Oil & Gas Group

This group brings together those who are interested in topics around oil and gas exploration, drilling, refining, and processing.

Post

News round-up, April, 3, 2023 8 by GERMÁN & CO

Most read…

In Surprise, OPEC Plus Announces Cut in Oil Production

Oil prices soared 7 percent on Sunday night after the group’s move to cut 1.2 million barrels a day.

NYT BY CLIFFORD KRAUSS, NOW World Bank Warns of Lost Decade for Global Economy

Lender sees demographics, war and pandemic aftereffects holding back growth

WSJ BY HARRIET TORRY, APRIL 2, 2023 Janet Yellen Says Bank Rules Might Have Become Too Loose

Treasury secretary argues that efforts to protect financial stability are incomplete

WSJ BY ANDREW DUEHRENExclusive: Russia shifts to Dubai benchmark in Indian oil deal - sources

The two state-controlled firms' move to leave the Brent standard, which is favored by Europe, is a part of a shift in Russia's oil sales toward Asia after Europe boycotted Russian oil after its invasion of Ukraine more than a year ago.

REUTERS BY NIDHI VERMADollar ahead as inflation worries resurface after OPEC+ surprise

The Organization of the Petroleum Exporting Countries (OPEC) and its allies, also known as OPEC+, announced data on Friday that revealed that U.S. consumer spending increased moderately in February after surging the previous month, with inflation showing some signs of cooling even though it remained high.

REUTERS BY ANKUR BANERJEE. EDITING BY GERMÁN & COJustice Department has more evidence of possible Trump obstruction in documents probe, Washington Post reports

According to the Post, which cited people familiar with the investigation, Trump looked through some of the boxes of government records in his home after his advisers were served with a subpoena in May demanding the return of the classified records out of an apparent desire to keep certain things in his possession.

REUTERS, EDITING BY GERMÁN & CO

“We’re living in a volatile world…

it’s easy to get distracted by things like changeable commodity prices or a shortage of solar panels. But this wouldn’t be true to our purpose – we can’t allow ourselves to lose sight of our end goal; said Andres Gluski, CEO of energy and utility AES Corp

Image: Germán & Co In Surprise, OPEC Plus Announces Cut in Oil Production

Oil prices soared 7 percent on Sunday night after the group’s move to cut 1.2 million barrels a day.

NYT BY CLIFFORD KRAUSS, NOWSaudi Arabia, Russia and their oil-producing allies announced on Sunday that they would cut production by more than 1.2 million barrels of crude a day, or more than 1 percent of world supplies, in an apparent effort to increase prices.

Oil prices soared as markets opened Sunday evening, with both the American and global oil benchmark prices rising by 7 percent.

The production cut was unexpected because leaders of the group, known collectively as OPEC Plus, said in recent days that they did not intend to make changes in their policies. While the announcement was a surprise, its significance may ultimately be slight, especially if the global economy slows.

The alliance produced nearly two million barrels below its supply target in February, the last month for which official output figures are available. “We expect shortfalls to continue,” said Ha Nguyen, a global oil analyst for S&P Global Commodity Insights.

There have been persistent reports that Russia is struggling to keep up production without the benefit of Western service companies that have wound down their operations since the Russian invasion of Ukraine more than a year ago. Saudi production has also been below its production quota set by Organization of the Petroleum Exporting Countries in recent months.

Taking up the slack in supplying the 100-million-barrel-a-day global market are Brazil, Canada, Guyana, Norway and the United States. All are increasing their oil production.

Still, the OPEC Plus action has symbolic importance at a time when oil prices are a third below where they were immediately after Russia’s invasion of Ukraine last February. OPEC Plus members may be responding to growing fears of a recession later this year in the wake of the failure of several American and European banks as well as central bankers’ continued efforts to tame inflation. Oil demand has also been undercut by strikes in France, including at refineries.

“We don’t think cuts are advisable at this moment given market uncertainty,” said Adrienne Watson, a spokeswoman with the U.S. National Security Council, adding, “We’re focused on prices for American consumers, not barrels, and prices have come down significantly since last year.”

Saudi Arabia and Russia will lead in making the announced cuts, with declines of 500,000 barrels each, followed by Iraq, United Arab Emirates and Kuwait. Some analysts said the move could spur more investor speculative interest in oil futures and help drive oil prices higher in coming weeks.

