Since the Dobbs ruling, private investors and philanthropic organizations have stepped up their pursuit of mission-driven impact investments in reproductive care enterprises, especially those serving systemically underserved individuals and communities. This research from the Bridgespan Group identifies opportunities for timely impact investments in the reproductive field as a complement to existing philanthropic funding.

Long before the Supreme Court’s Dobbs v. Jackson Women’s Health Organization ruling overturned Roe v. Wade in June 2022, reproductive care in the United States languished as an overlooked “niche” market for investors.

Times are changing. Since the Dobbs ruling, private investors and philanthropic organizations have stepped up their pursuit of mission-driven impact investments in reproductive care enterprises, especially those serving systemically underserved individuals and communities.

“In the three days after the Dobbs decision, we raised as much capital as we had in the previous six months,” said Elizabeth Bailey, managing director of RH Capital, a venture capital fund of Rhia Ventures that invests in reproductive and maternal health. “Investors interested in our work but who had been sitting on the sidelines said, ‘I need to do something now.’”

Indeed, the Dobbs decision “has created a new, heightened moral and economic imperative to invest in the [women’s health] category,” said Carolyn Witte, co-founder and CEO of Tia, a women’s health provider offering in-person and virtual care to support physical, mental, and reproductive health.1

[The Dobbs decision] “has created a new, heightened moral and economic imperative to invest in the [women’s health] category.”

Carolyn Witte, Co-Founder and CEO, Tia

As investments in reproductive health trend upward, many enterprises explicitly aim to improve access and quality of care for those most harmed by societal inequities: Black, Latinx, and Indigenous women;2 transgender, nonbinary, and gender-nonconforming people; young people; individuals with disabilities; individuals in rural communities; and people with low incomes. The equity-centered missions of these enterprises are well served by impact investors, whose aim is to generate social good alongside financial return.

Still, many foundations and wealth-holders see the field solely through the lens of philanthropy, missing the potential impact of their investment dollars. To help them channel their ambition, Bridgespan launched a research project to identify what opportunities exist for timely impact investments in the reproductive field as a complement to existing philanthropic funding. (See “Research methodology.”)

The results of our research were encouraging. We identified nine types of impact investment opportunities that cover the full spectrum of reproductive care. We also gathered insights on navigating the tensions and obstacles that have historically hobbled reproductive health investment and collaboration, and distilled advice on how to help the reproductive health field shed its niche status.

Pathways to strengthen reproductive care

Even before Dobbs, the United States failed to provide adequate prenatal, pregnancy, postpartum, and abortion care to millions of women (see “The Inequities of Reproductive Care in the United States”). Within four months of the Dobbs ruling, 18 states banned some or all access to abortion care, depriving more than 25 million women of reproductive age access to this procedure where they live.3

This abortion access crisis, however, did not begin with Dobbs, said Alicia Harris, reproductive health, rights, and justice program officer at the Grove Foundation. “Clinics have been operating in crisis for some time,” she noted.

“Investors interested in our work but who had been sitting on the sidelines said, ‘I need to do something now.’”

