Just under one year ago, legendary US talk show host Jon Stewart interviewed the CEO of Shell. “We should hold fossil fuel companies accountable, but they are not our enemies. They are our frenemies”, Stewart said, allowing now former CEO Ben Van Beurden an open platform to declare, unchallenged, the content of the company’s greenwashed and entirely faked climate “ambition”.

Shell understood that you could get thousands of otherwise-critical climate-supporting technocrats, journalists, centrists and politicians on side if you pump just enough complexity, confusion and smoke-and-mirrors into your greenwashing efforts, and many other fossil fuel companies aspired to their lofty climate delay achievements.

In the past few weeks, all the energy and effort put into greenwashing fossil fuel companies seems to have vanished. The profits of the world’s worst polluters have skyrocketed thanks to a bloody war and the ongoing effects of a bloody pandemic.

After saying for years that it needs to sell oil and gas so it can pay for its own transition to renewable energy, Shell has responded to obscene profits by winding down its own ambitions for renewable energy. BP has undergone a similar shift, happily declaring that selling safe energy products isn’t lucrative enough, and adjusting its production forecasts to show much more planet-heating fossil sales. One estimate puts the climate impact of this reversal at 300 megatonnes of CO2-e out to 2030.

Buried in a mountain of cash

These people were granted an incredible amount of trust, and their claims to want to act on climate were taken in good faith and oodles of credulity. The response? They were intoxicated by the cocktail of fossil fuels, conflict and disease, because it buried them in a mountain of pure cash. There is no trust they will not betray.

It is terrible, and terrifying then, that Australia’s new government’s central climate policy is essentially a massive honour system for the country’s worst emitters – mostly fossil fuel companies – blended with a government mandated system of greenwashing and fake climate action. The ‘Safeguard Mechanism’ was designed by the climate-denying Abbott government as a confusing and complicated greenwashing mechanism – something there just to be there, rather than to aggressively cut down on emissions.

Currently, the baselines float ethereally far above each company’s actual emissions. In the event the baselines end up encroaching on a company’s emissions, the punishment is having to pay for some cheap offsets, which have been the subject of growing criticism over the past months, due to fraudulent and suspect claims about emissions reductions.

Labor is fighting to update and upgrade this greenwashing system to the modern, best-practice habits of the fossil fuel industry. Every trick that features in the climate plans of the planet’s worst emitters features in the Safeguard Mechanism. From the ground up, it’s designed to make things worse. The reforms accelerate, rather than reduce, that effect. And if there’s anything that this year so far has taught us, is that’s we really ought to assume the worst of the fossil fuel industry. They really won’t disappoint us.

Smoothing the path for new coal and gas mines

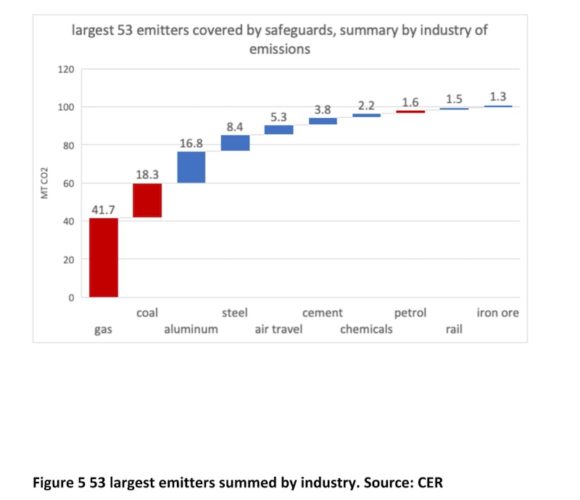

The ticket for getting into Safeguard is a company having emissions greater than 100,000 tonnes per year. Of the few hundred companies that tick that box, the vast majority are the companies that dig up coal and gas, and sell them overseas. RenewEconomy contributor David Leitch conveniently calculated this here:

