaningful and operational? Bridget Fawcett, Global Head, Strategy; Co-Head, Sustainability and Corporate Transitions, Banking, Capital Markets and Advisory, Citi.

Renewable Energy World

DECEMBER 3, 2021

SSE Renewables and joint venture partner Equinor have reached financial close on Dogger Bank C, the third phase of the offshore wind farm based in the UK. The total investment in Dogger Bank Wind Farm will be approximately £9 billion ($12 billion), with around £3 billion ($4 billion) allocated for phase C including offshore transmission.

Corporate Knights

OCTOBER 3, 2022

and Canadian banks are threatening to withdraw because of new membership criteria requiring a fossil fuel phase-down. The displeasure, especially by large North American banks, threatens to rupture the increasingly fragile alliance. says Baltej Sidhu, an analyst with National Bank of Canada, in an interview with The Globe and Mail.

Impact Alpha

NOVEMBER 17, 2021

Net zero pledges such as the one announced by the Glasgow Financial Alliance for Net Zero (GFANZ) during COP26’s Finance Day have left. The post How faith-based asset owners can advance sustainable banking as shareholders and customers appeared first on ImpactAlpha.

GreenBiz

JULY 27, 2020

bank to commit to measuring and disclosing the climate impact of its loans and investments, announcing last week that it has joined a multi-trillion dollar group of global financial institutions developing a standardized method for carbon accounting. Morgan Stanley has become the first major U.S. trillion in assets. trillion in assets.

Chris Hall

FEBRUARY 14, 2022

Banks could face a stormy AGM season, driven by investor concern over their ongoing financial support for oil and gas firms, which are already braced for a slew of shareholder proposals demanding greater transparency over their net zero transition plans. Among the banks targeted are JP Morgan, Bank of America and Citi.

GreenBiz

OCTOBER 20, 2021

Date/Time: November 18, 2021 (1-2PM ET / 10-11AM PT) As governments step up efforts to strengthen the Paris Agreement at COP26 and tackle the climate emergency, corporate action has never been more critical.

Chris Hall

OCTOBER 24, 2022

The Net Zero Banking Alliance (NZBA), which has 119 members and US$70 trillion in assets, has asserted its right not to follow toughened guidance issued by Race to Zero (RtZ), a campaign established by the UN to ensure non-state actors are taking science-led and ambitious action against climate change. . C pathway”. . Tough decisions” .

Chris Hall

MAY 19, 2023

At COP26, institutions managing more than US$130 trillion in assets committed to reaching a state of net zero before 2050. The UK banking sector has seen a huge reduction in branches since the 1980s. The post Banking on Change: Reducing Emissions in Financial Services appeared first on ESG Investor.

Environmental News Bits

OCTOBER 27, 2021

by Rachel Kyte, (Tufts University) Glasgow sits proudly on the banks of the river Clyde, once the heart of Scotland’s industrial glory and now a launchpad for its green energy transition.

Corporate Knights

JULY 4, 2022

Net-zero commitments proliferated ahead of COP26, held last November in Glasgow. Banks, insurance companies and institutional investors – including many of Canada’s biggest financial institutions – rushed to join the Glasgow Financial Alliance for Net Zero , led by former Bank of Canada governor Mark Carney.

Environmental News Bits

NOVEMBER 12, 2021

It comes at a time when countries are scrambling to reach consensus in the final days of the COP26… Read more →

3BL Media

SEPTEMBER 30, 2022

Following on from last November’s COP26 in Glasgow, Climate Innovation Forum (CIF) was seeking continued climate innovation collaboration this year, uniting senior public and private sector decision makers to accelerate the delivery of net zero commitments.

