The Energy Collective Group

This group brings together the best thinkers on energy and climate. Join us for smart, insightful posts and conversations about where the energy industry is and where it is going.

Post

Tesla Master Plan Part 3: Teardown By an Energy System Modeler

This article tackles a deceptively dangerous notion concerning energy, economics, and sustainability:

- We can practically and economically run our world almost exclusively on wind and solar power.

- We can accomplish this total transformation of the foundation of our civilization rapidly enough to keep global warming well below 2 °C.

It looks great at first glance: Cheap and clean energy forever! What’s not to like? Well, as the following sections will demonstrate, the nitty-gritty of turning this vision into reality reveals quite a lot to dislike.

Still, the simple, ideological appeal of this green ideal is undeniable. It gets politicians to pass deeply inefficient technology-forcing policies and investors to make even less efficient fossil fuel divestment decisions. These measures come with huge costs, and the opportunity costs are even larger, considering all our serious global problems in need of investment.

Recently, Tesla threw its $600 billion weight behind this ideal in its Master Plan Part 3 (henceforth abbreviated as TMP3). This is a big deal because Tesla has a wide reach and droves of devout followers who spread its message uncritically across the web (1, 2, 3).

To give Tesla credit, TMP3 frames the problem in a nicely simplified manner, making it accessible to a broader audience. In this article, I aim to leverage this simplified framing to highlight six obvious flaws in an equally accessible light, exposing the electrify-everything-with-wind-and-solar ideal as a clearly unworkable strategy.

Synopsis

Since this is a rather long article, let’s start with a simplified summary of the six most important false claims in the TMP3 report.

The Tesla plan is $4 trillion cheaper than fossil fuels.

This is a massive miss originating from a blatant apples-to-oranges comparison. Instead, the Tesla plan demands about 5x more annual investment than the fossil fuel status quo. Considering projected cost reductions to 2050, the wind and solar infrastructure needed to displace all fossil fuels is still affordable, but we will need vast additional investments to balance these fluctuating generators, massively expand transmission and distribution networks, and build all the battery packs, chargers, heat pumps, and electrolyzers required for broad electrification.

BEVs consume 4x less energy than ICEs.

When using the correct internal combustion engine (ICE) benchmark; modern hybrids like the new Prius, the battery electric vehicle (BEV) fuel efficiency advantage shrinks to 2x. Furthermore, when including the embodied energy of the battery and the losses in power production, total lifecycle energy consumption becomes equal. Since one gallon of gasoline costs about half that of one e-gallon of electric charge and hybrids are proving more reliable, BEVs have no operating cost advantage, leaving only their $10000+ higher sticker price.

Current BEV ranges will satisfy all drivers.

Tesla’s calculations assume electric cars with battery packs returning 250–300 miles of advertised range will convince the world to go electric. Real-world evidence of subsidized electric car sales proves this assumption wildly wrong. To achieve near-universal adoption, much larger battery packs or perpetual subsidies costing over $3T per year will be required.

Long-distance freight will go electric.

Combustion engines are at their best in large semis and freight ships, where they constantly operate in their optimal efficiency band. After correcting for the reduced payload of an electric semi (due to its heavy battery), there is little difference in the achievable fuel efficiency per ton-mile. Adding the battery’s embodied energy and electricity system losses swings the balance toward diesel. Furthermore, e-gallons from megachargers will be far more expensive (and less practical) than gallons of diesel from a pump, and Tesla’s proposed 800 kWh battery pack will have a range multiple times smaller than a typical diesel semi.

Land use concerns are unfounded.

Tesla estimates that the wind and solar farms required to power the world will only occupy 0.2% of the global land area, thus dismissing this common concern in a single page of the document. In reality, the land-use impacts of wind, solar, and the transmission expansions they require extend far beyond the borders of the directly occupied land. That is why wind and solar expansions face significant resistance already today when they supply a mere 2% of global final energy.

Material-related concerns are unfounded.

While Tesla is correct that the world contains enough minerals to theoretically carry out its plan, a mineral-based economy will retain (and augment) the biggest problems of a fossil fuel-based economy. The total annual cost of mineral extraction will be similar to that of fossil fuels, whereas geopolitical challenges, social injustices, and environmental damages will likely be larger.

Let’s now delve into each of these points in greater detail.

Claim 1: TMP3 is $4T cheaper than fossil fuels

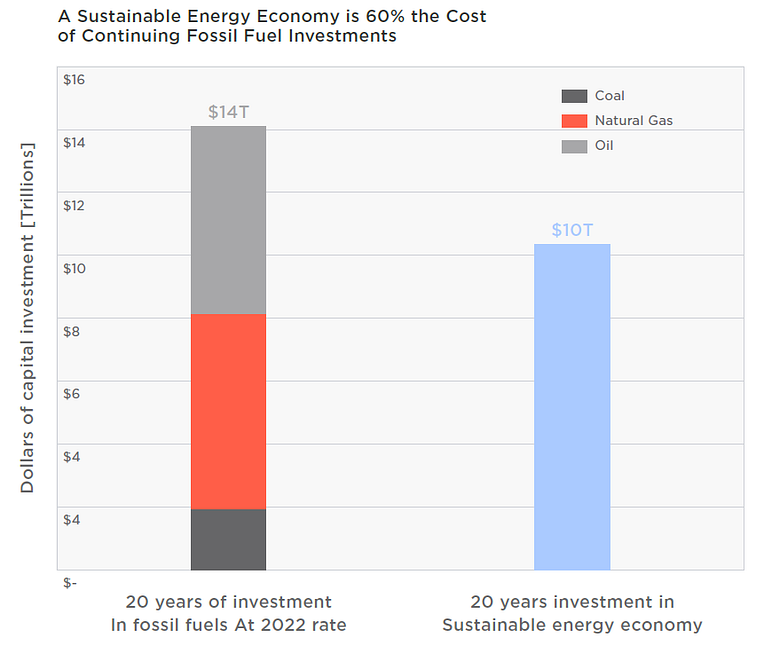

The first (and largest) false claim in the Tesla Master Plan Part 3 (TMP3) report is illustrated below.