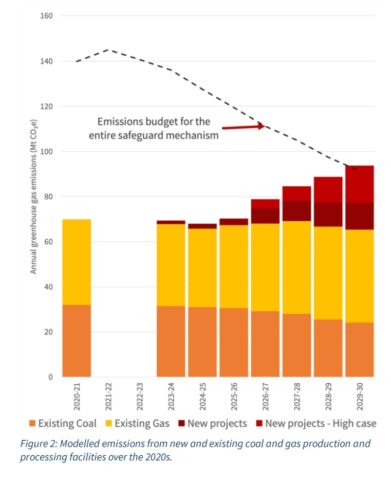

There are two key problems here. The first is that existing coal and gas mines have seen worsening emissions over the past few years, resulting in the emissions gains from growing renewables being ‘cancelled out’ by coal and gas mining (the release of methane from both, in particular).

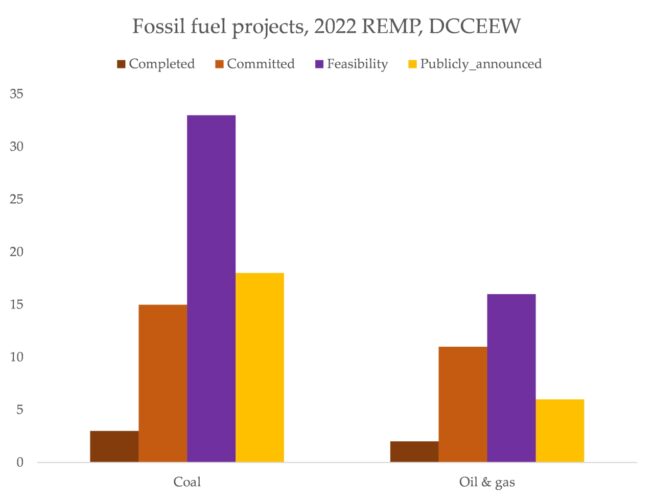

As bad as that is, it’s also destined to become significantly worse if even a small fraction of the several hundred proposed new coal and gas projects go ahead. The list is gargantuan – 69 coal projects and 35 oil/gas projects at various stages of the development process.

In December last year, a report commissioned by the Australian Conservation Foundation and published by Energy Resources Insight found just the existing coal and gas mines will emit far more than their proportionate share of the carbon budget in the Safeguard mechanism. But they also modelled a small number of planned coal and gas mines that are very likely to go ahead, and found that the additional emissions from these projects (only domestic, operational emissions – excluding the emissions when the products are burned overseas) will eat up the entire carbon budget of the Safeguard Mechanism.

“This leaves no room for the more than 130 facilities currently covered by the safeguard mechanism that are not involved in the production and processing of coal and gas. This includes iron ore miners, fertiliser manufacturers, and cement and aluminium producers”, wrote ERI. This roughly matches an analysis I published here last year, where I estimated the climate impacts of new fossil projects would basically destroy any chance of meeting a 43% target by 2030.

Amazingly, on Tuesday the 21st, in the lead-up to voting on Safeguard’s reforms, Environment Minister Tanya Plibersek approved 113 new coal seam gas wells in Queensland, operated by Labor party donor Santos.

The stage for this climate policy is an unchallenged worsening of the exact problem it claims it’s trying to solve. This is a mirror reflection of the fossil fuel industry’s expansionist ambitions, which are usually justified on the grounds of fossil fuels being “needed” by society in the near future.

Dodgy offsets and credits

There is simply no way that a carbon offset ever neutralises, cancels out or justifies ongoing emissions. At every single level, the concept either makes no sense, fails to deliver or delivers far too little. It is one of the most toxic elements of modern climate policy, and it dominates the government’s reforms to the Safeguard Mechanism.

First, most fundamentally, nearly all ‘Australian Carbon Credit Units’ (ACCUs) ‘avoid’ emissions, rather than actively removing carbon from the atmosphere and storing it permanently underground. That means nothing is physically ‘neutralised’. The logic that one harm is undone by paying someone else to decide not to harm is absurd in every single other corner of society, but in the fantastical world of neoliberal carbon markets, it’s accepted as normality.