“I really am surprised,” said Tom Kloza, the global head of energy analysis at the Oil Price Information Service. Mr. Kloza said he expected that the Brent global oil price benchmark, which has been hovering at $75 to $80 a barrel in recent weeks, would climb above $80. On Sunday evening, the price of Brent crude surged to $85.48 a barrel. West Texas Intermediate, the American benchmark, rose to $81.04.

Various energy experts estimated the eventual cut differently. Helima Croft, head of global commodity strategy at RBC Capital Markets, said that the voluntary cuts on paper amounted to more than 1.6 million barrels a day but, she added, the “real effect could be around 700,000 barrels a day.”

The global oil market is roughly 102 million barrels a day.

In recent years, Saudi Arabia, the leader of the group, has appeared determined to lift prices to around $90 a barrel. Ms. Croft said she saw the latest OPEC Plus cut as “just one more indication that the Saudi leadership is moving its oil production decisions with a clear eye to their own economic self-interests.” Other experts saw it as another sign of growing Saudi independence from the United States, with its relationship to China increasing in importance. It is already a vital partner of Russia’s in directing oil supply levels.

The cuts, which are voluntary and start in May, could be temporary depending on economic conditions.

Just last week, Saudi Aramco, the Saudi state oil company, announced two deals with China to supply refineries there with 690,000 barrels a day. Demand for oil continues to rebound from the global slowdown amid the Covid-19 pandemic. World diesel demand has nearly recovered to its levels before the pandemic, and jet fuel demand continues to surge as China emerges from its Covid shutdown.

The cuts come as gasoline prices, still well below where they were a year ago, are rising again. The average price for regular gasoline in the United States on Sunday was $3.51 a gallon, 13 cents above a month ago. The price a year ago was $4.20 a gallon, and was a major factor in the rise of inflation.

The cartel agreed in October to output cuts of two million barrels a day, but the ultimate reduction was well below that as producing countries like Libya and Nigeria agreed to cut to levels that they could not reach anyway.

The group had last slashed production in 2020, when demand collapsed because of the pandemic. It then gradually increased production until October.

Seaboard: pioneers in power generation in the country

…Armando Rodríguez, vice-president and executive director of the company, talks to us about their projects in the DR, where they have been operating for 32 years.

More than 32 years ago, back in January 1990, Seaboard began operations as the first independent power producer (IPP) in the Dominican Republic. They became pioneers in the electricity market by way of the commercial operations of Estrella del Norte, a 40MW floating power generation plant and the first of three built for Seaboard by Wärtsilä.

Image: The World Bank’’s forecast comes in the wake of the Inflation Reduction Act. PHOTO: SAMUEL CORUM/BLOOMBERG NEWS. Editing by Germán & Co World Bank Warns of Lost Decade for Global Economy

Lender sees demographics, war and pandemic aftereffects holding back growth

WSJ BY HARRIET TORRY, APRIL 2, 2023 “Over the past year, governments around the world have announced tax breaks, subsidies and new laws in a bid to accelerate investment, combat climate change and expand their workforces.

That might not be enough.

The World Bank is warning of a “lost decade” ahead for global growth, as the war in Ukraine, the Covid-19 pandemic and high inflation compound existing structural challenges.

The Washington, D.C.-based international lender says that “it will take a herculean collective policy effort to restore growth in the next decade to the average of the previous one.” Three main factors are behind the reversal in economic progress: an aging workforce, weakening investment and slowing productivity.

“Across the world, a structural growth slowdown is under way: At current trends, the global potential growth rate—the maximum rate at which an economy can grow without igniting inflation—is expected to fall to a three-decade low over the remainder of the 2020s,” the World Bank said.

Potential growth was 3.5% in the decade from 2000 to 2010. It dropped to 2.6% a year on average from 2011 to 2021, and will shrink further to 2.2% a year from 2022 to 2030, the bank said. About half of the slowdown is attributable to demographic factors.

The latest alarm bells from the World Bank about the global economy come in the wake of the U.S.’s passing the Inflation Reduction Act, which includes hundreds of billions in incentives and funding for clean energy, as well as a law to ratchet up investments in semiconductors. In response, the European Union is relaxing its rules on government tax breaks and other benefits for clean-tech companies.

Meantime, major economies are trying to boost their workforce numbers, often in the face of steep resistance. In France, protesters responded violently to President Emmanuel Macron’s overhaul of the country’s pension system, while China’s shrinking population has prompted local governments there to offer cash rewards and longer maternity leaves to boost births.