Here, Tesla compares investments in infrastructure to extract fossil fuels to investments in infrastructure to mine, process, and convert materials into green infrastructure. In effect, this equates the actual extraction of primary fossil energy to the ability to build the costly infrastructure required to harvest and use primary green energy.

Obviously, the apples-to-apples green equivalent of investments in the fossil fuel status quo is investments in the wind turbines, solar farms, battery packs, etc., required to harvest and deploy energy in the green economy envisioned by TMP3. This is a massive error.

Correcting the error

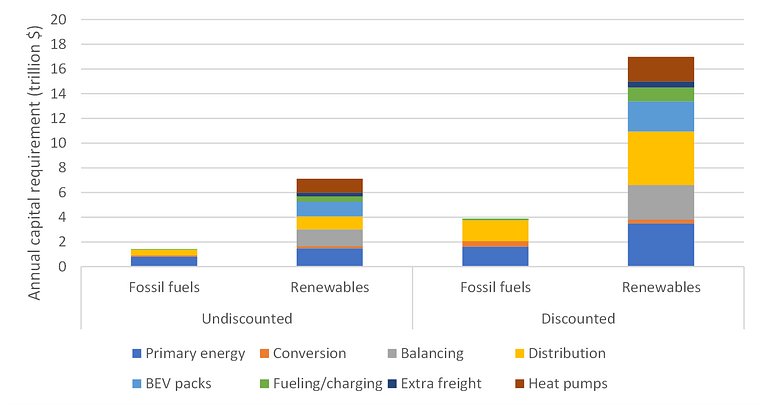

To illustrate, I made a rough estimate of the additional investment required to enable the envisioned green economy compared to fossil fuels. Clearly, the picture is very different from the one portrayed by TMP3.

As illustrated, the TMP3 economy will require energy supply investments totaling 3 T$/year in wind & solar, green fuel production, and system balancing (handling the intermittency of wind and solar). In addition, end-use investments totaling another 3 T$/year will be needed in electric vehicle battery packs, charging stations, extra freight vehicles, and heat pumps. Finally, 1.1 T$/year in electricity transmission & distribution investments will be required to deliver all the electricity generated in a fully electrified economy to end users. The total amounts to 7.1 T$/year.

In comparison, upstream and downstream investments in fossil fuels and power plants require 0.9 T$/year, whereas electricity and fuel distribution adds another 0.5 T$/year for a total of 1.4 T$/year.

Thus, investment requirements of the TMP3 vision are about 5x greater than those in the fossil fuel status quo.

Discounting

These were simple undiscounted numbers representing ideal annual investments needed to sustain a steady-state system by replacing components when they reach the end of their lifetimes. However, one should always account for risk and opportunity costs when calculating investment requirements (see the appendix). The two bars on the right in the figure above show the effect of using a standard 8% discount rate.

After applying this discount rate, the difference blows up to 13.1 T$/year. When considering operation, maintenance, and end-of-life management of this incredible amount of infrastructure, this large gap will widen by several trillion more. Thus, it is already clear that TMP3 is infeasible, even before we get to the five additional false claims below.

Energy cost feedback

Another crucial but commonly overlooked subtlety is that very expensive energy (as TMP3 will deliver) will make energy more expensive still. The assessment above is based on large cost declines to mid-century, implicitly assuming that the cost of energy and materials used to construct green infrastructure will remain at today’s levels. This is a very bad assumption.

In reality, rising energy and material costs will cancel out a large chunk of the cost reductions achieved by technological advancement. The size of this effect is hard to quantify due to its self-reinforcing nature, but we can safely say that the 5x higher cost calculated above is highly optimistic.

Claim 2: BEVs consume 4x less energy than ICEs

Tesla’s core business is electric cars, so it is no surprise that they completely overblow the benefits of these vehicles over those sporting internal combustion engines (ICEs).

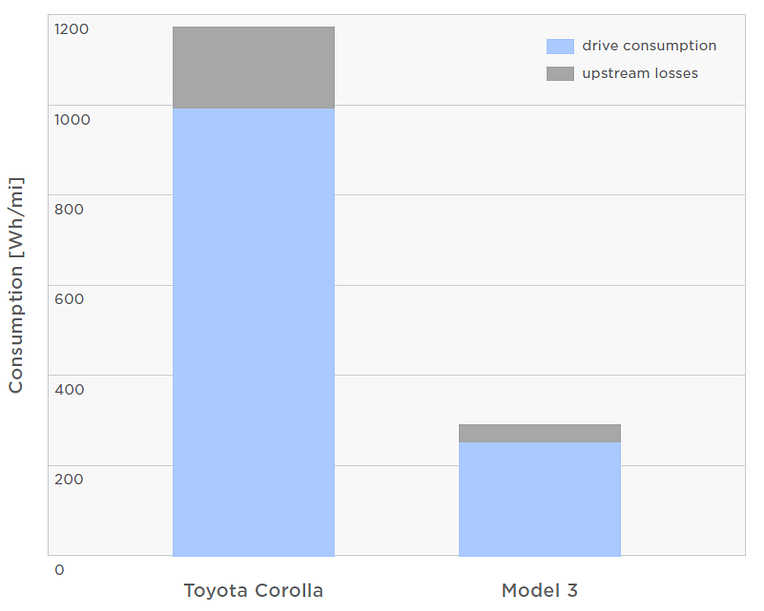

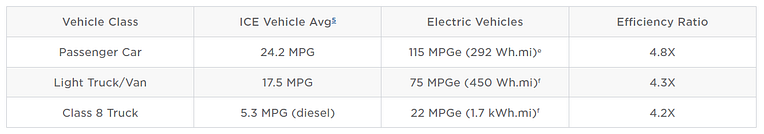

The simple comparison above uses the rated efficiency of a Tesla Model 3 and a standard gasoline Toyota Corolla. But this is a future-looking study, so a much more relevant comparison is to a best-in-class hybrid like the new Toyota Prius (now with solid power and striking looks). Hybrid cars are now superior to regular gasoline cars both in fuel economy (which pays for the small price premium in a couple of years) and in driving experience. Thus, wait times for Toyota’s hybrids are far longer than for Tesla’s BEVs.

