“Massive Move” to Impact Investing Underway – BNP Paribas

Chris Hall

SEPTEMBER 13, 2023

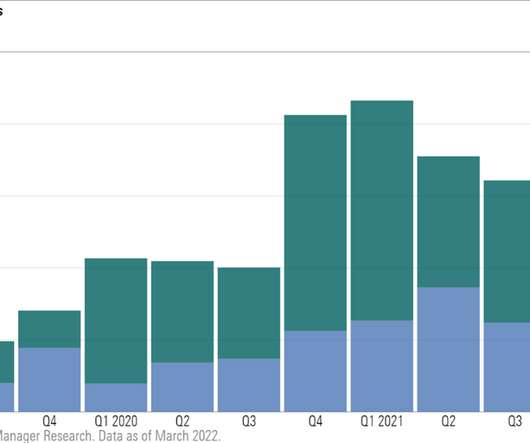

The asset manager’s latest survey highlighted a growing trend towards impact investing, with investors looking to take a more “holistic approach” to ESG-related investments. Estimates vary widely on the current size of the global impact investing market due largely to a lack of consensus on how impact investing is defined.

Let's personalize your content