Elizabeth Bailey, Managing Director, RH Capital

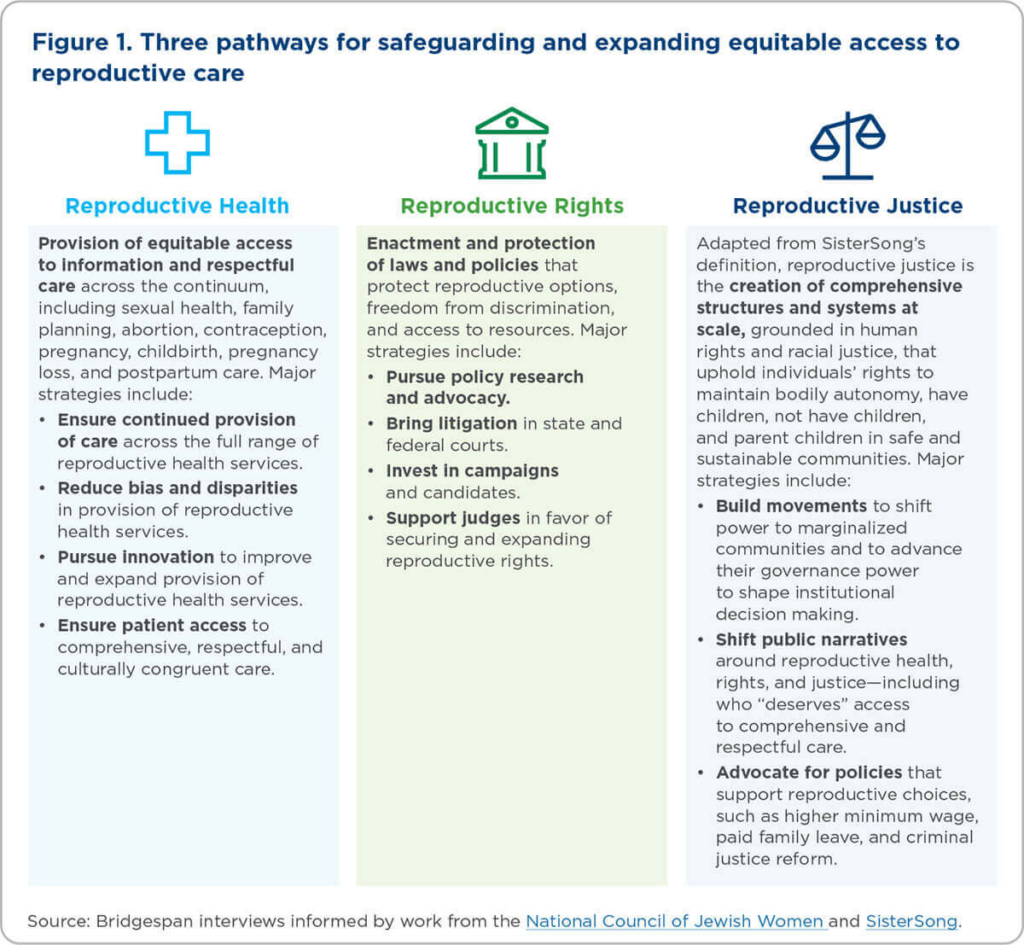

While it has further compounded these problems, Dobbs has also drawn attention to opportunities to safeguard and expand equitable access to a full spectrum of quality reproductive care across three pathways: reproductive health, reproductive rights, and reproductive justice, as defined below.

Each of these pathways encompasses multiple strategies to strengthen the reproductive field. Philanthropic grants can, and should, continue to play the leading role in supporting reproductive rights and reproductive justice organizations, particularly among place-based and grassroots organizations with Black, Latinx, and Indigenous leaders.

“Now is the time for philanthropists who believe in social justice and human rights to support abortion access, protect those likely to be harmed by bans, and work toward restoring strong policies,” Jonathan Wittenberg and Wendy Sealey of the Guttmacher Institute, a research and policy organization, have written.4 “This is a marathon, not a sprint,” they noted.

“Now is the time for philanthropists who believe in social justice and human rights to support abortion access, protect those likely to be harmed by bans, and work toward restoring strong policies.”

Jonathan Wittenberg and Wendy Sealey, Guttmacher Institute

Unfortunately, philanthropy has a poor record of funding leaders of color, despite the fact that they “often bring strategies that intimately understand the racialized experiences of communities of color and the issues these communities face,” concluded a 2020 Bridgespan report.5 It cautioned that the impact donors care about most “cannot happen without funding more leaders of color and funding them more deeply.”

Yet, even if philanthropy doubles down, grants alone will not be sufficient. The magnitude of the current challenge—and thus the opportunity—requires a large-scale infusion of capital from diverse sources. In particular, reproductive health enterprises meeting the needs of underserved communities and individuals need investment capital to grow. This makes reproductive health an attractive area for impact investment.

Impact investing’s role in reproductive care

Unlike traditional investing, which strives to maximize returns, impact investing is marked by a firm commitment to pursuing social benefit alongside financial returns. “We talk about impact investing as funding where traditional financing is not accessible and using blended capital to meet our partners where they are,” said Tenesha Duncan, founder and managing director of Orchid Capital Collective, an integrated capital firm that was born out of her own experience directing and supporting reproductive health clinics and communities of providers.