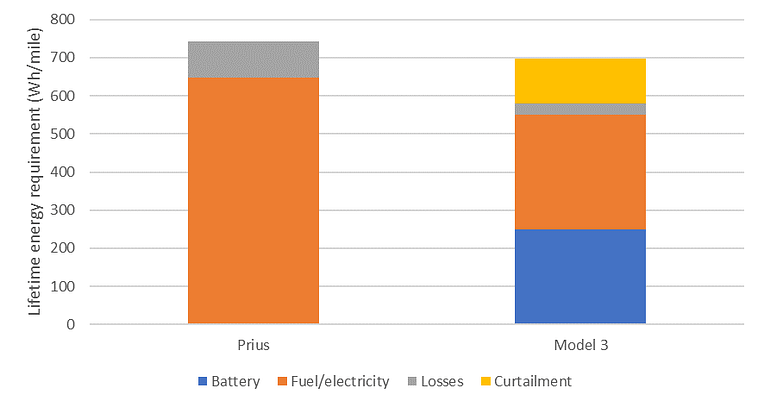

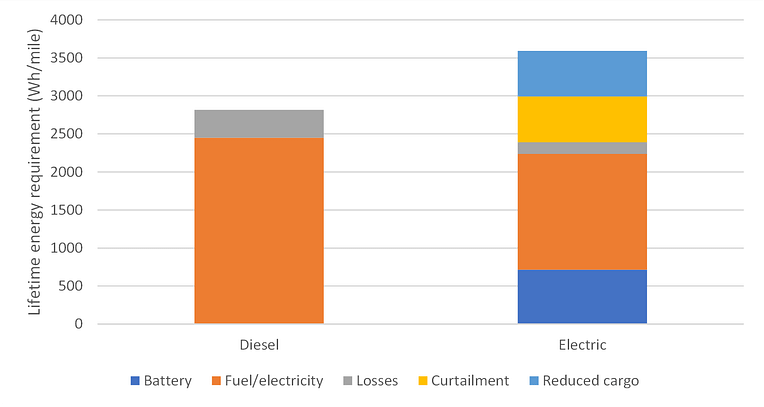

When considering that the Model 3 underperforms its official rating more than the Prius, the efficiency difference is only a factor of 2 — half Tesla’s claim. Furthermore, there is a lot of embodied energy in the large BEV battery pack (TMP3 states 312 kWh per kWh of capacity). When considering losses, one should also account for conversion losses in the power system or, in the case of the TMP3 vision, curtailment of excess wind and solar power. The latter will be used here.

As illustrated above, the lifetime energy requirement of the Model 3 is almost identical to that of the Prius. In addition, although the Prius might consume double the energy of the Model 3 while driving, gasoline is only about half the cost of electricity per kWh. For example, electricity at 0.15 $/kWh (e.g., 90% home charging at 0.12 $/kWh and 10% rapid charging at 0.4 $/kWh) equates to $5.1 per e-gallon — about double the gasoline price (after deducting taxes not applied to electricity).

Thus, fuel costs are essentially identical. So is maintenance (hybrids are proving themselves more reliable than BEVs). Overall, the only real difference in ownership costs is the $14000 higher price of the Model 3 (and the higher insurance premiums). BEVs still have peppier performance, but hybrids are closing the gap, and, as we will discuss next, the practicality of hybrids will outweigh the big torque of BEVs for most drivers.

Claim 3: Current BEV ranges will satisfy all drivers

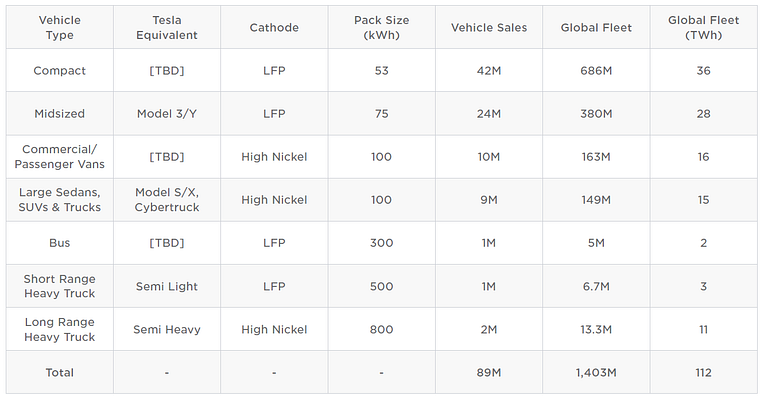

When estimating total battery capacity requirements to electrify the transportation sector, Tesla assumes pack sizes of 53 kWh for compact, 75 kWh for midsize, and 100 kWh for large cars (see below). In other words, a key assumption in TMP3 is that all drivers will be happy with advertised ranges typical today — a terrible assumption.

Car ownership is about freedom — the ability to go (in comfort) wherever you want whenever you want without any planning. If not for that key factor, cars would not dominate over cheaper, healthier, and more environmentally friendly alternatives like cycling and public transit.

BEVs with the 250–300 mile range implied in the table above fail to tick this critical box for most people. As illustrated below, the range that this type of BEV can guarantee under all circumstances (even when road-tripping with a loaded 10-year-old car on a cold day) is only about 100 miles. This is simply far too little to satisfy the mainstream consumer in an open market.