This is one hell of a bombshell story on forest offsets, by @pgreenfielduk, @hannahknuth, @Source_Mat

Emissions cuts claimed by massive companies (Shell, Netflix, Disney, United Airlines) are fake –>>https://t.co/sC8IuDjTcWhttps://t.co/a5nMuji3v4https://t.co/xDtdpDBOAo pic.twitter.com/1VNSm0pMvW

— Ketan Joshi (@KetanJ0) January 18, 2023

Even the promise to ‘avoid’ emissions is weak. The majority of credits issued in Australia stand on shaky ground. ‘Human Induced Regeneration’, for instance, often involves humans claiming to be responsible for restoring vegetation when that vegetation returned through natural causes. Carbon credits from burning landfill gas have their own doubts. The entire systems is predicated on a vague assurance of some alternative intent – utterly unverifiable without a portal to a parallel universe.

One analysis by the Australian National University’s Megan Evans et al found that around one quarter of the ACCUs that could potentially be used in the Safeguard Mechanism would come from what they politely term “high risk” sources – methods of claimed ‘reductions’ that have been ridden with fraud and deception, for which we’ve barely scratched the surface. “These are likely underestimates, because we excluded projects not yet issued ACCUs, plus the 20 million ACCUs in holding accounts. So it could be more like 60 million ACCUs, or 1/3 of Safeguard abatement at high risk”, Evans said on Twitter. By her calculations, it’s roughly the same as claiming the emissions reductions of shutting down an entire coal-fired power station – except, the reductions don’t really happen at all.

Imagine the scandal if Origin Energy pretended to shut down a coal plant, but kept it pumping out power and emissions anyway.

Carbon offsetting is an honesty system coupled with a financial incentive for dishonesty. What would you guess the outcome of that blend has been, so far? What do you think it will be, in the future?

Stunningly, the government is proposing no limit of any kind on carbon offset purchases for compliance with the Safeguard Mechanism. While this is in place, any hope of the scheme really reducing emissions is utterly dead.

Going down the 100% offset pathway (no matter the climate, philosophical or fraud-related reasons to not do so) will be a no-brainer for most polluters. One recent parliamentary library calculation found that the cost of buying up credits instead of reducing emissions would be less than 0.1% of big fossil fuel company profits.

“Analysis by the Parliamentary Library showed gas giant Woodside would have to pay between $2.6 million and $4.4 million a year in 2025 to comply with the emissions reduction required for its stake in the North West Shelf gas business in Western Australia. That is between 0.05 per cent and 0.09 per cent of the company’s annual profit in 2022,” wrote the SMH’s Mike Foley.

One line used in defence of offsets is that they’ll become so expensive that it won’t be feasible for high-emitters to rely on them. Of course, they’d have to inflate in price by many times to become a significant cost burden. But as The Australia Institutes’ carbon markets expert (and key critic of both offsetting and the Safeguard Mechanism) Polly Hemming points out in a Twitter thread, the price of ACCUs is likely to remain very low, thanks to the obscene lack of regulation or standards for creating carbon offsets in Australia.

Under the coalition the supply of carbon offsets was turbocharged. It was made easier to generate offsets, register offset projects & changes to contracting arrangements mean that there will be a ready supply of offsets on the market for industry. 4/ https://t.co/nJkYUsxLTe pic.twitter.com/slHUHZ3RAF