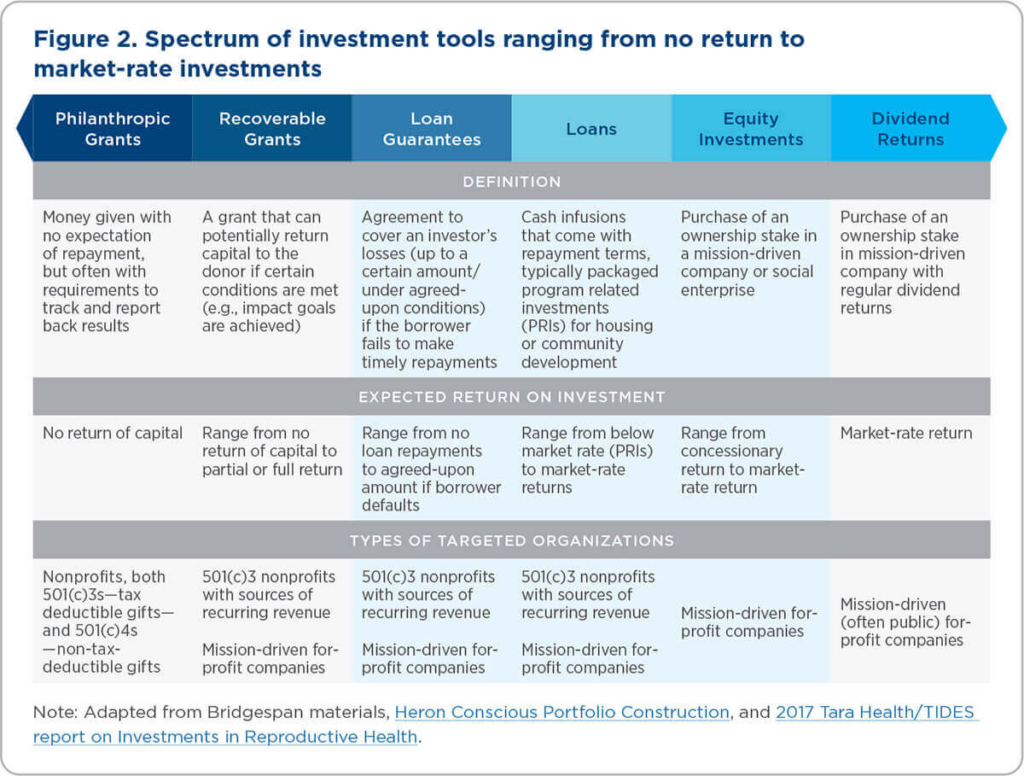

Beyond adhering to a blend of social and financial benefits, the impact investing field is diverse, reflecting an array of tools and financial expectations deployed by a variety of players. As shown in the table below, common investment tools include loans, loan guarantees, and equity investments. Financial expectations vary within and across investment tools, and they can range from zero (meaning return of most or all the initial capital but nothing more), to positive returns with concessionary rates or terms, to market rate returns, depending on each investor’s approach. Orchid’s blended capital approach, for example, matches different investment tools to its investees’ needs and phases of growth. “These approaches can take the form of [anything from] recoverable grants and low-interest loans,” said Duncan, “to ‘scalable’ capital that can yield market-rate returns and move us toward the end goal of building community health and wealth.”

Organizations deploying these investment tools include venture capital, private equity, and community development financial institutions, as well as philanthropic foundations and high-net-worth individuals (HNWIs). Foundations and HNWIs can also use impact investments to complement their philanthropic giving and advance their impact goals.

Even before the Dobbs ruling, impact investment in areas adjacent to reproductive care was on the upswing. For example, venture capital investments in “femtech” (technologies specifically focused on women’s health, including reproductive care) reached nearly $1.9 billion in 2021, up from $600 million in 2015.6 RH Capital’s Bailey noted: “We are absolutely moving up the curve, but we are still a sliver of the venture investment that’s going into healthcare”—let alone reproductive care.

To be clear, not all funding needs in the reproductive field are well suited for impact investing. Most efforts to advance reproductive rights and reproductive justice—along with some efforts to improve reproductive health—do not generate revenue and therefore cannot yield recoverable capital. But a significant number of reproductive health initiatives—both for-profit and nonprofit—do generate revenue while improving quality of care and access for patients, including those from systemically marginalized populations. These efforts, detailed below, can benefit from impact investments structured as loan guarantees, loans, or equity stakes (highlighted in Figure 2 above in light blue).

Entry points for impact investment in reproductive health

Our research identified nine areas of opportunity to invest in new or existing reproductive health enterprises.7 Each approaches reproductive health from a unique business perspective, which led us to sort the nine areas into five categories based on their stated goals:

- Harm-reduction potential. Capacity to directly and immediately reduce harm to individuals caused by the social and political factors shaping the current reproductive ecosystem, with a focus on reproductive choice.

- Equity focus. Focus on reaching and ensuring access for marginalized populations most impacted by current reproductive health inequities and supporting diverse leadership teams who reflect the populations served.

- Scale and reach potential. Potential to benefit a significant portion of individuals served by the reproductive care ecosystem across the United States.

- Catalytic potential. Capacity to generate positive impact that paves the way for additional innovation, collaboration, or investment that would not otherwise have been possible.

- Holistic impact. Incorporation and equal weighting of all levers above through establishment of a portfolio fund investing across multiple reproductive health enterprises.

They represent distinct “entry points” for potential impact investors. While these categories are not mutually exclusive, we found that the opportunities reflected in each entry point share a common set of strengths, considerations, and potential tradeoffs. We anticipate that current and prospective impact investors may gravitate toward one or more entry points based on their institutional strategies, preferences, and risk tolerance. In this way, the entry points are also intended to help leaders make a clear case for investment within their institutions.

Below, we detail investment opportunities for each entry point. In addition, we briefly describe one example enterprise with near-term investment potential and list one or more similar organizations that also merit consideration. The enterprises listed are illustrative and not intended to be exhaustive. They include for-profits and nonprofits that have the ability to generate income to repay loans framed as impact investments. We also recognize that the reproductive health ecosystem is evolving rapidly, and we invite readers to let us know of additional examples so that we can periodically update the following information.

Harm-reduction potential

Telehealth for Abortion and Contraception

Opportunity overview:

- Telemedicine seeks to improve access to reproductive health services through direct and innovative care online. Virtual providers have proven to be efficient and may lead to a decrease of bottlenecks at in-person clinics.

- While restricted in 19 states, telemedicine is a major provider of safe medication abortion prescriptions, which are approved by the FDA for use before the 11th week of pregnancy.

- Recognizing that telehealth as a field is continuing to develop in the wake of the COVID-19 pandemic, there is a clear opportunity to deploy capital to help reproductive-health-centered telemedicine organizations meet demand and scale.

Considerations:

- Clear and direct pathway to increasing access to contraception and timely abortion access by supplying medication abortions.

- Potential for wide scaling since physical infrastructure is unnecessary, but limited scale potential due to crowded field of players in a market narrowed by state legal bans.

Example organization: Choix Health (for-profit) is a clinician-founded telehealth platform with a mission to expand access for all people seeking abortion and reproductive care online. The organization has a commitment to addressing systematic inequity and barriers through sliding-scale fee models, partnerships with local abortion funds and organizations, multilingual clinicians, and a focus on mobile access.

Additional organizations: Hey Jane, carafem, Abortion On Demand, Wisp, Tia

Equity Focus

Equity-focused birth center infrastructure

- The birth-center model of care lessens rates of preterm birth and low birth weight, reduces cesarean usage, and improves breastfeeding rates. It’s also cost-effective and helps ensure families have a foundation on which to raise healthy, thriving children.