Environmental Finance

SEPTEMBER 7, 2022

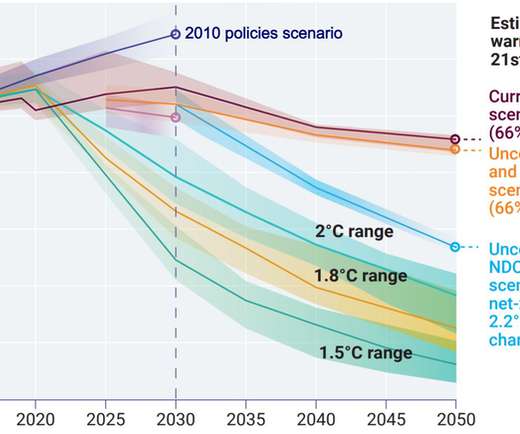

Climate scenarios for central banks and supervisors have been updated to include national 'net zero' commitments at the COP26 climate conference in Glasgow, ahead of a move to broaden the potential application of the scenarios to private financial institutions.

Renewable Energy World

NOVEMBER 24, 2021

The Glasgow Climate Pact also criticized the traditional channels of public funds that set the conditions for finance to flow, including the International Monetary Fund and the World Bank. All eyes are on Italian Prime Minister Mario Draghi, current president of the G20 and an experienced central banker.

Chris Hall

APRIL 12, 2022

According to the initiative’s latest report, Foundations for Science-Based Net-Zero Target Setting in the Financial Sector, banks, asset managers, insurers, and pension funds should ensure their operational and financing activities, as well as Scope 1, Scope 2 and Scope 3 greenhouse gas (GHG) emissions, are aligned with global net-zero goals.

Corporate Knights

FEBRUARY 9, 2022

Just before the launch of COP26, the UN climate conference in November, the DivestInvest network calculated that endowments, portfolios and pension funds worth nearly US$40 trillion have now committed to divesting their fossil fuel holdings. Eroding public support for the sector has been considered valuable work in itself.

Renewable Energy World

NOVEMBER 10, 2021

The Energy Transitions Commission , a coalition of businesses and nongovernmental organizations, calculated that if the commitments made at COP26 are delivered, it will cut the gap between today and the 1.5 This story is part of The Conversation’s coverage of COP26, the Glasgow climate conference, by experts from around the world.

ESG Today

OCTOBER 19, 2022

The ruling referred to ads displayed in bus stops in London and Bristol in October 2021, in the run-up to the COP26 climate conference, promoting HSBC’s initiatives to provide up to $1 trillion in finance and investment to help clients transition to net zero, and to help plant 2 million trees.

Chris Hall

JULY 8, 2022

Not following suit – The European Central Bank (ECB) said banks do not yet sufficiently incorporate climate risk into their stress-testing frameworks and internal models. Further, almost two-thirds of banks’ income from non-financial corporate customers stems from GHG-intensive industries. Going, going … green?

Sustainable Development Network

MARCH 27, 2024

In collaboration with the SDG Academy, the World Wildlife Fund (WWF), and the World Bank (WB), and with financial support from the Global Environment Facility (GEF), today, the SPA launched its groundbreaking massive open online course (MOOC), " The Living Amazon: Science, Cultures, and Sustainability in Practice. "

Chris Hall

MAY 12, 2022

Carney was speaking at the Net Zero Delivery Summit, organised by the City of London Corporation, in association with COP26 Presidency UK and GFANZ. The summit marked the halfway point between COP26 and COP27 in Sharm El-Sheikh, and addressed progress on key priorities of financial players agreed in Glasgow in November.

John Englart

NOVEMBER 10, 2021

This is Australia's 5th.

Chris Hall

FEBRUARY 18, 2022

Banks were hit by a double salvo for continued financing of fossil fuel firms in the face of widely accepted net zero roadmaps and the commitments made at COP26. Campaign groups led by Urgewald and Reclaim Finance reported that commercial banks channelled US$1.5

Chris Hall

DECEMBER 15, 2023

This integration process began at COP26 in Glasgow , but Dubai appeared to represent a major forward step toward recognising the dependencies of efforts to address twin crises. Cost of climate action – Away from COP28, this week also saw the European Central Bank and the Bank of England keep interest rates at existing levels.

GreenBiz

JULY 15, 2021

Helle Bank Jorgensen. Now, we are looking forward to COP26 in Glasgow and the stakes are high. Are you greenwashing, wishing or walking? Thu, 07/15/2021 - 00:01. We are in the middle of the biggest commitment to a green future. Fewer have set science-based targets, as those targets come with a bit more scrutiny.

