The world’s biggest oil companies are a lot better at talking up green initiatives than actually doing anything to counter the environmental damage caused by their reliance on fossil fuels to drive profits.

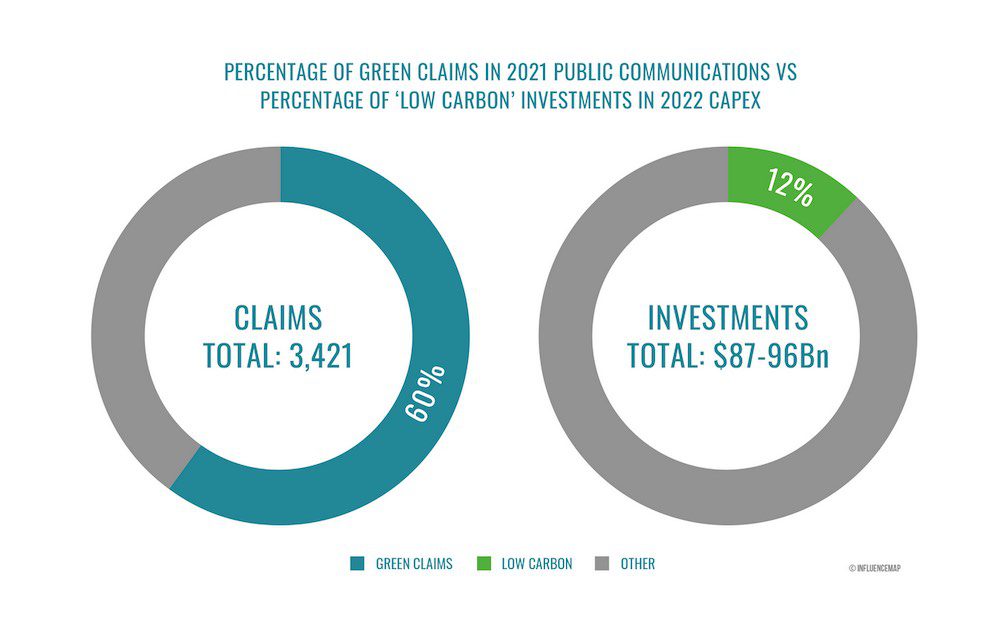

That’s the overriding conclusion drawn from a report that finds 60 per cent of public messages from BP, Shell, Chevron, ExxonMobil and TotalEnergies contain “green” claims but are forecast allocate just 12 per cent on average of their capital expenditure budgets for so-called ‘low-carbon’ investments this year.

The report, by climate think tank InfluenceMap, estimates these five companies combined spent at least $US750 million on climate-related messaging internally – including both green claims and pro-oil messaging – in 2021.

It says the real figure is likely to be significantly higher because this calculation does not include the cost of external advertising or PR agencies.

In Australia, the oil company’s are also under scrutiny, including Shell, which Belinda Noble, the founder of Comms Declare, says has run the country’s most expensive ever Facebook ad promoting its net zero target.

“It spent nearly half a million dollars ($454,800) boosting its net zero video, reaching more than a million Australians,” she said. “Fossil fuel companies can’t be trusted when it comes to greenwashing, which is why we are calling for a ban on fossil fuel ads.”

“The world’s big oil and gas companies are spending huge amounts of time and money talking up their green credentials, while their business investments and lobbying activities tell a different story,” said InfluenceMap program manager Faye Holder.

The research analysed 3,421 individual evidence items of public communication from each of the five companies during 2021, including company and CEO social media accounts, press releases, speeches, and secondary websites intended for outreach purposes.

It then categorised each item based on its narrative, noting that some items contained multiple messages, both ‘green’ and pro-oil.

The research focused on activities in Europe and North America.

Big Oil’s ‘green’-focused public communications strategies contrast with its investment in low carbon activities, according to InfluenceMap.

Furthermore, some of these low carbon-labeled activities are likely to include fossil fuel investments, given both TotalEnergies and Shell include fossil gas-related investments in their ‘low carbon’ CAPEX outlook, it said.

As a result, the report finds it’s likely that the disparity in spending on fossil fuel-related investments as compared to zero-emission technologies is even greater than publicly disclosed.

The study follows findings published in the journal PLOS One in February that Chevron, ExxonMobil, BP and Shell used terms like “climate,” “low-carbon” and “transition” more frequently in recent annual reports and devised strategies around decarbonisation, while remaining financially reliant on fossil fuels.