These efforts so far might be too little, too late. Weakness in growth could be even more pronounced if financial crises erupt in major economies and trigger a global recession, the World Bank report cautions. The warning comes just weeks after the collapse of Silicon Valley Bank sparked turmoil in the U.S. and European banking sectors.

Questions surrounding global growth prospects will be in the air in Washington, D.C., alongside the blooming cherry blossoms at the spring meetings of the International Monetary Fund and World Bank from April 10 to 16.

Policy makers and central-bank officials will join economists from around the world to discuss topics including inflation, supply chains, global trade fragmentation, artificial intelligence and human capital.

Earlier this year, the World Bank sharply lowered its short-term growth forecast for the global economy, citing persistently high inflation that has elevated the risk for a worldwide recession. It expects global growth to slow to 1.7% in 2023. Other organizations, such as the International Monetary Fund and the Peterson Institute for International Economics, a Washington-based think tank, expect global GDP growth to expand a more robust 2.9% in 2023.

This isn’t the first time the World Bank has warned of a lost decade. In 2021, the lender said the Covid-19 pandemic raised the prospect owing to lower trade and investment caused by uncertainty over the pandemic. It issued similar warnings after the 2008 financial crisis. Global growth from 2009 to 2018 averaged 2.8% a year, compared with 3.5% in the prior decade.

The World Bank identifies a number of challenges conspiring to push down global growth: weak investment, slow productivity growth, restrictive trade measures such as tariffs and the continuing negative effects—such as learning losses from school closures—because of the pandemic.

It said pro-growth policies would help. Measures to boost labor-force participation among discouraged workers and women can help reverse the negative trend in labor force growth from an older population and lower birthrates, according to the World Bank.

Some view the World Bank’s projection for a lost decade as too pessimistic. Harvard University economist Karen Dynan said that aging populations in nearly every part of the world will be a drag on global growth, but she was more optimistic on raising productivity—output per worker.

“I expect, outside the demographic effects, output per person to look a lot like it did before the pandemic,” she said.

“The World Bank is right to draw concern to the possibility of a lost decade in sub-Saharan Africa, in Central America, in South Asia—an awful lot of human beings are at risk or are facing very grim situations,” said Adam Posen, president of the Peterson Institute for International Economics.

“But from a global GDP outlook, or even a global population outlook, most of the major emerging markets along with most of the Group of 20 essentially are doing pretty well,” Mr. Posen said. He pointed to economic resilience in Europe and emerging markets in recent years, even as the Federal Reserve has sharply raised interest rates.

Image: WSJ, editing by Germán & co Janet Yellen Says Bank Rules Might Have Become Too Loose

Treasury secretary argues that efforts to protect financial stability are incomplete

WSJ BY ANDREW DUEHRENWASHINGTON—Treasury Secretary Janet Yellen said that regulators might need to tighten banking rules after the collapse of Silicon Valley Bank and Signature Bank, arguing that the recent turmoil is a sign that efforts to bolster the financial system are incomplete.

Speaking at an economics conference Thursday, Ms. Yellen questioned whether the regulatory system she helped build after the 2008 financial crisis was adequate to protect financial stability. Regulators this month extended emergency assistance to banks and stepped in to protect all depositors at SVB and Signature.

“These events remind us of the urgent need to complete unfinished business: to finalize post-crisis reforms, consider whether deregulation may have gone too far, and repair the cracks in the regulatory perimeter that the recent shocks have revealed,” Ms. Yellen said.

She spoke at the National Association for Business Economics, which was presenting her with an award in memory of former Federal Reserve Chair Paul Volcker. Before becoming Treasury secretary, Ms. Yellen held top jobs at the Fed, including serving as its chair.

Since SVB and Signature failed, some former regulators have said Washington might have focused too much on the biggest banks after the 2008 financial crisis. In 2018, lawmakers from both parties voted to raise to $250 billion from $50 billion the asset threshold at which banks automatically face strict stress tests and other rules.

The Federal Reserve is now reconsidering a number of its rules for banks with assets between $100 billion and $250 billion. The White House on Thursday also called for tougher rules for midsize banks.

“Regulatory requirements have been loosened in recent years. I believe it is appropriate to assess the impact of these deregulatory decisions and take any necessary actions in response,” Ms. Yellen said.

More broadly, Ms. Yellen said the fallout from the recent banking turmoil—as well as from the market volatility in the spring of 2020, when the Covid-19 pandemic struck the U.S.—had been successfully mitigated.