- Birth centers led by Black, Latinx, and Indigenous people provide safe, respectful, and culturally appropriate care.

- Birth centers offer opportunities to invest in brick-and-mortar providers, the intermediaries who support them, or both.

Considerations:

- Clear pathway to improving reproductive care and reducing disparities in birth outcomes.

- Scale and reach potential are limited in the near term, as 98 percent of births in the United States currently take place in hospitals.

Example organization: Birth Center Equity (BCE) supports birth center leaders who are Black, Indigenous, and people of color (BIPOC) to access financing to grow and sustain community-birth-center infrastructure providing safe and culturally “reverent” maternal healthcare. BCE aims to leverage public and private investments to quadruple the scale and strength of what it calls the “birth economy” over the next five years.

Additional organization: Mamatoto Village

Home-based pregnancy and postpartum care

Opportunity overview:

- The healthcare system can be difficult to navigate, particularly for patients who are low-income, BIPOC, or both. For reproductive and pregnancy care in particular, the lack of touch points outside of a provider’s office can mean that emerging problems are not addressed early enough to ensure informed patient decision making and, ultimately, good maternal and child outcomes.

- A growing number of technology-enabled companies are delivering personalized pregnancy and postpartum care accessible to patients at home, particularly through digital platforms and tools. These services supplement traditional care and create a more comprehensive care experience tailored to individual needs and concerns.

Considerations:

- Clear and explicit focus on addressing inequities in care and providing respectful and dignified holistic support.

- Potential for wide scaling due to virtual platform and services, but may face some scale constraints due to (1) home visit delivery and (2) partnerships with health systems and insurers, which are a fragmented market.

Example organization: Cayaba Care (for-profit) provides personalized support through pregnancy, birth, and postpartum by connecting patients to a multidisciplinary team of nurse practitioners, nutritionists, patient care coordinators, and peers—all coordinated by a “maternity navigator” offering virtual or home services.

Additional organization: Bloomlife

Patient-provider matching

Opportunity overview:

- Disparities persist in reproductive health outcomes across the United States, particularly for BIPOC patients with diverse gender identities. Disparities in the quality of healthcare delivered to patients, particularly across lines of difference, are one important contributor to these inequitable outcomes.

- Patients are more likely to receive high-quality, culturally competent reproductive care from providers who share their racial, ethnic, and/or gender identity—particularly if they are supported by a community of similar patients who can vouch for a provider’s culturally sensitive care delivery.

- Digital platforms facilitate the connection of patients to healthcare providers who share key aspects of their identity, thus reducing potential bias in care delivery.

Considerations:

- While the opportunity doesn’t expand the total amount of respectful care available, it does ease the connectivity of patients to existing providers of respectful reproductive care. At the same time, it is important to understand whether and how these business models monetize patient data as part of their revenue streams.

Example organization: Health in Her HUE (for-profit) connects Black women and women of color to culturally sensitive healthcare providers, evidence-based health content, and community support; it focuses on healthcare broadly, including sexual and reproductive care.

Additional organization: Irth

Provider upskilling

Opportunity overview:

- Healthcare delivery teams—including but not limited to providers of reproductive care—can be trained to deliver more inclusive and culturally competent services for patients with diverse identities. This can help providers meet surging demand for quality reproductive care.

- Training programs can be delivered virtually, broadening access to providers across the country. At the same time, impact depends on provider willingness to participate in the trainings and capacity to act on lessons learned.

Considerations:

- Clear and explicit focus on addressing disparities in care quality and outcomes. Given that this focuses on training providers to offer more competent care, the direct impact to be felt by patients may be over a longer time horizon as the effects of training are more indirect.

Example organization: Quality Interactions (for-profit) delivers online cultural competency education to healthcare organizations across the United States. The organization was founded by culturally diverse physicians, and it uses a data-driven approach to training that is person-centered, research-based, and backed by evidence of effectiveness.

Additional organization: Violet

Scale and Reach Potential

Medical supply distribution

Opportunity overview:

- Due to restrictions on public funding and insurance reimbursement, reproductive care providers, including abortion providers, are at increased risk of being overcharged for key medical supplies. This creates hurdles for sustainable operations, particularly for community-based health centers serving low-income and marginalized populations.

- Opportunities exist for targeted investment in the distribution process for reproductive-care-related medical supplies. In particular, large medical suppliers and wholesale pharmacies can help secure favorable pricing and easy access to both branded and generic products for a broad base of healthcare providers.

Considerations:

- Investment opportunity is less likely to have a clear equity focus, since it relies on providers for distribution and requires a favorable legal landscape for distribution of medication, such as abortion pills.

Example organization: Afaxys (for-profit) is an impact healthcare company that partners with those who serve community and public health patients to ensure access to affordable sexual and reproductive healthcare by providing stable pricing and reliable access to products and services needed by providers. As a leading provider of oral and emergency contraceptives in US clinics, Afaxys’ mission is to ensure affordable access to sexual and reproductive healthcare is a right, not a privilege, for all patients. The company offers discounted pricing and its own online marketplace through the Afaxys Group Services subsidiary.

Additional organizations: Bridgespan requested approval from all organizations included in this report. At the time of publication, we have yet to receive approval from additional organizations working in medical supply distribution.

Medical supply production

Opportunity overview:

- Years of escalating restrictions on abortion services have already tipped the balance of abortion care from a medical procedure to prescription medication. More than half of abortions result from taking FDA-approved8 “abortion pills,” the common name for using two different medicines to end a pregnancy: mifepristone and misoprostol.

