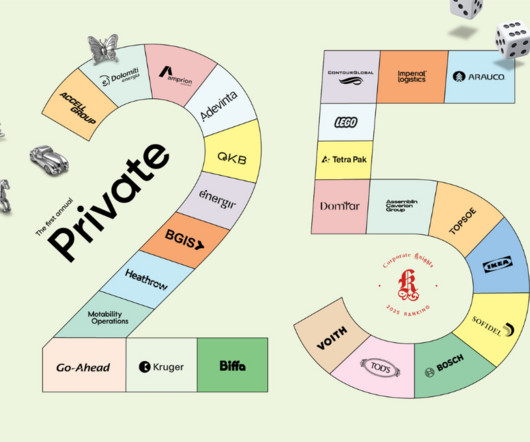

The 25 most sustainable private companies in the world

Corporate Knights

APRIL 21, 2025

But with sustainability, there are reasons to be more forthcoming. Private companies are increasingly eager to report on their environmental, social and governance (ESG) performance and their sustainability investments amid the publics growing appetite for companies that are trying to be good corporate citizens.

Let's personalize your content