“In large part, this was due to the post-crisis reforms we put in place,” she said. “But in both cases, the government had to deliver substantial interventions to ease the pressure on certain parts of the financial system. This means that more work must be done.”

Ms. Yellen also laid out the work she and federal regulators are doing to address risks they see outside of banks. Under Ms. Yellen, the Financial Stability Oversight Council—an interagency forum created after the financial crisis—is preparing to change its rules so it can more easily subject institutions such as money-market funds to enhanced federal supervision.

Ms. Yellen said that money-market funds, hedge funds and stablecoins, a type of digital asset typically pegged to the dollar, each present the risk of creating fire sales of assets that could fuel instability. For instance, she said, if investors try to pull out of money-market funds en masse, that can force sales of underlying assets, potentially destabilizing those markets.

“The financial stability risks posed by money market and open-end funds have not been sufficiently addressed,” she said.

FSOC has restarted a group studying hedge funds, Ms. Yellen said, adding that the group could make policy recommendations. The Treasury has also asked Congress to pass legislation that would regulate stablecoin issuers more like banks. And Ms. Yellen said she would continue to accelerate hiring efforts at the FSOC, which she said had been decimated because of staff turnover before she took office.

Image: A model of oil barrels is seen in front of Russian and Indian flags in this illustration taken, December 9, 2022. REUTERS/Dado Ruvic/Illustration./Editing by Germán & Co Exclusive: Russia shifts to Dubai benchmark in Indian oil deal - sources

The two state-controlled firms' move to leave the Brent standard, which is favored by Europe, is a part of a shift in Russia's oil sales toward Asia after Europe boycotted Russian oil after its invasion of Ukraine more than a year ago.

REUTERS BY NIDHI VERMANEW DELHI, April 3 (Reuters) - Russia's largest oil producer Rosneft (ROSN.MM) and India's top refiner Indian Oil Corp (IOC.NS) agreed to use the Asia-focused Dubai oil price benchmark in their latest deal to deliver Russian oil to India, three sources familiar with the deal said.

The decision by the two state-controlled companies to abandon the Europe-dominated Brent benchmark is part of a shift of Russia's oil sales towards Asia after Europe shunned Russian oil following Russia's invasion of Ukraine more than a year ago.

Both benchmarks are denominated in dollars and set by S&P Platts, a unit of U.S.-based S&P Global Inc (SPGI.N), but Brent is mostly used by European oil majors and traders, whereas Dubai is heavily influenced by Asian and Middle Eastern oil trading.

Rosneft's chief executive Igor Sechin said in February that the price of Russian oil would be determined outside of Europe as Asia has emerged as largest buyer of Russian oil since the West imposed progressively tighter sanctions on the export.

Under the new deal, announced on March 29, Rosneft will nearly double oil sales to Indian Oil Corp (IOC.NS), two of the sources told Reuters.

IOC and Rosneft did not immediately respond to Reuters emails seeking comment on the details of the agreement, which have not been previously reported.

Russian Deputy Prime Minister Alexander Novak said on Tuesday that Russian oil sales to India jumped 22-fold last year, but he did not specify the volume sold.

Rosneft would sell up to 1.5 million tonnes (11 million barrels) each month, including some optional quantities, to IOC in the new fiscal year from April 1, the two sources said.

They said that in 2022/23, IOC had a deal to buy 3 million barrels of Urals grade with an option to double the quantity every month priced at differentials to dated Brent on a delivered basis.

The new contract includes Urals crude, shipped from Russia's European ports of Primorsk, Ust-Luga and Novorossiysk, and Sokol oil exported from Sakhalin which will be sold at a discount of $8-$10 per barrel to Dubai quotes on a delivered basis, three sources said.

The larger volumes and change in Russian oil pricing highlight closer ties between Moscow and India, which has now become the largest buyer of seaborne crude from Russia.

Indian refiners rarely bought Russian oil in the past due to higher freight costs compared with Europe, but after Urals prices fell to historical lows Russia has now replaced Iraq as top oil supplier to India in the last few months, data from trade sources showed.

Russia has been rerouting its energy supplies from traditional markets in Europe to Asia, mainly India and China, since the West imposed wide-ranging sanctions, including an embargo on seaborne Russian oil imports.

