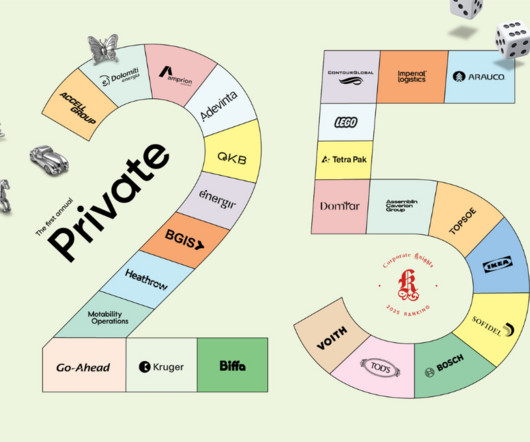

The 25 most sustainable private companies in the world

Corporate Knights

APRIL 21, 2025

A new project to transport wind energy to the Ruhr region will make an important contribution to the security of supply in Germany and Europe in the future as early as 2030, Amprion CTO Hendrik Neumann says. Reaching net-zero as we grow remains vital. Go-Ahead Group Ltd Net-zero-aligned transporter Go-Ahead is a U.K.-based

Let's personalize your content