Measuring biodiversity impact and risk: a new focus in ESG disclosure

The risks resulting from a loss of nature and changes to natural capital have the potential to disrupt society and the stability of the global economy. Whilst most research on financial risks related to natural capital has historically focused on climate change, there is a growing awareness of the risks associated with other aspects of natural capital, such as the loss of biodiversity.

The risks resulting from a loss of nature and changes to natural capital have the potential to disrupt society and the stability of the global economy. Whilst most research on financial risks related to natural capital has historically focused on climate change, there is a growing awareness of the risks associated with other aspects of natural capital, such as the loss of biodiversity.

In this article, we outline industry trends observed in sustainability reporting of biodiversity and provide a summary of metrics and KPIs to account for biodiversity in sustainability disclosure frameworks.

What is biodiversity and why is it significant?

The term Biodiversity refers to the variety of life: the diversity of all living organisms from the various ecosystems of the planet. It “includes diversity within species, between species and of ecosystems” in which they live.

The significance of biodiversity is best understood when looking at ecosystem services, which are the benefits humans gain from the natural environment. Businesses depend on ecosystem services because they directly use natural resources and make use of environmental functions such as waste decomposition and detoxification. Ecosystem services depending on biodiversity include:

- pollination

- pest and disease control

- fresh water

- soil formation

- and climate regulation.

Reduced pollination and declining resilience of ecosystems and species illustrate the consequences of biodiversity loss for economic activity. While determining the exact impact of biodiversity loss on the solidity of financial institutions remains challenging, specific risk channels are clearly identifiable.

Biodiversity-related corporate reporting

Biodiversity-related corporate reporting is a fast-moving, developing area, and there is ongoing work to create harmonisation, particularly related to measurement and disclosure.

Businesses and financial institutions may experience increased pressure to assess and mitigate their impact on biodiversity. Initiatives are being taken internationally to raise awareness of the ramifications of biodiversity loss, including by the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES) and the Natural Capital Coalition (NCC). These contribute to an improved understanding of the risks involved.

Most recently, the Taskforce on Nature-related Financial Disclosures (TNFD), a working group of 35 financial and climate members whose mission is to develop risk management frameworks for climate change, released a 1st beta nature framework to help companies move investments away from nature-negative activities. This is aimed to integrate with existing TCFD frameworks alongside new ISSB standards.

The Taskforce on Nature-related Financial Disclosures (TNFD) was established in response to the growing appreciation of the need to factor nature in financial and business decisions. The TNFD is a global, market-led initiative with the mission to develop and deliver a risk management and disclosure framework for organisations to report and act on evolving nature-related risks and opportunities, with the ultimate aim of supporting a shift in global financial flows away from nature-negative outcomes and toward nature-positive outcomes.

In terms of definitions, “nature” includes “biodiversity” along with other parts of the environment. On page 22 of the beta version of the TNFD framework, there is the definition of “nature”: The working definition of nature in the TNFD framework is ‘the natural world, with an emphasis on the diversity of living organisms (including people) and their interactions among themselves and with their environment. People and societies interact with nature and are not separate from it. Nature can be understood through a construct of four realms – Land, Ocean, Freshwater and Atmosphere.

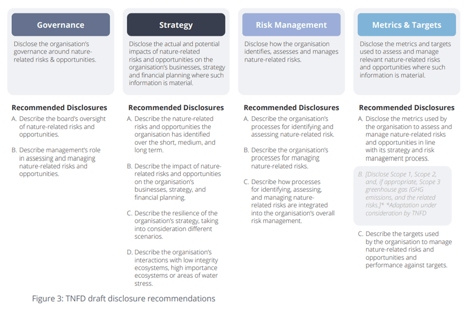

The below table lists a draft of TNFD disclosure recommendations to address ecosystem services, so companies can begin to align governance, strategy, and risk management incorporating principles to address nature (including biodiversity):

Unlike carbon, biodiversity does not have an intrinsic value and is more complicated to assess. A key challenge around effectively reporting on a company’s biodiversity impact is that it requires extensive effort to monitor the state and condition of biodiversity at given locations. The following summary describes a few methodologies and guidelines that are being used by businesses and financial institutions to address measuring biodiversity impact.

