Divesting works: Study finds ditching fossil stocks lowers corporate footprints

Corporate Knights

FEBRUARY 9, 2022

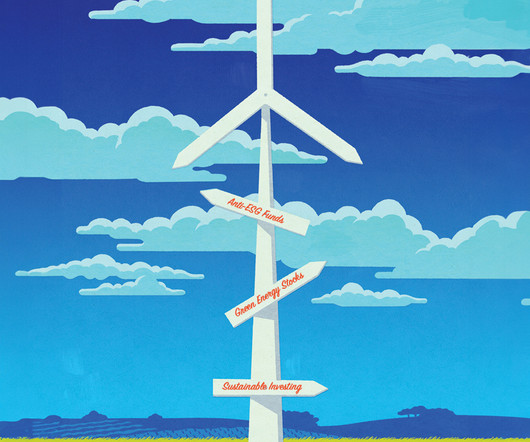

For the leaders of the divestment movement, which encourages institutional investors to sell off their shares in fossil fuel companies, winning isn’t everything. But after a decade of determined lobbying, the divest side is suddenly doing a lot of winning. That tally, they noted, is bigger than the combined GDP of the U.S.

Let's personalize your content