The European Union nations stopped buying Russian oil from Dec. 5 and the Group of Seven (G7) countries joined the EU in imposing a price cap on Russian crude of $60 per barrel. The move was aimed at cutting Russia's oil revenue while maintaining stability on the global oil market.

India was the biggest buyer of Russia's benchmark Urals grade crude in March. Deliveries to India are set to account for more than 50% of all seaborne Urals exports last month, with China in second place.

China, which buys Russian Urals at prices pegged against either dated Brent or ICE Brent, doubled its purchases of Urals oil in the first half of February compared to the same period of January, according to traders and Refinitiv Eikon data.

Image: Germán & Co Cooperate with objective and ethical thinking…

Image: Woman holds U.S. dollar banknotes in front of Euro banknotes in this illustration taken May 30, 2022. REUTERS/Dado Ruvic/Illustration/File Photo. Editing by Germán & Co Dollar ahead as inflation worries resurface after OPEC+ surprise

The Organization of the Petroleum Exporting Countries (OPEC) and its allies, also known as OPEC+, announced data on Friday that revealed that U.S. consumer spending increased moderately in February after surging the previous month, with inflation showing some signs of cooling even though it remained high.

REUTERS BY ANKUR BANERJEE. EDITING BY GERMÁN & COSINGAPORE, April 3 (Reuters) - The U.S. dollar was broadly higher as fears over inflation resurfaced after a surprise announcement by major oil producers to cut production further, with traders wagering the Federal Reserve may need to increase interest rates at its next meeting.

The announcement from the Organization of the Petroleum Exporting Countries (OPEC) and its allies, known as OPEC+, comes after data on Friday showed U.S. consumer spending rose moderately in February after surging the prior month, with inflation showing some signs of cooling even as it remained elevated.

"While receding broader contagion risks, positive developments in China and expectations that the Fed is nearing the end of the tightening cycle should keep sentiments broadly supported, the oil price gain due to the surprise production cut is a fresh risk to inflation," said Christopher Wong, a currency strategist at OCBC in Singapore.

"Fresh inflation risks do imply the inflation fight is not over."

The euro was down 0.44% to $1.0791, after touching a one-week low of $1.0788, while the Japanese yen weakened 0.46% to 133.41 per dollar. Sterling was $1.2277, down 0.45% on the day. The dollar rose 0.32% against the Swiss franc.

The dollar index , which measures the U.S. currency against six peers, was 0.078% higher at 103.01, breaking past 103 for the first time in a week.

The OPEC+ cuts caused oil price increases of more than 6% on Monday.

The cuts were announced even before a virtual meeting of the OPEC+ ministerial panel, which includes representatives from Saudi Arabia and Russia, that was expected to stick to cuts of 2 million barrels per day (bpd) already in place until the end of 2023.

Instead, the oil producers on Sunday announced further output cuts of around 1.16 million bpd.

The two-year U.S. Treasury yield, which typically moves in step with interest rate expectations, was up 4.6 basis points at 4.108%. The yield on 10-year Treasury notes was up 2.9 basis points to 3.519%.

Markets are now pricing in the probability of the Fed hiking rates by a quarter point in May to 61%, from 48% on Friday. But, by the end of the year, expectations are priced in for cuts of 40 basis points.

Friday's report from the U.S. Commerce Department showed that personal consumption expenditures price index rose 5.0% in February from a year earlier, down from the 5.3% increase in January. A measure of core inflation - seen as a better gauge of future price increases - came in a shade lower than expected at 4.6%.

Additional data also showed U.S. consumer sentiment fell for the first time in four months in February on concerns of an impending recession, although the impact of the banking crisis was muted.

Citi strategists said concerns over financial stability are fading and any drag from tighter credit is likely to be both lagged and limited.

"Still, the recent experience likely will keep the Fed more cautious in raising rates and markets more cautious in pricing hawkish policy," Citi strategists said in a note, adding they expect 25 basis point hikes at the next three Fed meetings.

The risk-sensitive Australian dollar fell 0.30% to $0.667 ahead of a high-stakes policy meeting from the Reserve Bank of Australia this week, with markets betting the central bank will stand pat on interest rates after 10 interest rate hikes.

The kiwi slid 0.62% to $0.622, its biggest one-day percentage drop since March 24.

In cryptocurrencies, bitcoin last fell 2.43% to $27,703.00. Ethereum , last fell 2.27% to $1,776.40.