- There is an opportunity to invest in manufacturers working to improve the production of generic mifepristone and misoprostol for medication abortions (and related reproductive-care medicines, such as emergency contraceptives) to enable high-quality, cost-effective care delivery.

- Improving the production of these medical supplies improves the capacity and reach of providers, particularly in the expanding telehealth and mail-order prescription markets, helping meet growing demand.

Considerations:

- Has the ability to increase access to contraceptives, medical supplies, and other medications that are both affordable and reliable.

- Opportunity area is less likely to have a clear equity focus because it has an indirect impact on patient access and outcomes.

Example organization: GenBioPro (for-profit) is an innovative, mission-driven pharmaceutical company dedicated to putting reproductive health care within reach. It developed the first generic mifepristone to expand access to medication abortion for providers and patients, and it is currently the only US company making both mifepristone and misoprostol. GenBioPro is advancing a pipeline of three other reproductive health products and leveraging a novel litigation strategy to reverse state abortion bans.

Additional organization: Danco Laboratories

Catalytic potential

R&D for reproductive health products

Opportunity overview:

- Opportunities exist to invest in organizations developing more effective, lower-cost, and more consumer-friendly medications and technologies for reproductive health purposes, including over-the-counter products, emergency contraception, and abortion medications.

- These innovations can continue to improve the quality and accessibility of care for patients, and, in particular, address existing limitations, such as the current weight limit above which emergency contraception pills are not effective.

- Due to the nature of medical development and rigorous testing for FDA compliance, investment in R&D companies requires long-term, patient capital over the course of years or decades.

Considerations:

- Important potential to reshape reproductive care ecosystem by disrupting current care models and delivery channels and, if leading products are proven successful, can catalyze additional investment in innovation.

- Investment is not well positioned to address immediate need due to timeline and inherent uncertainty of the R&D process.

Example organization: Cadence OTC (for-profit public benefits corporation) is focused on opening direct access to reproductive health options for all by conducting research to convert contraceptives to over-the-counter products. Cadence seeks to achieve FDA approval of the first over-the-counter estrogen-progestin birth control pill, Zena, to be available in the United States within the next few years.

Additional organizations: Your Choice Therapeutics, Contraline

Holistic impact

Holistic ecosystem support via intermediary fund

Opportunity overview:

- Intermediary investment funds focus on a spectrum of reproductive care needs, from supporting expansion of existing provider infrastructure to providing cohort-based support to emerging business owners in the provision of sexual and reproductive healthcare.

- Intermediaries pool investments from partners and function as important translators connecting investors’ goals to organizations that can help meet those goals.

- Investing via intermediary funds takes advantage of existing field knowledge, relationships, investments, and market expertise, thus lowering risks for new entrants. This opportunity also gives nationally focused funders the ability to invest in local and regional organizations.

Considerations:

- Offers a good entry point for investors who do not have existing expertise and trusting relationships in the reproductive field.

- Building expertise and relationships requires additional effort to make direct investments in the future.

Example organization: Orchid Capital Collective is a newly launched impact investing firm stewarding resources to community-owned ventures that address birth and reproductive health inequities, improve outcomes, and build economic power and resilience. It focuses on accelerating community reproductive health infrastructure—the actual birthing centers and other structures, providers, and care models that enable access to culturally and racially appropriate care. In addition, Orchid Capital Collective seeks to promote safety, rights, education, and economic power for communities of color.

Additional organizations: RH Capital, Coyote Ventures

Navigating the nuances of investing in the reproductive care ecosystem

Throughout our interviews, we heard how investing in reproductive care is nuanced and that prospective impact investors face a variety of choices and challenges when considering whether to deploy capital in this field. Indeed, while investors—private and philanthropic—play a major role in advancing the field of reproductive care, money alone is not enough.

Chronic underinvestment in the reproductive care ecosystem reflects entrenched systems and attitudes that need to change to increase capital flow to worthy enterprises and organizations.

Real and perceived risks hamper investment

In many cases, we heard concerns that stemmed from perceptions of either financial risk or blowback from abortion opponents, particularly when investing in abortion services. It’s worth emphasizing that reproductive care encompasses a far broader field than abortion alone, and that investors in reproductive care span political divides and faith traditions. Still, to mitigate negative reactions specifically to funding abortion services, investors can work to frame abortion as a critical component of healthcare—especially if their institutions have a history of funding healthcare organizations more broadly. Alternatively, investors can consider investing in reproductive health more broadly, selecting among entry points that focus on contraception, prenatal and pregnancy care, or postpartum maternal and infant health.

Foundation investments in reproductive care

Only a minority of foundations have experience with how the breadth of impact investing tools can advance their impact goals. Based on a 2019 Foundation Source survey of its clients, 54 percent reported no experience with impact investing, although 88 percent said they were “somewhat,” “very,” or “extremely” interested in it in the future.9

Foundations can make program-related investments (PRIs) using part of their 5 percent required annual disbursement. For example, the David & Lucile Packard Foundation deployed a $5 million seed-capital PRI loan to enable Afaxys to address the needs of 7.8 million women unable to access affordable oral contraceptives and other essential family planning products at publicly accessible health clinics across the country. Afaxys strives for affordable family planning services through group purchasing to negotiate lower prices and by releasing its own generic private-label products.