Geographical diversity appears to play a role in how oil companies promote green credentials to the public.

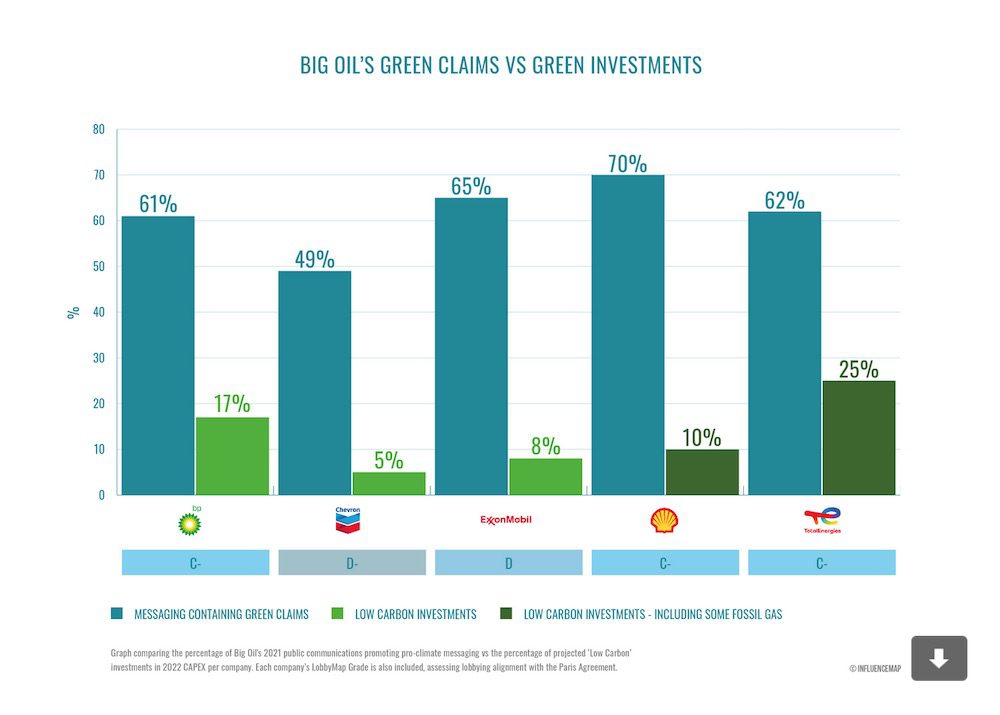

InfluenceMap’s research shows the three European-based super majors –Shell, BP, and TotalEnergies – focused more on energy transition claims than their U.S.-based competitors, in effect, presenting themselves as broad energy companies.

ExxonMobil, by comparison, centred most of its public messaging on emissions reductions, suggesting its strategy is to portray itself as a ‘low emission’ oil and gas producer.

Chevron appears less concerned about promoting its climate credentials than the other four companies – it used more pro-oil and gas messages (37%) than any of its competitors.

Government enforcement actions and civil suits alleging greenwashing are increasing through a myriad of different laws, including securities regulations and consumer protection legislation, according to global law firm Norton Rose Fulbright.

The legal firm warns greenwashing can artificially inflate company stock as customers and investors divert spending power to companies with the best eco-credentials.

As a result, disclosures related to sustainability can therefore be material from the perspective of securities regulators, it says.

Big Oil’s ‘green’-focused public communications strategies contrast with its investment in low carbon activities, according to InfluenceMap.

Furthermore, some of these low carbon activities are likely to include fossil fuel investments, given both TotalEnergies and Shell include fossil gas-related investments in their ‘low carbon’ CAPEX outlook.

The report states it’s likely that the disparity in spending on fossil fuel-related investments as compared to zero-emission technologies is even greater” than publicly disclosed, with the biggest divergence between ‘green’ claims and ‘low carbon’ CAPEX displayed by Shell, followed by ExxonMobil.

The report also charges that all of the companies have failed to align their climate policy engagement activities with the goals of the Paris Agreement.

Shell,TotalEnergies, and BP rank a ‘C-’ on InfluenceMap’s A-to-F scale, indicating mixed support.

ExxonMobil and Chevron rank a ‘D’ and ‘D-’ respectively, indicating broad opposition to Paris-aligned climate policy to reduce global warming to below 2C.