Take Norway, the undisputed global leader in BEV adoption, as an example. Norway is an ideal location for electric cars thanks to little long-distance driving, cheap hydropower, and a rich population. Still, the financial incentive required to get Norwegians to 75% BEV adoption is a mind-boggling 35000 $/car. I call this massive number the “freedom premium” — something that 25% of the population is willing to pay for the ability to “recharge” 500 miles of range in 5 minutes at the nearest gas station.

Adding this freedom premium to 100 million annual sales amounts to a cool 3.5 T$/year — an approximation of the cost of incentives that will be required to get almost everyone to adopt the type of BEVs Tesla advocates.

Claim 4: Long-distance freight will go electric

As illustrated in the table from the previous section, Tesla envisions 20 million electric heavy trucks on the roads worldwide. This would seem like a good idea if we assume electric semis to be 4.2x more efficient than diesel alternatives. But as in Claim 2 above, this is all smoke and mirrors.

The 22 MPGe quoted for the Tesla semi is the maximum that can be squeezed out of a fully loaded semi-truck (current claims of “less than 2 kWh/mile” translate to “more than 19 MPGe”). A fair diesel benchmark gets about half that number (not 4.2x less). And this gap will close further as diesel engine thermal efficiency rises, waste heat recovery systems are commercialized, and hybridization is introduced. This report sees advances up to 13.8 MPG by 2035 — only 1.6x less than an electric semi.

Furthermore, a big problem with electric semis is that the huge battery takes up a substantial fraction of the potential cargo weight. At a battery pack energy density of 200 Wh/kg, the 800 kWh battery pack assumed for the Tesla semi would weigh 4 tons — about a fifth of the typical truck cargo. This adjustment narrows the advantage of the electric semi to a factor of only 1.3. Adding the embodied energy of the battery and renewable curtailment to the equation tips the advantage toward diesel. If solid state batteries can overcome a long list of scale-up problems, this issue can reduce in the future, but logistics companies may prefer to leverage more energy-dense batteries for longer ranges instead of lighter trucks.

When adjusting for the value of the consumed energy, things turn ugly for the electric semi. While electric cars consume electricity that is only about double the cost of gasoline, semis will need to charge from enormous MW-scale charging stations with costs similar to current fast chargers. This would make the fuel costs of an electric semi about triple that of a diesel semi — an order of magnitude reversal of Tesla’s claim.

At the Tesla semi launch, Elon Musk claimed that the semi would be charged at only 0.07 $/kWh, which is simply impossible (similar to an earlier claim that supercharging would always be free). Even direct industrial electricity prices are higher than this claim. And that is before we add the cost of the megacharger itself and the massive grid connection (with loads of underground wiring) it will require. These factors bring fast charging costs up to about 0.4 $/kWh, and they will remain equally significant for megachargers (some economies of scale will be counteracted by the added cost of developing vast charging complexes for electric truck fleets that must spend 20x more time filling up than diesel alternatives).

Lastly, the range of the electric semi promoted by Tesla will only be 500 miles (with the “freedom range” being far less). In comparison, diesel semis have 1000–2000 miles of range for maximum fleet utility. Also, even with MW-scale chargers, electric semis will require about an hour to get a full charge, further reducing their utilization factor. These practical challenges make the business case for electric semis even more hopeless.

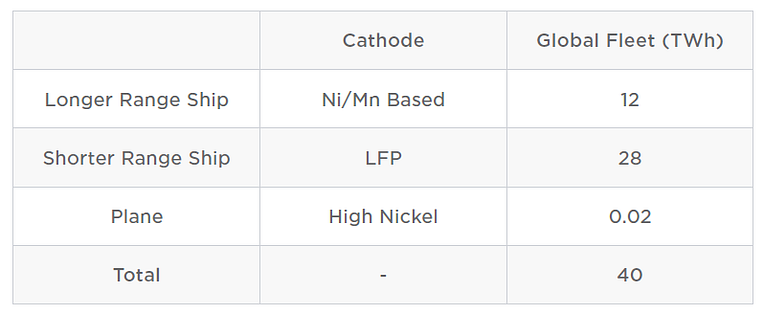

To put the cherry on top, Tesla even assumes 40 TWh of battery capacity for use in ships. The thought of heavy freighters sailing across the Atlantic on battery power alone must be one of my most memorable moments from the TMP3 report.

Claim 5: Land use concerns are unfounded

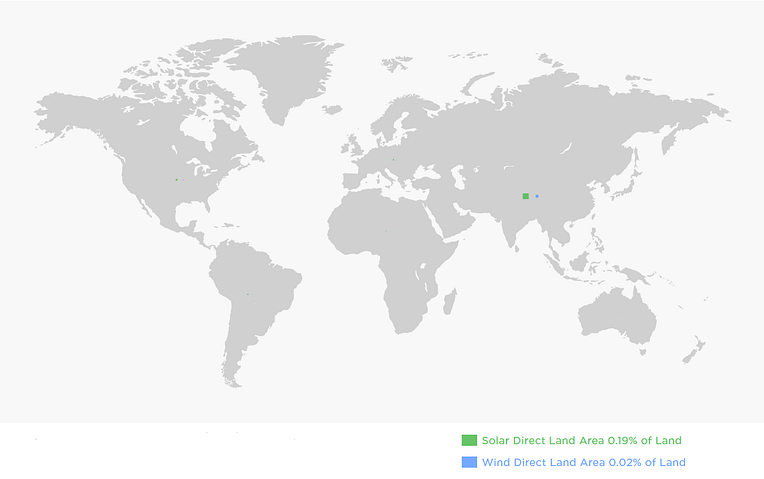

TMP3 includes a quick one-page dismissal of the popular concern regarding wind and solar land use. After all, the required wind and solar buildout will require a mere 0.2% of global land area:

While it may be true that wind turbines directly occupy only 0.02% of land, this is an irrelevant metric. For example, Germany is fighting tooth and nail to breathe new life into its slumping wind installations, promising that 2% of land will be dedicated to wind (including the land between wind turbines). In other words, the German Energiewende is already experiencing major issues from the land occupation of wind turbines at a time when the technology delivers a mere 5% of total final energy demand (20% of electricity, which constitutes 25% of final energy).