Foundations can also make mission-related investments (MRIs) using endowment capital—the other 95 percent of their assets—in service of mission-related goals. Once a foundation has committed to deploying PRIs or MRIs, grantmaking program staff and investment staff often collaborate to develop shared funding goals and strategies for supporting organizations advancing equitable and accessible reproductive care. Those interested in initiating impact investments, including HNWIs, can turn to established sources such as the Mission Investors Exchange, Global Impact Investing Network, TONIIC, and The ImPact for additional information.

Capital and equitable outcomes work together

As we embarked on this work, some of the first reactions we heard were: “Isn’t investing in reproductive health equity an oxymoron?” The underlying perception is that the profit motive and reproductive care are at odds—and even more so when considering reproductive care for systemically marginalized communities and individuals. How could reproductive health organizations with a commitment to access and equity possibly deliver on their goals if their investors insist on maximizing returns? (To be sure, we hear similar hesitations when it comes to impact investing in areas such as racial equity.) Indeed, reproductive health, rights, and justice advocates caution entrepreneurs about the risks associated with accepting investments that only pay lip service to equity goals.

One way to mitigate this tension is to ensure that impact investors become more familiar with the lived experiences and issues their investee organizations are working to solve. This can help create more alignment and understanding vis à vis balancing returns and equity.

Diversifying the leadership of impact investing institutions is another powerful way to achieve this goal. Right now, only 6 percent of US venture capital funds are led by women, and only 2 percent are founded by women of color.10 In the months and years ahead, impact investors can work toward diversifying leadership while also ensuring that they learn from proximate leaders and elevate the voices of diverse individuals within their institutions today.

Building trust between funders and investees

Leaders of mission-driven enterprises worry about the burden of educating investors and guiding them to value social purpose alongside financial return.11 This is particularly true for organizations with leaders of color and those who are focused on equity in reproductive health.

To help foster trust, investors should first acknowledge how their identities might differ from that of prospective investees—especially when building relationships across lines of difference that may include race, ethnicity, and gender identity. Investors should also promote convenings where reproductive care leaders gather to network and make their case for more investment capital. Community development financial institutions, in particular, can hold trust-based relationships with proximate reproductive care enterprises, given the place-based nature of their work, especially in economically disadvantaged communities. Finally, impact investors can seek out place-based intermediary funds that have expertise in reproductive health and existing community relationships.

Continuous learning among reproductive ecosystem funders

It’s important that investors of all types share a nuanced understanding of the reproductive ecosystem, especially as it continues to evolve in terms of policies, strategies, leading organizations, and investment opportunities. (See “Sources for Continued Learning.”) Our research suggests that the following questions can help guide funders’ learning in the years ahead:

- Impact investing field building. What field-wide efforts within impact investing can most effectively help foster a shared understanding (language, player landscape, investment tools, and collaboration opportunities) of the reproductive space to attract more investments?

- Centering equity. As impact investing in the reproductive field increases, what steps can investors take to ensure a continued focus on equity in terms of investee organizations, leadership, and patient outcomes? How can organizations measure equity impact?

- Intermediary or pooled funds. What factors can contribute to the successful proliferation of intermediary funds targeted at different opportunity areas in the reproductive field, particularly with a focus on lower-return expectations?

- Emerging opportunity areas. What additional investment opportunities may arise in the next three to five years?

- Complementary opportunity areas. Are there adjacent fields or opportunity areas that may benefit from paired or coordinated investment strategies, particularly with a racial equity lens (e.g., housing, education, etc.)?

- Harm mitigation. What mitigation strategies can impact investors employ to ensure their capital maximizes impact and limits harm, with a focus on the abortion space?

Investors may pursue these topics individually or through peer-learning cohorts, several of which are emerging in the reproductive space. In addition, many interviewees remarked that “field catalyst” organizations can play an instrumental role in ongoing funder learning by monitoring the reproductive landscape, disseminating resources that capture the perspectives of proximate leaders and funders, identifying connection points to other fields, and highlighting timely investment opportunities. Organizations with field catalyst capabilities in reproductive care include Abortion Care Network, National Network of Abortion Funds, Resources for Abortion Delivery, Spring Activator, Society of Family Planning, Rhia Ventures, and VCs for Repro.

Future of reproductive care in the U.S.

Since the Dobbs ruling, legal fights over reproductive care, and in particular abortion, will continue to be dynamic and ongoing in the states and federal courts. This kind of shifting environment might influence what opportunities investors consider based on their risk tolerance and familiarity with the field.

Yet the tide appears to be turning in favor of more philanthropic and private investments in reproductive care. Our research identified nine broad opportunity areas in need of investment capital, most with multiple nonprofit or for-profit enterprises ready to absorb investments today. Some explicitly support delivery of abortion services, but most span the broad field of reproductive care, from contraception to prenatal and postpartum care.

Impact investors—both private and philanthropic—have a unique role to play in supporting organizations and enterprises that make explicit commitments to access and equity for all. Now is the time to act to sustain the momentum behind investments in reproductive care. A market that should never have been underfunded, underserved, and overlooked finally seems poised to leave its “niche” status behind.

The Inequities of Reproductive Care in the United States

Reproductive care—including contraception, sexually transmitted infection prevention and treatment, abortion services, and maternal care—has a profound impact on women’s ability to live healthy, fulfilling lives. Yet in the United States, far too many women do not have access to such care.

