Tetra Pak Reveals 20% Greenhouse Gas Emissions Reduction Across Value Chain Since 2019

3BL Media

JUNE 11, 2024

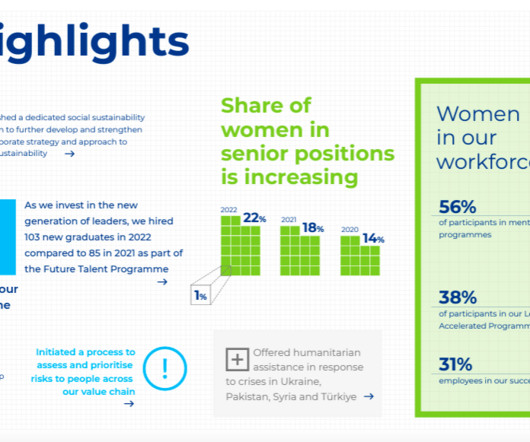

A 47% reduction in operational greenhouse gas (GHG) emissions [2] since 2019. Tetra Pak launches its 25th Sustainability Report, which tracks the progress the company has made against its sustainability agenda. It focuses on five interdependent areas: food systems, circularity, climate, nature and social sustainability.

Let's personalize your content