The reason is that wind farms have impacts that extend far beyond their borders. Noise and flickers can annoy residents a mile away, whereas impacts on natural beauty and birdlife extend for tens of miles around a wind farm. Solar is less affected than wind, but impacts are large enough to trigger considerable resistance.

Another important land-use issue with wind and solar is the visual obstructions and ecological impacts of high-voltage transmission lines that connect distant resources with demand centers. The pushback from residents along planned transmission corridors explains why Germany’s grid expansion plan is behind schedule and increasingly expensive.

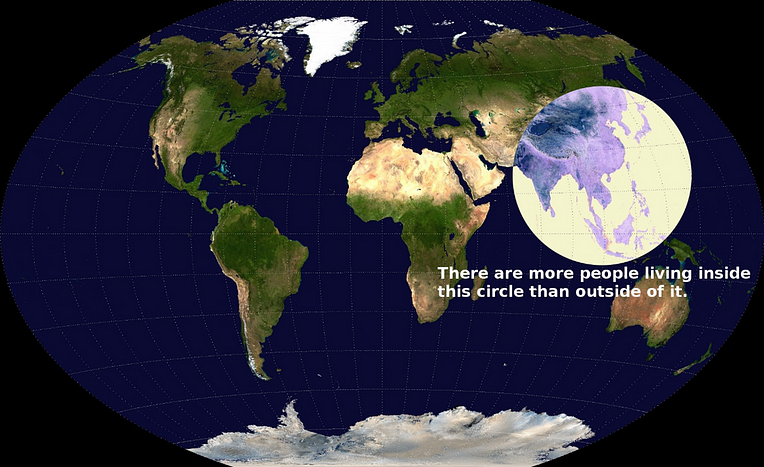

While Tesla’s estimate of global wind/solar capacity needs is already substantially too low (due to a big simplification that the excellent US wind and solar resources can be extrapolated to the world), a larger source of underestimation comes from the fact that energy demand will continue to grow massively in Asian regions with population densities more than double that of Germany (e.g., the highlighted circle in the image above). If European experience is anything to go by, these regions will see strong resistance to wind, solar, and transmission lines even at single-digit market shares (in terms of final energy).

Thus, TCM3 is underestimating the land occupation problem of fundamentally diffuse and spatially variable wind and solar resources by several orders of magnitude. It is a major issue for developers even at current low market shares, and this problem will only grow in the future.

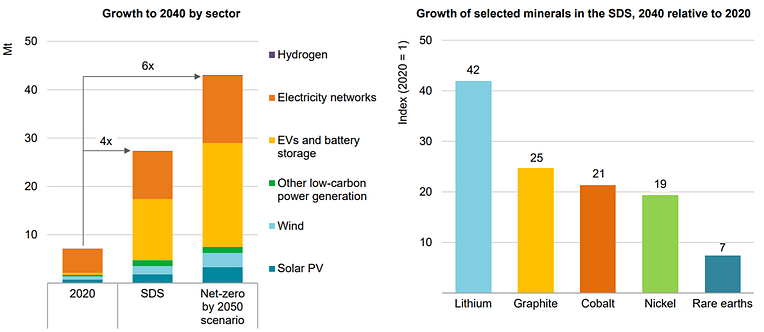

Claim 6: Material-related concerns are unfounded

I found the last section of TMP3 on material intensity particularly interesting because we are working on a study drawing on much of the same data Tesla cites in their analysis. Overall, the numbers presented in TMP3 are sound, but again, the conclusion is oversold by about 10x.

Tesla draws two main conclusions from their analysis:

- The rate of material extraction required in a fully electrified economy is only about a fifth that of fossil fuels today

- The total material resource requirement is well within resource limits, after which recycling will ensure sustainability

This section will present a very different conclusion: The mineral-intensive economy proposed in TMP3 will preserve and even worsen the most serious fossil fuel-related problems regarding energy security, social justice, and environmental degradation.

Correct but irrelevant

It’s not that Tesla’s conclusions are wrong; they’re just irrelevant for a true comparison between a mineral economy and a fossil fuel economy.

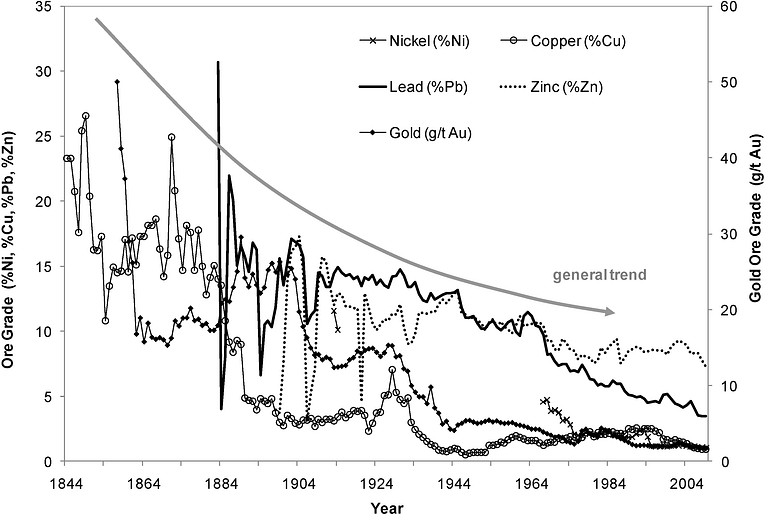

First, the rate at which ore needs to be extracted may be about a fifth of the rate at which fossil fuels must be extracted (if we ignore overburden), but the difficulty (and environmental impact) of finding, extracting, and refining minerals is far greater. Fossil fuels are extracted in relatively pure forms, whereas several mineral ores grades are only about 1%, making refining far harder. In addition, oil and gas are extracted in liquid and gaseous forms, which can be pumped out relatively easily.