Disparities in access and quality of care are compounded by structural racism and biases. “Roe had never been enough,” said Cerita Burrell, director of programs at the Afiya Center, a reproductive justice organization in Texas.

In 2020, Black women were three times more likely to die from mostly preventable pregnancy-related causes than white women.1 Researchers maintain that systemic racism and discrimination at the individual level play a major role in these tragic outcomes. A recent study found that the Black-white gap in infant and maternal health cannot be explained by differences in economic circumstances. “It suggests it’s much more structural,” said Maya Rossin-Slater, an economist and associate professor of health policy at Stanford and an author of the study.2

More broadly, more than 19 million women lack reasonable access to a health center that offers a full range of contraceptive methods. Almost 90 percent of US counties do not have a clinic that provides abortion care, and almost one-quarter of US women do not have access to adequate prenatal care throughout pregnancy.

In general, low-income women have few touch points with the healthcare system, contr`ibuting to limited access to contraceptives and higher rates of unintended pregnancy. Three out of four women who seek an abortion live in low-income households, according to the Guttmacher Institute, a research and policy organization.3 Half live at less than the federal poverty level. Many lack health insurance coverage for abortion services4 and turn to philanthropically supported clinics for a wide range of care. Clinics provide roughly 95 percent of all medical abortions in the United States5 and get by “on an IV drip of philanthropic dollars,” said Patty Fernandez Piñeros, grants and evaluation manager for the Tara Health Foundation.

Years of escalating restrictions on abortion services have already tipped the balance of abortion care from a medical procedure to prescription medication. More than half of abortions result from taking “abortion pills,” the common name for using two different medicines (mifepristone and misoprostol) to end a pregnancy. Medical abortion is currently an FDA-approved method to end an unwanted pregnancy while it is still in its early stage. For those with unwanted pregnancies who live in states with abortion prohibitions, using medication to self-manage an abortion is often the more accessible option compared to traveling great distances to out-of-state clinics for medical abortions. Those journeys incur high costs for transportation, childcare, accommodations, and lost wages.6 “It’s only a minority of people who can afford the travel,” said Linda Prine, cofounder of the Miscarriage and Abortion Hotline.7 However, states that have restricted abortion have also banned or tightly restricted abortion pills.

After the Dobbs ruling, the most systemically marginalized groups will bear the brunt of harmful effects. Black women will likely experience a disproportionate burden of maternal mortality risk from carrying more unintended pregnancies to term. Latinx, Indigenous, and low-income women will be most significantly impacted by geography-based restrictions to reproductive autonomy because they are typically least able to travel for healthcare. And transgender, nonbinary, and gender-nonconforming people could face a particular loss of healthcare access, including to gender-affirming care, due to Dobbs’ implications for the rights to bodily privacy and autonomy.

________________________________

1 Jamila Taylor, Anna Bernstein, Thomas Waldrop, and Vina Smith-Ramakrishnan, “The Worsening U.S. Maternal Health Crisis in Three Graphs,” The Century Foundation, March 2, 2022.

2 Claire Cain Miller, Sarah Kliff, and Larry Buchanan, “Childbirth Is Deadlier for Black Families Even When They’re Rich, Expansive Study Finds,” The New York Times, February 12, 2023.

3 No racial or ethnic group made up the majority of abortion patients. In 2020, 33 percent were white, 39 percent were Black, 21 percent were Hispanic, 7 percent were some other race or ethnicity. See “Reported Legal Abortions by Race of Women Who Obtained Abortion by the State of Occurrence, 2020,” Kaiser Family Foundation.

4 The federal Hyde Amendment restricts state Medicaid programs from using federal funds to cover abortions beyond the cases of life endangerment, rape, or incest; see Alina Salganicoff, Laurie Sobel, and Amrutha Ramaswamy, “Coverage for Abortion Services in Medicaid, Marketplace Plans and Private Plans,” Kaiser Family Foundation, June 24, 2019.

5 Rachel K. Jones, Marielle Kirstein, and Jesse Philbin, “Abortion incidence and service availability in the United States, 2020,” Perspectives on Sexual and Reproductive Health 54, no. 4 (December 2022): 128-141.

6 Shirin Ali, “Abortion Restrictions Will Disproportionately Burden Low-Income Americans,” Changing America, The Hill, July 6, 2022.

7 Michelle Goldberg, “The Next Phase of the Abortion Fight Is Happening Right Now in New York,” The New York Times, January 20, 2023.

Research Methodology

We conducted an extensive literature review and interviewed 25 stakeholders—reproductive care experts, funders (including high-net-worth individuals), impact investment fund managers, and community development finance institution leaders, among others—to identify investment opportunities that hold promise for improving the quality of reproductive and maternal health care for all people who can become pregnant.

Our research affirmed not only that increasing investment in reproductive care is more critical than ever, but also that numerous opportunities for investment in reproductive health exist. To elevate the highest-impact opportunity areas, we applied the following considerations:

- Degree of alignment with impact investing tools. We focused on opportunities with potential to receive loans, loan guarantees, and equity investments. A large set of organizations and efforts in reproductive health, rights, and justice do not generate revenue and are thus best suited for philanthropic investment.

- Potential for impact that centers the most vulnerable and systemically marginalized patients. We focused on opportunities with potential to improve or reduce disparities in key reproductive outcomes—reproductive choice, maternal mortality and morbidity, and birth outcomes. This focus led us to exclude opportunities beyond the reproductive field (e.g., investments in education that may benefit women), as well as “femtech” outside the scope of reproductive health.

