UK Drops Plans for Sustainable Finance Taxonomy

ESG Today

JULY 15, 2025

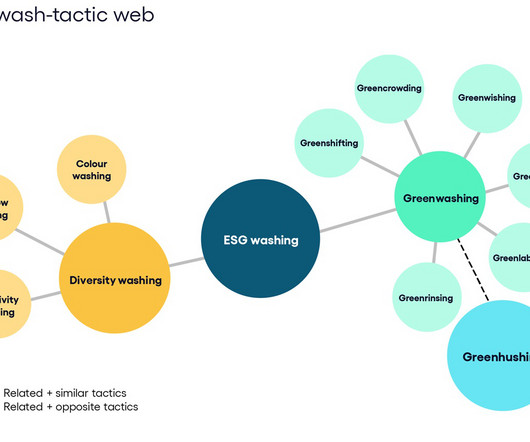

Whilst the government’s ambitions to continue as a global leader remain unchanged the consultation responses showed that other policies were of higher priority to accelerate investment into the transition to net zero and limit greenwashing.” Sustainable investment groups expressed disappointment at the government’s decision.

Let's personalize your content