Second, it is well-known that the Earth has enough of almost every mineral we may ever need, but the problem is declining ore grades. Humanity naturally exploits the highest-grade resources first, after which extracting additional resources becomes gradually more difficult. To use an ICE (oil) vs. BEV (lithium) analogy, battery materials are currently in their gusher phase. As with oil, their extraction will become much more difficult following massive increases in production rates (below).

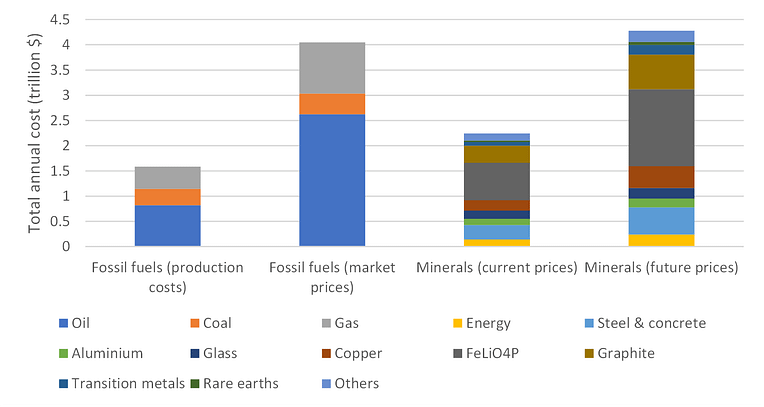

Cost comparison

Ultimately, the key metric in this benchmarking exercise must be the cost of extracting minerals or fossil fuels. For this reason, I compiled the following cost comparison using data from our ongoing assessment (methodology and preliminary results available here).

The first column shows the production cost of the global fossil fuel supply based on these cost curves, while the second shows the costs at current market prices. The difference between these two columns represents wealth transfers from importers to exporters, illustrating the astonishing profitability of the global fossil fuel (especially oil) industry. Incidentally, a big boost in these already crazy profits is the most painfully ironic effect of the global fossil fuel divestment movement.

The third column is the current (April 2023) market value of the total annual mineral supply necessary to sustain a mineral-based economy, while the fourth column illustrates potential future costs. This increase assumes a doubling of prices for minerals from low-grade ores due to declining ore grades, growing labor costs, and stricter environmental legislation, and a tripling of fuel costs due to a transition to green H2 and its derivatives (which mainly affects steel prices).

Several interesting points are evident from the figure above. First, extractive industries will cost as much in a mineral-based economy as in a fossil fuel-based economy. In other words, the greater difficulty of extracting and refining minerals cancels out the lower mass of material that needs to be processed.

Second, battery minerals dominate the mineral bars much like oil dominates the fossil fuel bars. Thus, the transportation sector will experience similar constraints in a battery world as in an oil world.

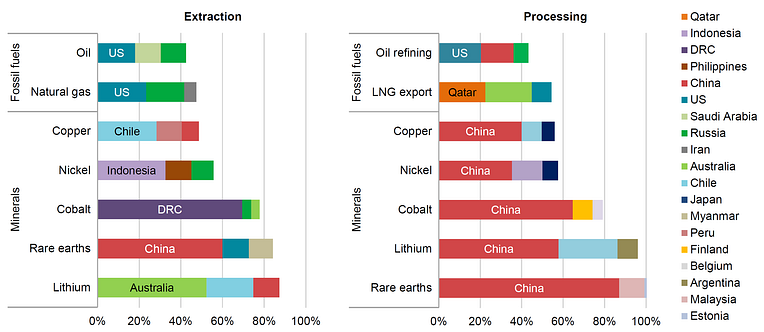

Supply security and recycling

The parallels between oil and battery minerals do not stop there. Supply security concerns will likely grow considerably in a mineral-based economy (see below). Like oil, the geographical concentration of supply combined with the ease of international trade will cause global prices to be fixed by the most expensive producer, creating high market prices and massive profits for producers further down the cost curve. Like OPEC members today, these producers will have more money than what is good for them and wield considerable geopolitical power.

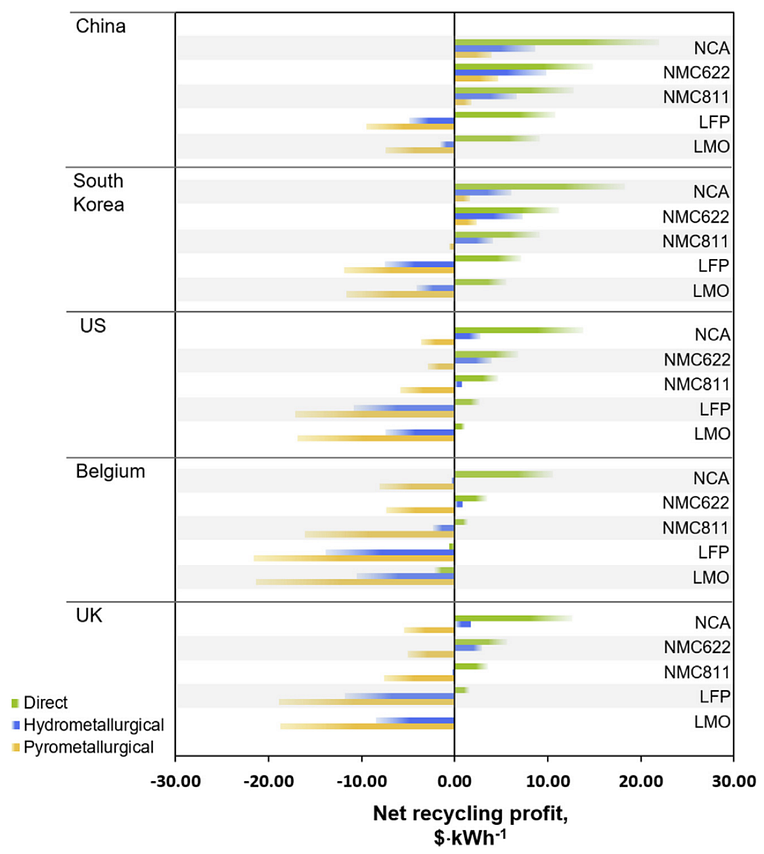

When significant volumes of recycled materials eventually become available, this situation may improve but not as much as many imagine. First, mineral extraction will continue to be necessary due to growing demand and losses in recycling value chains. Even if recycling eventually proves cheaper than extraction, global prices will still be set by the cost of mining and refining minerals from ever-declining ore grades.