— Polly Hemming (@pollyjhemming) February 18, 2023

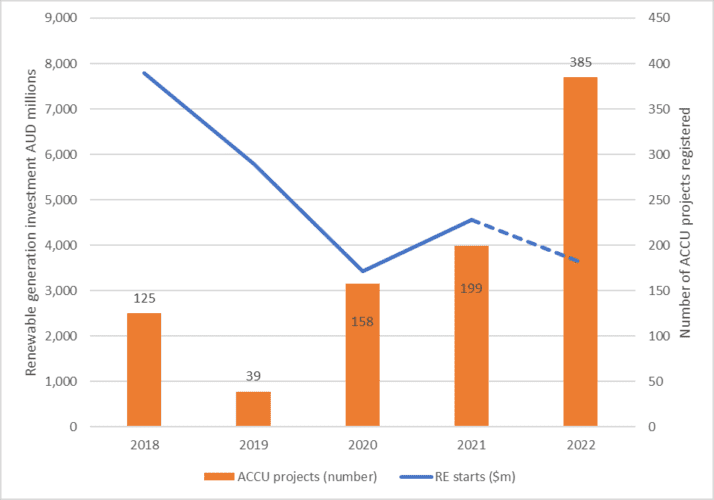

In the event that the price of ACCUs were to rise, the government proposes supplying them at a guaranteed price of $75, with taxpayers forced to cover the difference. So high-emitters can keep on with the cheap greenwashing, enabled by the taxpayers who’ll suffer the climate impacts. Another analysis by Hemming at TAI finds, horrifyingly, a slow-down in renewable energy growth and an acceleration in the creation of carbon offsets.

“When industry or government buys carbon credits to offset emissions – even if they are of high integrity – they are not spending money on technology that permanently displaces fossil fuel use and permanently reduces emissions,” Hemming said. As I showed in my projections analysis, Australia needs to massively accelerate renewable growth to get aligned with power sector climate targets. The scales are tipping the wrong way – Safeguard plants a 10 kilo block on exactly the wrong end.

It’s also worth noting that the vast majority of ACCUs in Australia come from the land sector – if the reformed Safeguard triggers an explosion in supply of these offsets, the land impacts of offset plantations will be severe. Farmers for Climate Action recently put out a statement expressing concern about fossil fuel companies eating up agricultural land purely for the purpose of greenwashing their expanding emissions footprint:

Sign Phil's open letter today calling for an end to fossil fuel giants, like Woodside, buying up farmland to 'offset' their emissions. https://t.co/7Rd2Xex3jQ

— Farmers for Climate Action (@farmingforever) February 15, 2023

Again, the Safeguard mechanism is a mirror reflection of the current trends in fossil fuel sector greenwashing. One analysis by Oxfam found that “the ‘net-zero’ climate promises of…BP, Eni, Shell and TotalEnergies― could require them foresting an area of land equivalent to more than twice the size of the UK to achieve net zero by 2050”, due to their massive reliance on land-based carbon offsets.

There’s a widespread belief that a mountain of carbon offsets is ‘better than nothing’. “Progress is always better than regression”, says the Guardian’s Katharine Murphy. But we now know that unlimited carbon offsetting plays a major role in what’s known as “mitigation deterrence” – that is, simply, companies find it easier to just buy cheap offsets instead of actually reducing emissions. As I’ve detailed here, there is no end of examples of offsets being used for every polluting activity, no matter how wasteful or avoidable.

A recent analysis by the New Climate Institute found that dodgy carbon neutral claims and massive over-reliance on offsets have essentially destroy any hope of corporate net zero targets working how they’re meant to. Even the ‘Science Based Targets Initiative’, often criticised for setting weak criteria when rating targets, have now set a hard limit of between 5 to 10% for offset reliance, with the rest to be covered by real, deep decarbonisation.

In addition to avoiding climate action, carbon offsets can be applied like a cream to a very tiny section of supply chain emissions to provide public cover to massive increases elsewhere in the supply chain. The example of coal mines ‘offsetting’ their local mining emissions while the coal they sell is burned in rising quantities is a perfect example. One recent analysis by Climate Analytics found that “unfettered use of offsets under the Safeguard mechanism will likely allow real emission increases (as opposed to reductions) in Australia”.

As fossil fuel companies have already learned, greenwashing the emissions that come from producing fossil fuels is a fantastic way to distract from the massive emissions that come from burning fossil fuels. That knowledge is simply being transplanted, through regulatory capture, into a government the fossil industry has full control over.

