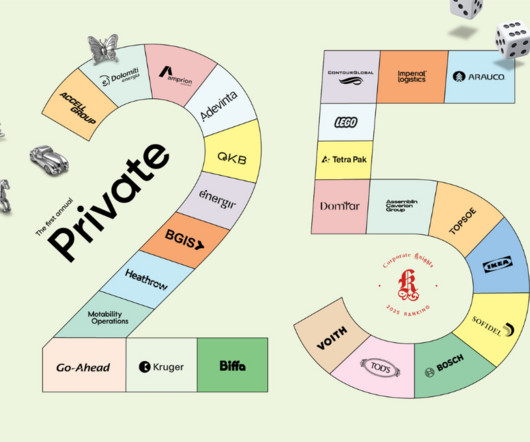

The 25 most sustainable private companies in the world

Corporate Knights

APRIL 21, 2025

Oesterreichische Kontrollbank AG Sustainable development bank Oesterreichische Kontrollbank (OeKB) or Austrian Control Bank is a special-purpose financial institution owned by Austrias main banks. billion in hydrogen technologies between 2021 and 2026. Canada 47.2% 12 Biffa PLC United Kingdom 56% 63.4%

Let's personalize your content