- Need for investment capital. We sought to identify the subset of potential investment opportunities that would benefit most significantly from a near-term infusion of capital. This resulted in several notable exclusions. First, experts in abortion services noted that brick-and-mortar abortion providers do not currently report a significant need for investment capital, but rather are accessing funding via philanthropic capital, favorable community lending practices, and intermediaries that are supplying bridge loans. Second, a number of opportunity areas show promise, but may have fewer direct entry points for significant investment today. These include (1) contracted supports for abortion-provider operations, including security, biowaste, and medical insurance; (2) mobile-care infrastructure for abortion and other reproductive services; (3) accelerators and incubators for reproductive technology; and (4) campaign and advocacy tools to amplify reproductive-justice movement building. We encourage interested impact investors to monitor these opportunity areas as part of a funder learning agenda (see “Ensuring Continuous Learning Among Reproductive Ecosystem Funders”), as investment needs may evolve over time.

Sources for Continued Learning

- The Guttmacher Institute is a leading research and policy organization committed to advancing sexual and reproductive health and rights.

- SisterSong works to build an effective network of individuals and organizations to improve institutional policies and systems that impact the reproductive lives of marginalized communities.

- The Abortion Care Network works with independent abortion providers and their allies to ensure the rights of all people to experience respectful, dignified abortion care.

- The National Women’s Law Center leads legal and public policy efforts for gender justice.

- If/When/How: Lawyering for Reproductive Justice works to transform the legal system to make it possible for all people to decide if, when, and how to define, create, and sustain families.

- Elephant Circle builds local and national networks to address issues of birth and reproductive justice and shares their expertise through organizing, coaching, consulting, and educational curricula, as well as through direct legal, perinatal, and policy work.

- Groundswell Fund supports efforts that use grassroots organizing to advance reproductive justice policy and systems change.

Acknowledgments

This report was developed with support from the Robert Wood Johnson Foundation. The authors thank Bridgespan colleagues Angie Estevez Prada and Stephanie Kater for their contributions to this work. For their expertise, guidance, and insights, we also thank everyone we interviewed and those who reviewed drafts. This includes reproductive health, rights, and justice experts, funders, and impact investment fund managers. We are deeply appreciative to the advisory guidance of Elizabeth Bailey and Stasia Obremskey of RH Capital/Rhia Ventures, Tenesha Duncan of Orchid Capital Collective, and many others who for years have been making the case for investing in the reproductive field.

Bridgespan recognizes we are echoing messages of those who have long been fighting for equitable and respectful reproductive care and bodily autonomy. This report also builds on some of our own recent work, including our research with Shake the Table on feminist movements and our research into advancing diversity, racial equity, and inclusion goals in impact investing.

Marina Fisher is a principal in Bridgespan’s Boston office. She is passionate about working at the intersection of nonprofits and philanthropy to help innovative organizations plan for, and fund, large-scale growth.

Nate Wong is a partner in The Bridgespan Group’s Boston office, where he focuses on equity-based, power-shifting efforts that ensure communities have the agency to influence the decisions that may affect them.

Lauren McDermott is an associate consultant in The Bridgespan Group’s Boston office.

Roger Thompson joined Bridgespan in 2012 as editorial director, working with Bridgespan teams to develop and write manuscripts and helping to plan content for newsletters and other editorial packages.

Footnotes

1 Michael Schroeder and Maia Anderson “Where Investment in Women’s Health Will Be Focused in 2023,” HealthCare Brew, December 16, 2022.

2 In discussing reproductive health, rights, and justice, we often refer to “women” because that is how the vast majority of impacted individuals identify and because that identity is most frequently used in research. At the same time, we recognize that others are impacted and capable of pregnancy, including transgender, nonbinary, and gender-nonconforming people.

3 Elyssa Spitzer, Tracy Weitz, and Maggie Jo Buchanan, “Abortion Bans Will Result in More Women Dying,” American Progress, November 2, 2022.

4 Jonathan Wittenberg and Wendy Sealey, “Here’s How Philanthropy Can Protect Access to Abortion in a Post-‘Roe v. Wade’ World,” The Chronicle of Philanthropy, May 12, 2022.

5 Cheryl Dorsey, Jeff Bradach, and Peter Kim, Racial Equity and Philanthropy: Disparities in Funding for Leaders of Color Leave Impact on the Table, The Bridgespan Group, May 2020.

6 Bertha Coombs, “Investors See Growth Opportunity in Femtech Devoted to Women’s Health,” CNBC, March 21, 2022.

7 This report does not constitute (i) an offer or solicitation to purchase or sell any securities or assets or (ii) a recommendation to purchase or sell any securities or assets. Any potential investors in these opportunities should each make their own independent assessment of the investment.

8 At the time of publication, a legal ruling in Texas has overturned the FDA’s approval of mifepristone, one of two medicines used for medication abortion in the United States; while the consequences of the ruling for the drug’s availability remain unclear, this may pose risks for investors.

9 Impact Investing and Private Foundations: The Current Reality and Future Potential, Foundation Source, 2019. Seventy-one percent of survey respondents managed less than $10 million in assets.

10 The Untapped Potential of Women-Led Funds, Women in VC, October 2020.

11 “Just Transition for Philanthropy,” Justice Funders, n.d.