ESG Today

OCTOBER 28, 2022

Launched in April 2021 , GFANZ brings together several leading net zero groups representing sectors across the financial industry including asset owners and managers, banks, insurers, investment consultants, service providers and investors. Sustainable finance and investing advocacy groups expressed concern about the announcement.

3BL Media

SEPTEMBER 15, 2022

Bloomberg and the UN Climate Change High-level Champions for COP26 & COP27 will host a landmark summit during the UN General Assembly and Climate Week in New York City, convening business, finance, government, civic and cultural leaders. Wednesday, September 21: United Nations Climate Action: Race to Zero and Resilience Forum.

Chris Hall

NOVEMBER 9, 2023

COP28 in Dubai will explore climate adaptation investment opportunities for public-private partnerships in emerging markets and developing economies (EMDEs), according to COP27’s UN Climate Change High-Level Champion. “COP26 highlighted the importance of businesses and the private sector to [international climate progress] with the launch of coalitions (..)

Sustainable Development Network

MAY 18, 2023

The first report of the SPA, launched in 2021 at the COP26 in Glasgow, is the most in-depth and holistic report of its kind on the Amazon. PROJECT ASSISTANT ROLES AND RESPONSIBILITIES The Consultant will Development and implementation a strategy for dialogues with development banks and financial institutions. Analyze data.

Corporate Knights

DECEMBER 5, 2023

After signing on to the Global Methane Pledge two years ago during the COP26 meeting in Glasgow, Canada released a methane reduction strategy in September, 2022 that affirmed the 75% reduction from 2012 levels by decade’s end, Guilbeault’s department recalled in a backgrounder published earlier today.

ESG Today

JANUARY 9, 2023

The Government of India will issue its first-ever green bond this month, according to an announcement by the Reserve Bank of India, with plans to raise approximately US$2 billion to support green infrastructure projects aimed at reducing the carbon intensity of the economy.

ESG Today

JANUARY 26, 2023

The Government of India’s first ever issuance of green bonds met strong demand, with orders exceeding the offering size by more than 4 times, earning the bonds a 5-6 basis point “greenium,” or a favorable yield spread relative to similar issues lacking green credentials, according to results released by the Reserve Bank of India (RBI).

Chris Hall

NOVEMBER 29, 2023

billion loan fund was conceived in recognition that public capital alone is “insufficient” to fill US$3.9 trillion funding gap in emerging markets.

Chris Hall

OCTOBER 6, 2023

GFANZ then plans to “build out solutions that allow for the recycling of that financing”, bringing in a wider set of investors to provide the necessary “patient capital”, such as pension funds, which have far longer time horizons.

Chris Hall

SEPTEMBER 11, 2023

The UK initially committed to introduce mandatory disclosure of transition plans from financial institutions and listed companies during the COP26, resulting in the formation of the Transition Plan Taskforce (TPT) in 2021.

Chris Hall

OCTOBER 14, 2022

At the closing of COP26 in Glasgow in 2021, one of the headline questions centered on how countries would address the need for finance to address loss and damage , those impacts from climate change that are so severe communities are simply unable to adapt to them. Finance must scale significantly to support adaptation needs. degrees C.

Eco-Business

SEPTEMBER 7, 2021

In the run-up to a key UN climate summit in November, activists urge the Asian Development Bank to eliminate fossil fuel projects in its proposed energy policy which are feared to undermine efforts to limit global heating to 1.5C.

Eco-Business

NOVEMBER 4, 2021

The ADB unveiled at the climate summit its Energy Transition Mechanism (ETM), a private sector-led initiative to retire existing coal power plants. But climate groups call the scheme “premature and unclear.”

Chris Hall

NOVEMBER 25, 2022

In the circumstances, others noted , preventing backsliding from COP26 was no mean achievement, nor were the efforts of Indonesia and India to maintain the G20 leaders ’ commitment to climate action last week in Bali.

3BL Media

JULY 15, 2022

In fact, volunteer market offset activity hit US$1 trillion for the first time in 2021, according to the World Bank. The recent COP26 global climate change conference adjourned with a first-ever multinational agreement for trading standards. Market Parameters and Rules Are Starting to Gel.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content