The positive effect of recycling is that importing regions can source part of their supply from local recycling value chains, thus reducing the enormous international wealth transfer typical of global oil markets. But this will only be the case if countries with higher labor and energy costs are willing to forego the economic benefits of outsourcing the job to cheaper countries (see the image above for the case of the UK).

Social and environmental damages

But we are many decades away from experiencing the intricacies of such a circular economy. In the meantime, the mineral mining boom may also outdo fossil fuels regarding social injustice and environmental damage. A recent scientific paper identifies three key problem categories:

- Processes of dispossession that displace local populations and communities from land and livelihood through expropriation and resource exploitation.

- Pollution and degradation of local and global ecosystems at the extraction, production, transportation, and disposal/recycling points of the supply chain.

- Systemic patterns of unequal environmental exchange that trap regional and national economies in destructive development dependencies of primary extraction, land expropriation, elite capture, and unsafe disposal of toxic and hazardous waste (resource curse).

Here, we can draw some interesting parallels to the climate impacts of fossil fuels. One of the most enlightening findings from our ongoing work on holistic economic-environmental energy system optimization is that climate change, although important, is not the largest environmental impact. Published monetary valuation coefficients of various lifecycle impact categories (e.g., this review), suggest that land-use impacts of wind, solar, and transmission are similar to climate change, whereas ecotoxicity damages cost considerably more.

These large ecotoxicity impacts result mainly from extractive processes and become particularly high for mining operations from low-grade ores. Like climate change from fossil fuels, ecotoxicity from mining is also associated with grave social injustices. For example, rich-world citizens are driving around in their 2.5-ton subsidized electric SUVs, telling themselves they are saving the world from climate change, while they are actually heaping huge environmental damages on the developing countries where the battery minerals are produced and refined (with no climate benefit).

All considered, a mineral-based economy will display similar or greater negative effects to a fossil fuel-based economy: vast wealth transfers from importers to exporters, geopolitical tension, exploitation of vulnerable social groups, and large environmental damages.

Final Thoughts

To sum up, Tesla’s envisioned energy system will be unaffordable, impractical, and obtrusive without solving any of the major issues of the fossil fuel status quo. We need a much more pragmatic approach.

What are the alternatives?

Don’t get me wrong; wind, solar, and electric vehicles are compelling when deployed in the right niches. Moderate wind and solar shares in regions with good resources and plenty of space can avoid CO2 at little or no added cost. EVs can create tremendous value powering 2-and-3-wheelers in large cities, and they are not too bad as commuter cars with small battery packs.

Looking a couple of centuries into the future, an all-renewable energy system could potentially work for a fully developed world where the global population has declined to a couple of billion. But that would be a last resort in case we fail to make any of the other possibilities work:

- Fusion. The holy grail.

- 4th-gen nuclear. Fast neutron reactors offer infinite energy, and modularization can solve the negative learning rate problem.

- Deep geothermal. Drilling deep enough holes grants access to an infinite supply of on-demand heat beneath our feet.

- Ocean biomass. We lack the land area to power the world with biomass, but shifting to the oceans can remove this fundamental constraint.

- Coal with CCS. The world has three millennia of coal resources (IEA) and the CO2 storage capacity to match.

All of the above

As always, my main recommendation is to put a fair price on CO2, scrap all handouts to mature technologies like wind, solar, and electric cars, and let the market go to work. In parallel, we need a big boost in sustainable energy RD&D beyond the ridiculously low 0.03% of global GDP currently directed toward this key priority.

Like wind, solar, and EVs, each of the technologies listed above has its niche: nuclear fusion and fission for a steady power supply anywhere on Earth, deep geothermal for combined heat and power in northern regions, and biomass and coal for producing various fuels for transport, industry, and grid balancing. A technology-neutral policy framework combined with aggressive RD&D efforts will allow such a synergistic system to develop naturally.

In addition, an economy-wide carbon tax will naturally incentivize a wide array of cost-effective demand-side measures with numerous side benefits. This includes energy efficiency and, more importantly, life efficiency (the art of gaining more health and happiness from less consumption).

Carbon tunnel vision

Simultaneously, we must escape “carbon tunnel vision” and recognize many serious global problems of similar or greater importance than climate change. While we should certainly take steps to address climate change, we must take great care not to do more harm than good.

One surefire way to do more harm than good is to downgrade the global energy-industrial system by pursuing unworkable plans like TMP3. The incredible amounts of work facilitated by cheap energy powering practical machinery is the fundamental reason we can sustain 8 billion (and counting) Homo sapiens on planet Earth. Since 6.7 billion of us still live below 1000 $/month, the work of this energy-industrial system is only getting started. At the current point in our history, downgrades to this system underpinning the lifestyles of the top 1.3 billion and the aspirations of the bottom 6.7 billion can only end in tears (and possibly blood).

It’s high time we move past the point where any plan that sounds green at first glance is greeted with uncritical applause. We must hold visions for our collective future to a much higher standard if we are to build a sustainable and equitable global civilization.