Far from ‘any progress being good’, this is a case of the illusion of progress being weaponised by a shockingly dangerous industry, and that illusion working perfectly on the centrist technocratic media and political players involved. The consequences are going to be disastrous.

That old intensity trick (and a thousand other loopholes)

An understated problem among the many, many problems with the government’s proposed reforms is a shift towards baselines that look at intensity (emissions per unit of output) rather than absolute emissions. As ‘Australian Parents for Climate Action’ (AP4CA) write in a detailed statement on the policy, “The SGM will allow individual emitters to increase their overall emissions”. How?

It’s simple. Let’s say you’re a coal mining company. You double your production of coal from one year to the next. Normally, your emissions from doing that would also double, but you find some efficiencies and you reduce the intensity of your emissions a few percent. That would meet the demands of the Safeguard Mechanism, but your actual, total emissions would still increase by just under half.

As AP4CA also point out, there is a new system proposed where any company that ends up beneath their baseline gets granted a special kind of in-policy carbon credit, called a ‘Safeguard Mechanism Credit’ (SMC), which can be sold to other companies that find themselves above their baseline.

So our coal mine, which doubled coal output, and almost doubled emissions, also gets granted a financial reward, and on top of that, another company gets to buy that offset instead of reducing their emissions. “In some cases the proposed SGM reforms could incentivise facilities to increase overall emissions even as they are improving their emissions intensity”, wrote AP4CA.

Again – this is reminiscent of a trend in fossil fuel industry greenwashing. Both Shell and Equinor set themselves ‘intensity’ targets, which allow them to increase total emissions while slightly reducing the ‘intensity’ of that production. Shell uses mostly offsets for that, whereas Equinor is leading towards electrifying its extraction sites (taking much-needed renewable resources away from Norwegian society). Either way, all fossil fuel companies know it’s a handy way of rebranding rising emissions with a badge of fake progress.

As Rebecca Pearse writes in The Conversation, there is a massive suite of options available to high-emitters to avoid taking real action to reduce emissions, beyond credits and intensity baselines.

Companies already well below too-high baselines will get issued Safeguard credits. They can also lobby to have these baselines weakened, or set over longer time periods, for unclear and vague reasons. Exporters will also receive significant exemptions and compensation – including the exporters of fossil fuels that make up most of the scheme.

“Ultimately, such flexibility means facilities can delay cutting their emissions to a later date. But as climate change accelerates, we have no time to waste”, Pearse writes. The Climate Council warns urgently against opening up funds such as the ‘Powering the Regions’ fund to fossil fuel companies. There is truly no end to the complex and varied ways that a high-emitting company that lobby to cut their climate task down to zero.

The Australian government has become an engine of corporate greenwashing

Labor might really only care about kicking the can down the road. If the next election is held in May 2025, the latest emissions data release will only cover up to September 2024. That’ll be 1 year and one quarter of data from the initiation of Safeguard in July 2023. Certainly short enough that the government can simply claim we need to ‘wait longer’ to see it working, if those data show rising emissions from Safeguard facilities.

“We certainly lead the world, in government-sponsored greenwashing”, The Australia Institute’s Polly Hemming recently told the Washington Post. She was referring to ‘Climate Active‘, a government scheme with confers ‘carbon neutrality’ status among the country’s worst (and worsening) polluters through the system of dodgy carbon offsets.

If the Safeguard Mechanism remains a massive wish-fulfilment exercise for the corporations making super-profits selling fossil fuels overseas, rather than an appropriately powerful scheme to bring about real emissions reductions, Australia will truly become known globally as the international centre of climate delay.

If the Coalition were the great climate wreckers, Labor are shaping up as the great pretenders. Both have precisely the same effect of producing worsening emissions and weak climate policies.

Update 20/02/2023 – removed reference to projections as researcher corrected on Twitter

Update 21/02/2023 – Added in two new reports (Evans et al, ANU and Hemming, TAI, renewable energy vs ACCUs), along with new of Santos’ gas expansion approval.