This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

January 3, 2023

Task Force on Climate-Related Financial Disclosures: A Preview of Sustainability Roundtable Inc.’s Full Member Advisory

The Task Force on Climate Related Financial Disclosures (TCFD) first released recommended disclosures on climate risk in 2017. Since that time, transparency on climate impacts and risk has become increasingly central to economic activity, and more companies are beginning to report in accordance with the TCFD framework.

What is the Task Force on Climate-Related Financial Disclosures (TCFD)?

Investors are increasingly agreeing that ESG is significant in helping to illuminate financial performance. Analysts at Bank of America Merrill Lynch found that ESG was “the best measure we’ve found for signaling future risk,” prompting more and more asset managers to incorporate ESG into standard analysis. In response to calls from investors for better climate-related information, the Financial Stability Board (FSB) in 2015 created the Task Force on Climate Related Financial Disclosures (TCFD), which was tasked with recommending disclosures related to climate-related risks for major companies. While disclosure was and continues to be entirely voluntary, the intent is to make useful and practical climate-related information widely available in the market.

TCFD recommendations are intended to be incorporated by corporates into annual reports, like other popular frameworks Global Reporting Initiative (GRI) and Sustainability Accounting Standards Board (SASB), rather than submitted to an independent body, like popular climate questionnaire CDP. Many companies who utilize TCFD disclosures elect to comply with the recommendations by adding specific informational tables at the end of their annual ESG reports, and others have even released standalone TCFD reports. The organization’s guidelines on disclosure are intended to specifically serve investor interests rather than those of a broader audience, so a reporting company can incorporate the relevant information into any annual report as they see fit, including a CDP questionnaire.

TCFD Reporting Statistics

A recent 2022 report by the Governance and Accountability Institute found that 50% of Russell 1000 reporters mention (16%) or align with (34%) TCFD recommendations. The 34% alignment represents a significant growth from 2019, when only 4% of the Russell 1000 reporters aligned with TCFD.

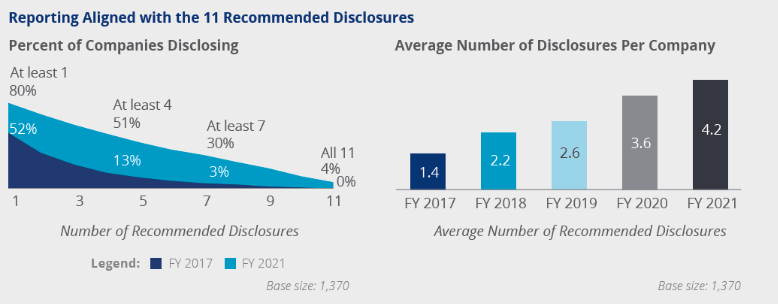

Although pursuance of the TCFD’s recommended disclosures has consistently risen, most companies still do not disclose all 11 items recommended by the framework. In February of 2022, Moody’s Corporation released a white paper analyzing TCFD-aligned reporting by major companies in the U.S. and Europe, revealing a disparity in reporting on the full set of recommended TCFD disclosures, with most companies only reporting on four. TCFD’s 2022 status report published in October confirms that only 4% of reporting companies provided information for all 11 recommended disclosures.

Explanation of Scenario Analysis

Scenario analysis is, at its simplest, a thought exercise. Corporations use climate scenario analysis as a tool to examine how various possible climate futures may affect their company’s business model over time. Scenario analysis falls into the third segment of the strategy section of TCFD, which requires companies to “describe the resilience of the organization’s strategy, taking into consideration different climate related scenarios, including a 2°C or lower scenario.” Many companies carry out risk analysis as part of their enterprise risk management function, but adding the lens of climate-related risk along with projected climate scenarios makes it increasingly relevant in our changing world.

Scenario analysis, like many aspects of sustainability reporting, has a sliding scale of complexity. Companies often start with two simple climate scenarios from established organizations like the Intergovernmental Panel on Climate Change (IPCC) and the International Energy Agency (IEA). Recommended scenarios include the Representative Concentration Pathways, or RCPs, as well as the Shared Socioeconomic Pathways, or SSPs, which also predict social changes. Companies use these scenarios to examine the impacts of different physical (e.g.. extreme weather, climate migration, resource wars) and transition (e.g. climate regulation, carbon taxes, reputational impacts) risks.

As companies advance their TCFD reporting, they often add more scenarios (either external or developed in-house) and transition to quantifying risk from a financial perspective. For both physical and transition risks, this means quantifying the financial impact of each risk occurring – for example, the costs of repairs and emergency backup measures if a hurricane should hit a critical data center for a software company, or the cost of losing customers due to failing to reach a corporate ESG goal. Several existing reporting structures such as the CDP and the proposed SEC rule already ask companies to quantify their risks, but ensuring TCFD disclosures include this level of detail increases the reliability of the exercise. Within TCFD, adding this extra layer of hard numbers lends credence to the conclusions of the scenario analysis working group and allows teams from different functions to translate the findings to their own work.

Conclusion

TCFD’s recommendations have changed the reporting landscape within corporate sustainability and continue to influence emerging regulation across the globe. More and more corporations are committing to transparency for investors regarding sustainability information, and are using the process to improve their own climate risk management efforts.

For additional guidance on scenario analysis, information on how TCFD reporting is being integrated into mandatory reporting standards (ISSB, U.S. SEC, EU CSRD), and a case study on Member-Client Biogen, Member-Clients can refer to the Member Advisory available in the SR Inc Digital Library. SR Inc is working with Member-Clients to report on TCFD recommended disclosures and will be adding additional Case Studies throughout 2023. SR Inc welcomes the opportunity to deepen our assistance to Member-Clients on TCFD broadly and continue to develop best practices, specifically on scenario analysis and aligning corporate risk assessment with broader national considerations on transition risk.

As a Senior Analyst at SR Inc, Julia supports Member-Clients with outsourced program assistance and creates original research to help clients drive industry best practice in areas ranging from ESG governance structures, ESG reporting, and innovative renewable energy procurements.

As a Senior Analyst at SR Inc, Julia supports Member-Clients with outsourced program assistance and creates original research to help clients drive industry best practice in areas ranging from ESG governance structures, ESG reporting, and innovative renewable energy procurements.

Before working at SR Inc, Julia worked as a Sustainability Consultant for footwear distributor Weyco Group, creating a GHG inventory aligned with the globally recognized GHG Protocol and working to reduce impact in their supply chain. She has additional experience providing sustainability support services from working with consulting firm Scott Echols Group, LLC and interning at TerraCycle. Julia graduated with a B.S. in Environmental Science from Brown University. There, she worked with the Brown Office of Sustainability for three years, helping Brown reduce waste to landfill, measure Scope 3 emissions, and institute a campus-wide Sustainability Plan. During college, Julia also volunteered with the Food Recovery Network and the organic farming consortium World-Wide Opportunities on Organic Farms (WWOOF).