Appendix

Assumptions in the system investment cost estimate

Primary energy. Fossil fuel investments are set to 0.8 T$/year (IEA data), and wind and solar capacity investments are calculated to generate 92 PWh/year of electricity (following TMP3). However, unlike TMP3 where the excellent US wind and solar resources were extrapolated globally, real-world global average capacity factors from BP Statistical Review data (27% for wind and 15% for solar) were augmented to 30% and 17% for future improvements. This results in about 50% more capacity. In practice, the 92 PWh/year of electricity would also need to increase due to increased curtailment of the more peaky profiles of lower-quality global wind and solar resources, but this was omitted as an optimistic green assumption. Wind and solar costs were set to 1250 $/kW and 450 $/kW based on mid-century projections by the IEA.

Conversion. Fossil fuel power plant capacity investments were calculated to generate 16.5 PWh/year of electricity, with capital costs set to 1500 $/kW based on IEA data. For renewables, TMP3 assumes massive electrification with little green hydrogen production, and the small additional electrolyzer capacity was added at 500 $/kWH2.

Balancing. Due to their inherent energy storage and dispatchability, fossil fuels need no extra costs for balancing. However, large additional costs are needed to balance intermittent wind and solar power. This cost was approximated by adding 4 kWh of battery storage at future costs of 150 $/kWh (IEA) for every kW of wind and solar capacity, thus bringing balancing costs to about 80% of generation costs. Of course, four hours of battery storage will never be enough to guarantee supply (wind and solar can experience lulls lasting for days or weeks), but adding power-to-H2-to-power to the mix can ensure a secure supply (see our prior system model assessments). These extra electrolyzers, H2 storage sites, and H2 power plants are ignored as an optimistic green assumption.

Distribution. Electricity transmission and distribution capital costs were back-calculated from approximately 0.32 T$/year spent for this purpose (IEA data). The levelized T&D capital expenditure under these assumptions amounts to a reasonable 46 $/MWh. Fossil fuel distribution costs in the form of oil shipping, refined fuel distribution, gas pipelines and liquefaction, and coal trade were estimated similarly. Since electricity is much more expensive to transmit than fuels, this category is far larger in the highly electrified TMP3 future than in the fossil fuel status quo, further augmented by 300 $/kW of additional transmission to connect distant wind and solar resources with demand. There will be further factors influencing this important cost component, but these were ignored since the two most important factors; a more peaky demand profile from a lot of rapid vehicle charging and industrial heat storage and a lower share of low-voltage distribution due to more large-scale consumers, should cancel out to some extent.

BEV packs. The battery generally constitutes the difference between hybrid and electric car prices (e.g., about 150 $/kWh of battery capacity more for the Niro EV than a similarly equipped hybrid). The added capital cost of battery packs for electric vehicles relative to gasoline hybrids was estimated based on 100 million light-duty vehicles per year, each getting an 80 kWh battery costing 100 $/kWh. As discussed in Claim 3, this battery is far too small for universal BEV adoption, but we will preserve this optimistic green assumption. The total cost is increased by 50% for the extra battery capacity required for freight applications.

Fueling/charging. The capital cost of fuel stations and distribution is back-calculated from a levelized cost of 0.4 $/gal for distribution and marketing. For the TMP3 system, the cost of BEV charging infrastructure was estimated by assuming a $1000 home charger for half of 1 billion cars, with every two of the remaining half a billion (e.g., apartment dwellers) sharing a $10000 public charger. This slow-charging infrastructure is backed by one $200k rapid charger for every 100 cars. For the fleet of 30 million trucks, a megacharger serving five trucks was assumed to cost $1 million, and an additional 50% was added for charging ships.

Extra freight. Due to the heavy battery pack, large battery-powered trucks and ships can carry less cargo than diesel alternatives. Thus, a larger fleet of these haulers will be needed in the TMP3 scenario. The extra cost was estimated by assuming that the current full-size truck build rate of 4 million/year must be increased by 20% at a cost of 0.18 M$/truck. This cost was doubled to account for similar considerations in shipping. Additional costs from road damages are ignored.

Heat pumps. TMP3 estimates that residential/commercial and industrial heat pumps will consume 6 PWh and 5 PWh per year in a fully electrified future. Installed capacities were then estimated, assuming 25% and 85% capacity factors for home and industrial units. Replacing gas boilers with heat pumps is very expensive (especially on existing properties), but a conservatively low cost of 5000 $/kWe for an installed heat pump was assumed in the cost calculation.

Discounting for risk and opportunity costs

Investment calculations should always deploy discounting to account for risks and opportunity costs. For example, building a solar farm requires a large investment today in exchange for a gradual income from electricity sales over the next 2–3 decades. Discounting states that the revenues from electricity sales 20 years down the line are discounted relative to the cost of building the plant today. This is done because 1) revenues 20 years from now are not guaranteed (risk), and 2) there are many alternative investment opportunities that could yield stronger future returns (opportunity costs).

The energy system proposed in TMP3 is extremely complex and interdependent and has never been demonstrated. This complexity will be ramped up several times during the transition period as we transform the very foundation of our society. Hence, the risk is very high.

More importantly, the massive infrastructure investments advocated in TMP3 come with equally massive opportunity costs. These trillions (and all the materials, energy, time, and expertise they represent) could do much greater good elsewhere. For example, we could invest in decent housing, schools, hospitals, roads, factories, etc., required to uplift the 6.7 billion world citizens still living below 1000 $/month, which would yield vast economic and societal returns.

In practice, the discount rate is manifested as the interest developers pay to banks and investors financing their projects. Investors will demand higher returns if the project is perceived as risky. Similarly, if there is a large demand for capital to develop the global economy, investors will demand higher interest rates because there are many alternative high-yield opportunities. From their returns, investors absorb losses from the projects that fail, finance new projects required to develop the economy further, and earn their (often quite lavish) living.

Get Published - Build a Following

The Energy Central Power Industry Network® is based on one core idea - power industry professionals helping each other and advancing the industry by sharing and learning from each other.

If you have an experience or insight to share or have learned something from a conference or seminar, your peers and colleagues on Energy Central want to hear about it. It's also easy to share a link to an article you've liked or an industry resource that you think would be helpful.

Sign in to Participate