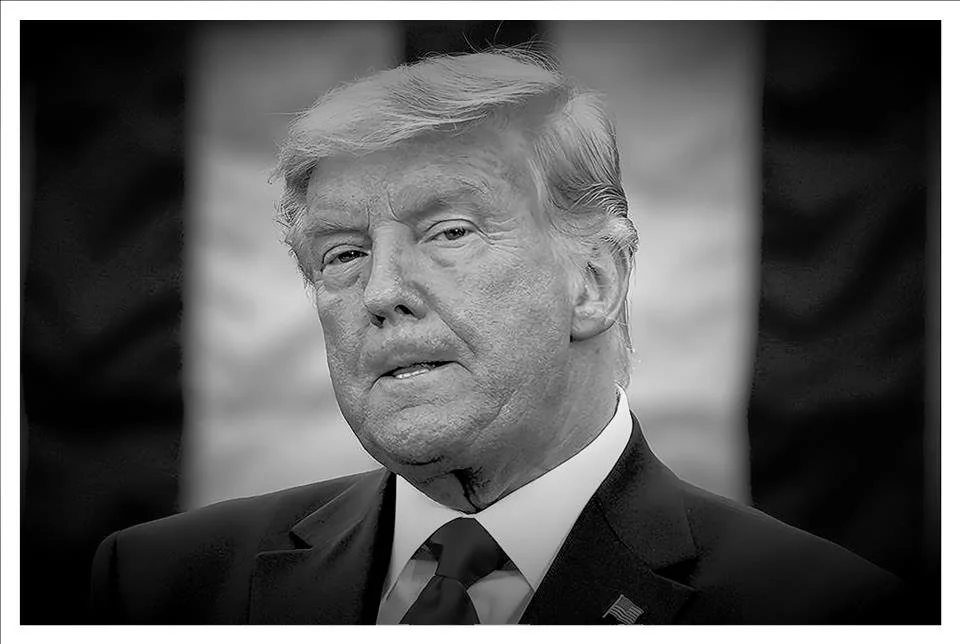

Image: U.S. President Donald Trump delivers an update on the so-called Operation Warp Speed program in an address from the Rose Garden at the White House in Washington, U.S., November 13, 2020. REUTERS/Carlos Barria/File Photo/Editing by Germán & Co Justice Department has more evidence of possible Trump obstruction in documents probe, Washington Post reports

According to the Post, which cited people familiar with the investigation, Trump looked through some of the boxes of government records in his home after his advisers were served with a subpoena in May demanding the return of the classified records out of an apparent desire to keep certain things in his possession.

REUTERS, EDITING BY GERMÁN & COApril 2 (Reuters) - U.S. Justice Department and FBI investigators have amassed new evidence indicating possible obstruction by former President Donald Trump in the probe into classified documents found at his Florida estate, the Washington Post reported on Sunday, citing sources.

FBI agents seized thousands of government records, some marked as highly classified, from Trump's Mar-a-Lago estate in August. The investigation is one of two criminal inquiries into the former president being led by Special Counsel Jack Smith.

Trump, who was indicted on Thursday in a separate inquiry in New York, has denied any wrongdoing in the cases and describes them as politically motivated.

After his advisers received a subpoena in May demanding the return of the classified records, Trump looked through some of the boxes of government documents in his home out of an apparent desire to keep certain things in his possession, the Post reported, citing people familiar with the investigation.

Investigators also have evidence indicating Trump told others to mislead government officials in early 2022, before the subpoena, when the U.S. National Archives and Records Administration was working to recover documents from Trump's time as president, the Post reported.

The FBI referred questions to the Justice Department, which did not immediately respond to a request for comment.

In a statement to the Post, Trump spokesman Steven Cheung said that the "witch-hunts against President Trump have no basis in facts or law," and accused Special Counsel Smith and the Justice Department of leaking information to manipulate public opinion.

Smith's investigations are among a growing number of legal worries for Trump, who in November launched a campaign seeking the 2024 Republican presidential nomination.

In addition to the New York probe, Trump faces a Georgia inquiry over whether he tried to overturn his 2020 election defeat in the state.

Discussions

No discussions yet. Start a discussion below.

Get Published - Build a Following

The Energy Central Power Industry Network® is based on one core idea - power industry professionals helping each other and advancing the industry by sharing and learning from each other.

If you have an experience or insight to share or have learned something from a conference or seminar, your peers and colleagues on Energy Central want to hear about it. It's also easy to share a link to an article you've liked or an industry resource that you think would be helpful.

Sign in to Participate