Frameworks for measuring biodiversity loss, impact and risk

Below are examples of metrics, KPIs, tools and frameworks that account for biodiversity in sustainability disclosure frameworks:

- Focus on impacts on ecosystems / habitats / land cover:

- Biodiversity Footprint Financial Institutions (BFFI)

- Global Biodiversity Score (GBS)

- Corporate Biodiversity Footprint (CBS)

- Focus on species:

- Species Threat Abatement and Restoration Metric (STAR)

- Environmental Profit & Loss (EP&L): Monetary values

- Model or extrapolate biodiversity impacts from indirect environmental pressure data (e.g., GHG emissions and water use):

- TheProduct Biodiversity Footprint (PBF) approach aims to bridge the gap between LCA and ecology. The objective is to enable the comparison of variants of a given product to inform eco-design, addressing the five drivers of biodiversity loss as defined by the MEA (Multilateral Environmental Agreements).

- Biodiversity Footprint Financial Institutions (BFFI)

- Environmental Profit & Loss (EP&L) tools, which help to reduce their environmental footprint and generate tangible benefits

- Use primary biodiversity data to measure changes in biodiversity:

Other Measuring tools:

- GBSFI – Global Biodiversity Score for Financial Institutions

- BIA-GBS – Biodiversity Impact Analytics powered by the Global Biodiversity Score

- ENCORE – Exploring Natural Capital Opportunities, Risks and Exposure

- Water Watch – Tool that highlights the business activities with the greatest impact on water (quantity and quality along the whole value chain) Water Watch - CDP Water Impact Index - CDP

Frameworks for biodiversity disclosure:

- TNFD

- CDP – The scope of Biodiversity questions was expanded in 2022.

- SASB

- GRI

- MSCI

Where to start with managing biodiversity and nature-related risk

Companies should not wait for globally agreed frameworks or perfect tools to be available to approach the topic of biodiversity and nature. Companies should begin to understand and manage biodiversity and nature-related risk and opportunities and to prepare to respond to the introduction of frameworks such as the TNFD. To get started, companies should:

- Plan and Educate –Familiarise leaders across the business with biodiversity concepts, tools and frameworks. Build the capability and competence of the company, including by starting to align to the beta TNFD framework. Begin to develop a clear plan for managing biodiversity - related financial risks and opportunities, including setting targets. Bring in new skills to help map biodiversity risks up and down the value chain.

- Monitor and disclose targets– Prepare to monitor the performance of companies in your portfolio and track and disclose your own biodiversity performance - what the company is doing to identify, measure and manage biodiversity risk. Set science-based targets and build internal accountability for biodiversity across the business.

- Support –Get involved in biodiversity initiatives, such as actively supporting the development TNFD or the global finance for biodiversity pledge to improve biodiversity management and help shape policy and framework development.

References

UN Environment Program (Feb 2022) Learnings-from-soy-supply-chains.pdf (globalcanopy.org)

Global Canopy (Feb 2022) Testing a nature-related risk framework in the consumer staples sector: learnings from soy supply chains – Global Canopy

IFLR (Feb 2022) Biodiversity concerns set to be the next frontier after climate change | International Financial Law Review (iflr.com)

UNEP (Oct 2021) Are you ready for the TNFD framework? – United Nations Environment – Finance Initiative (unepfi.org)

WEF (2020) pdf (weforum.org)

WE Forum (2018) https://www.weforum.org/agenda/2018/10/this-is-why-putting-a-price-on-the-value-of-nature-could-help-the-environment

Capital Coalition (2021) https://capitalscoalition.org/project/transparent/

https://ec.europa.eu/environment/biodiversity/business/align/index_en.htm

https://www.cdsb.net/biodiversity